- Hong Kong

- /

- Capital Markets

- /

- SEHK:6066

CSC Financial Co., Ltd.'s (HKG:6066) CEO Compensation Is Looking A Bit Stretched At The Moment

Under the guidance of CEO Geping Li, CSC Financial Co., Ltd. (HKG:6066) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 29 June 2021. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

See our latest analysis for CSC Financial

Comparing CSC Financial Co., Ltd.'s CEO Compensation With the industry

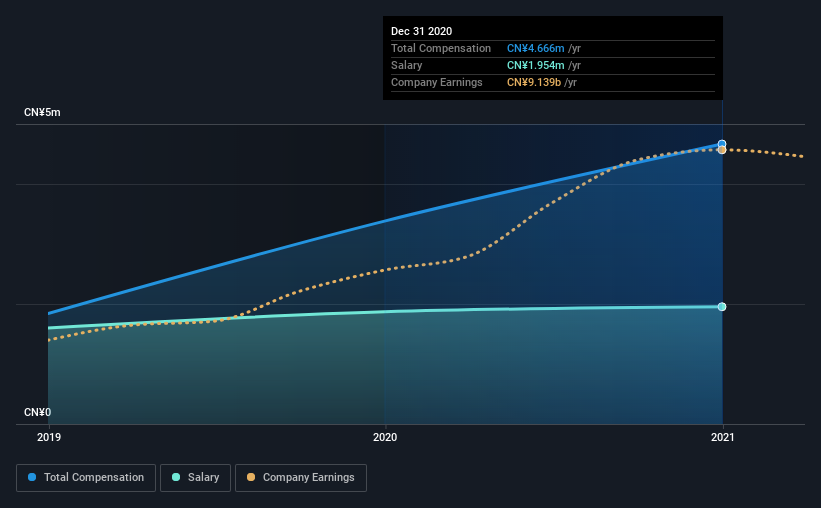

At the time of writing, our data shows that CSC Financial Co., Ltd. has a market capitalization of HK$254b, and reported total annual CEO compensation of CN¥4.7m for the year to December 2020. That's a notable increase of 38% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at CN¥2.0m.

On comparing similar companies in the industry with market capitalizations above HK$62b, we found that the median total CEO compensation was CN¥3.2m. Hence, we can conclude that Geping Li is remunerated higher than the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CN¥2.0m | CN¥1.9m | 42% |

| Other | CN¥2.7m | CN¥1.5m | 58% |

| Total Compensation | CN¥4.7m | CN¥3.4m | 100% |

On an industry level, roughly 84% of total compensation represents salary and 16% is other remuneration. It's interesting to note that CSC Financial allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

CSC Financial Co., Ltd.'s Growth

Over the past three years, CSC Financial Co., Ltd. has seen its earnings per share (EPS) grow by 30% per year. It achieved revenue growth of 65% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has CSC Financial Co., Ltd. Been A Good Investment?

Most shareholders would probably be pleased with CSC Financial Co., Ltd. for providing a total return of 89% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 2 warning signs for CSC Financial you should be aware of, and 1 of them is potentially serious.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:6066

CSC Financial

Provides investment banking services in Mainland China and internationally.

Undervalued with reasonable growth potential.