- Hong Kong

- /

- Capital Markets

- /

- SEHK:6608

Shareholders Will Probably Hold Off On Increasing Bairong Inc.'s (HKG:6608) CEO Compensation For The Time Being

Key Insights

- Bairong will host its Annual General Meeting on 21st of June

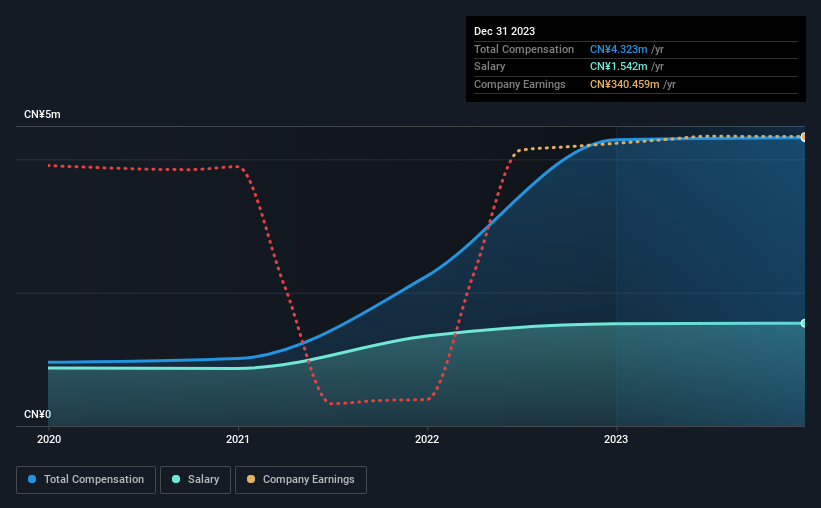

- CEO Shaofeng Zhang's total compensation includes salary of CN¥1.54m

- Total compensation is 74% above industry average

- Over the past three years, Bairong's EPS grew by 98% and over the past three years, the total loss to shareholders 53%

Shareholders of Bairong Inc. (HKG:6608) will have been dismayed by the negative share price return over the last three years. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. The AGM coming up on the 21st of June could be an opportunity for shareholders to bring these concerns to the board's attention. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

Check out our latest analysis for Bairong

Comparing Bairong Inc.'s CEO Compensation With The Industry

Our data indicates that Bairong Inc. has a market capitalization of HK$4.4b, and total annual CEO compensation was reported as CN¥4.3m for the year to December 2023. This means that the compensation hasn't changed much from last year. We think total compensation is more important but our data shows that the CEO salary is lower, at CN¥1.5m.

On comparing similar companies from the Hong Kong Capital Markets industry with market caps ranging from HK$1.6b to HK$6.2b, we found that the median CEO total compensation was CN¥2.5m. Accordingly, our analysis reveals that Bairong Inc. pays Shaofeng Zhang north of the industry median. Furthermore, Shaofeng Zhang directly owns HK$780m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥1.5m | CN¥1.5m | 36% |

| Other | CN¥2.8m | CN¥2.8m | 64% |

| Total Compensation | CN¥4.3m | CN¥4.3m | 100% |

Speaking on an industry level, nearly 83% of total compensation represents salary, while the remainder of 17% is other remuneration. It's interesting to note that Bairong allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Bairong Inc.'s Growth Numbers

Bairong Inc. has seen its earnings per share (EPS) increase by 98% a year over the past three years. In the last year, its revenue is up 31%.

This demonstrates that the company has been improving recently and is good news for the shareholders. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Bairong Inc. Been A Good Investment?

Few Bairong Inc. shareholders would feel satisfied with the return of -53% over three years. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. The fact that the stock price hasn't grown along with earnings may indicate that other issues may be affecting that stock. Shareholders would be keen to know what's holding the stock back when earnings have grown. At the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at Bairong.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Bairong might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6608

Bairong

An investment holding company, operates as an artificial intelligence (AI) technology services company in China.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success