- Hong Kong

- /

- Capital Markets

- /

- SEHK:6881

China Galaxy Securities (SEHK:6881) Earnings Surge 77%, Profit Margin Beats Narrative on Sector Quality

Reviewed by Simply Wall St

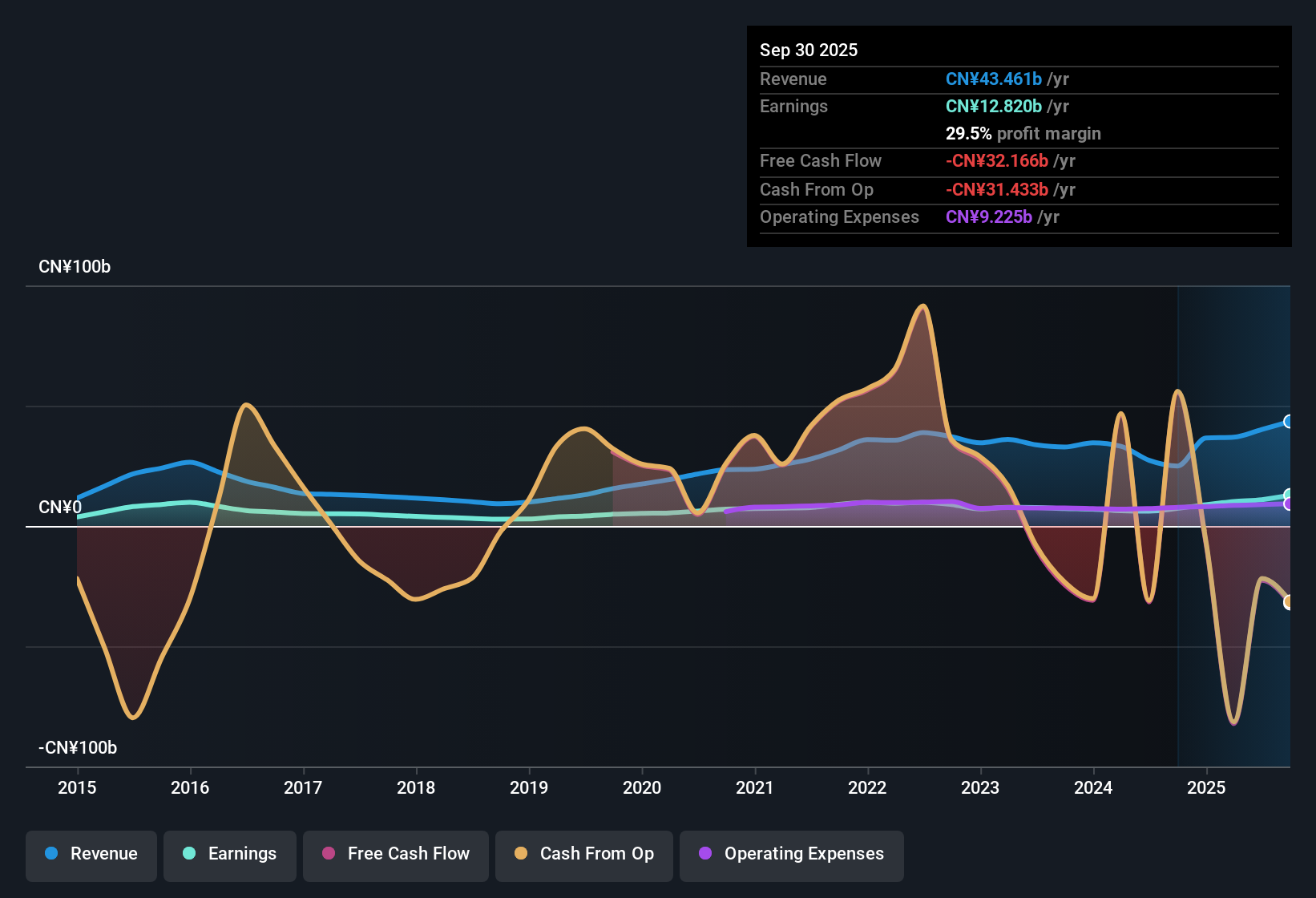

China Galaxy Securities (SEHK:6881) delivered standout results, with earnings soaring 76.9% over the past year, far outpacing its 5-year annual average of just 1.7%. Net profit margins reached 27.2%, beating last year’s 22.6%, and the share price at HK$11.18 trades below the estimated fair value of HK$12.84, helping the stock's valuation case. While earnings and revenue growth are expected to lag the broader Hong Kong market, ongoing profit gains and a competitive Price-to-Earnings Ratio highlight the company’s appeal, though questions remain around dividend sustainability.

See our full analysis for China Galaxy Securities.The next step is to see how these headline figures match up with the dominant market narratives. Some expectations could be confirmed, while others might face a reality check.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Expansion Outpaces Sector Peers

- Net profit margins climbed to 27.2%, outstripping both last year's 22.6% and averages seen among local rivals. This makes profitability a relative strength for China Galaxy Securities in this cycle.

- Profit margin resilience keeps the stock in focus for bullish investors seeking quality, as sector news points to a cyclical rebound but with heightened regulatory and trading risks.

- With higher margins now in place, commentators looking for strong market leaders see the company as better positioned to benefit from policy reforms than smaller brokers.

- However, the sector’s volatility means that any regulatory shocks or a drop in trading activity could quickly test the durability of these improved margins.

Growth Forecasts Trail the Hong Kong Market

- Forward earnings growth is projected at 3.3% per year and revenue at 0.5% per year, lagging broader Hong Kong market averages. This sets a slower pace for future expansion than local benchmarks.

- The prevailing view holds that, while recent headline gains are impressive, the muted growth outlook keeps expectations grounded.

- Analysts looking for strong, sustained growth in leading brokers may temper their enthusiasm due to these more measured forecasts.

- Current optimism relies on positive policy catalysts rather than outperformance against the wider sector trend.

Valuation Discount Versus Peers Remains Wide

- The Price-to-Earnings Ratio stands at 10.2x, well below the peer average of 23.9x and the industry average of 25.5x. The share price of HK$11.18 is trading under the DCF fair value level of HK$12.84.

- This substantial discount is frequently cited as a key reason value-focused investors look past near-term dividend uncertainties.

- Supporters highlight the relative value and margin strength, arguing that the gap against sector valuations may offer a buffer if broader market conditions soften.

- However, dividend sustainability concerns mean investors remain watchful for signs of payout cuts that could erase some of this valuation appeal.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on China Galaxy Securities's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

China Galaxy Securities’ muted growth outlook means its future expansion may trail both sector averages and long-term market leaders.

If you want steadier growth prospects, focus your search on companies showing reliable expansion by using our stable growth stocks screener (2102 results) to find those built for consistency.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6881

China Galaxy Securities

Provides various financial services in the People’s Republic of China.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives