- Hong Kong

- /

- Capital Markets

- /

- SEHK:8017

Here's Why TradeGo FinTech (HKG:8017) Has Caught The Eye Of Investors

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like TradeGo FinTech (HKG:8017), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for TradeGo FinTech

How Fast Is TradeGo FinTech Growing Its Earnings Per Share?

Over the last three years, TradeGo FinTech has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. In impressive fashion, TradeGo FinTech's EPS grew from HK$0.042 to HK$0.077, over the previous 12 months. It's not often a company can achieve year-on-year growth of 84%. The best case scenario? That the business has hit a true inflection point.

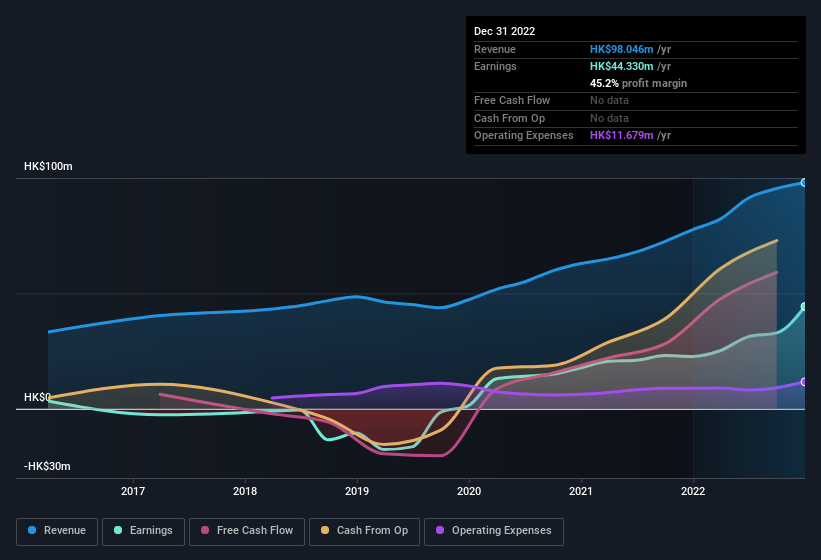

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. TradeGo FinTech maintained stable EBIT margins over the last year, all while growing revenue 26% to HK$98m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since TradeGo FinTech is no giant, with a market capitalisation of HK$1.0b, you should definitely check its cash and debt before getting too excited about its prospects.

Are TradeGo FinTech Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Not only did TradeGo FinTech insiders refrain from selling stock during the year, but they also spent HK$869k buying it. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading. We also note that it was the Executive Chairman & CEO, Yong Liu, who made the biggest single acquisition, paying HK$368k for shares at about HK$0.76 each.

Along with the insider buying, another encouraging sign for TradeGo FinTech is that insiders, as a group, have a considerable shareholding. Indeed, they hold HK$277m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 27% of the company; visible skin in the game.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because TradeGo FinTech's CEO, Yong Liu, is paid at a relatively modest level when compared to other CEOs for companies of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like TradeGo FinTech with market caps under HK$1.6b is about HK$1.8m.

TradeGo FinTech's CEO took home a total compensation package of HK$884k in the year prior to March 2022. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is TradeGo FinTech Worth Keeping An Eye On?

TradeGo FinTech's earnings per share growth have been climbing higher at an appreciable rate. What's more, insiders own a significant stake in the company and have been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest TradeGo FinTech belongs near the top of your watchlist. Now, you could try to make up your mind on TradeGo FinTech by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

The good news is that TradeGo FinTech is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if TradeGo FinTech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8017

TradeGo FinTech

An investment holding company, provides integrated securities trading platform services to brokerage firms and their clients in Hong Kong and the People’s Republic of China.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives