- Hong Kong

- /

- Consumer Finance

- /

- SEHK:86

Here's What We Learned About The CEO Pay At Sun Hung Kai & Co. Limited (HKG:86)

This article will reflect on the compensation paid to Seng Huang Lee who has served as CEO of Sun Hung Kai & Co. Limited (HKG:86) since 2007. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for Sun Hung Kai

How Does Total Compensation For Seng Huang Lee Compare With Other Companies In The Industry?

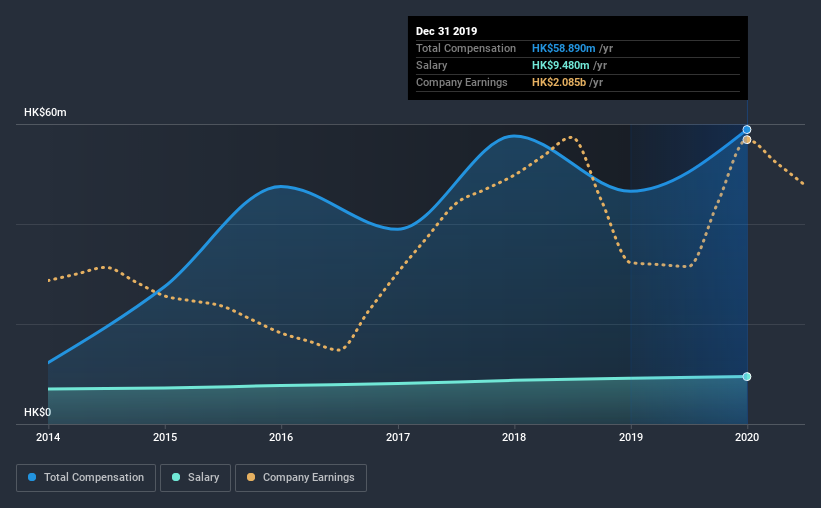

Our data indicates that Sun Hung Kai & Co. Limited has a market capitalization of HK$6.3b, and total annual CEO compensation was reported as HK$59m for the year to December 2019. That's a notable increase of 26% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at HK$9.5m.

For comparison, other companies in the same industry with market capitalizations ranging between HK$3.1b and HK$12b had a median total CEO compensation of HK$1.7m. Hence, we can conclude that Seng Huang Lee is remunerated higher than the industry median.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | HK$9.5m | HK$9.2m | 16% |

| Other | HK$49m | HK$37m | 84% |

| Total Compensation | HK$59m | HK$47m | 100% |

Speaking on an industry level, salary and non-salary portions, both make up 50% each of the total remuneration. It's interesting to note that Sun Hung Kai allocates a smaller portion of compensation to salary in comparison to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Sun Hung Kai & Co. Limited's Growth Numbers

Sun Hung Kai & Co. Limited has seen its earnings per share (EPS) increase by 6.0% a year over the past three years. Its revenue is down 8.5% over the previous year.

We generally like to see a little revenue growth, but the modest EPSgrowth gives us some relief. It's hard to reach a conclusion about business performance right now. This may be one to watch. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Sun Hung Kai & Co. Limited Been A Good Investment?

Since shareholders would have lost about 19% over three years, some Sun Hung Kai & Co. Limited investors would surely be feeling negative emotions. So shareholders would probably want the company to be lessto generous with CEO compensation.

In Summary...

As previously discussed, Seng Huang is compensated more than what is normal for CEOs of companies of similar size, and which belong to the same industry. While we have not been overly impressed by the business performance, the shareholder returns have been utterly depressing, over the last three years. And the situation doesn't look all that good when you see Seng Huang is remunerated higher than the industry average. All things considered, we believe shareholders would be disappointed to see Seng Huang's compensation grow without first seeing an improvement in the performance of the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 3 warning signs for Sun Hung Kai (of which 1 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Sun Hung Kai, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:86

Sun Hung Kai

Operates in the alternative investment and wealth management businesses.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.