- Hong Kong

- /

- Capital Markets

- /

- SEHK:3908

Assessing China International Capital’s (SEHK:3908) Valuation After Strong Results and 2025 Interim Dividend Announcement

Reviewed by Simply Wall St

China International Capital (SEHK:3908) just shared its latest results and announced a 2025 interim cash dividend. The company saw significant growth in revenue and net income over the past nine months, which has attracted fresh investor interest.

See our latest analysis for China International Capital.

China International Capital’s strong earnings have fueled optimism, with the stock delivering a 69% year-to-date share price return and a 26% total shareholder return over the past year. Positive momentum is building, further supported by newly announced board appointments and the interim dividend, both of which are seen as signs of stability and ongoing strategic progress.

If you’re interested in uncovering more opportunities like this, broaden your view and discover fast growing stocks with high insider ownership.

With the stock’s strong rally and upbeat results now out in the open, the question remains: is China International Capital still trading at a discount, or is the market already factoring in the next phase of growth?

Price-to-Earnings of 10.5x: Is it justified?

China International Capital is currently trading at a price-to-earnings (P/E) ratio of 10.5x, with the last close price at HK$20.7. This suggests the shares remain attractively valued relative to sector benchmarks and the company’s peers.

The P/E ratio measures how much investors are willing to pay per dollar of earnings, a key metric for evaluating profitability and growth prospects within the capital markets sector. A lower-than-average P/E may indicate the market is not fully recognizing the company’s earnings power or its potential to sustain profit gains.

Compared to the Hong Kong Capital Markets industry average of 23x and a peer average of 19.5x, China International Capital’s P/E stands out as a bargain. In addition, it is also well below the company’s calculated fair P/E ratio of 14.1x, a level the market could ultimately shift toward if optimism persists.

Explore the SWS fair ratio for China International Capital

Result: Price-to-Earnings of 10.5x (UNDERVALUED)

However, slower-than-expected revenue growth or a shift in market sentiment could quickly challenge the perception that shares remain undervalued.

Find out about the key risks to this China International Capital narrative.

Another View: What Does the SWS DCF Model Say?

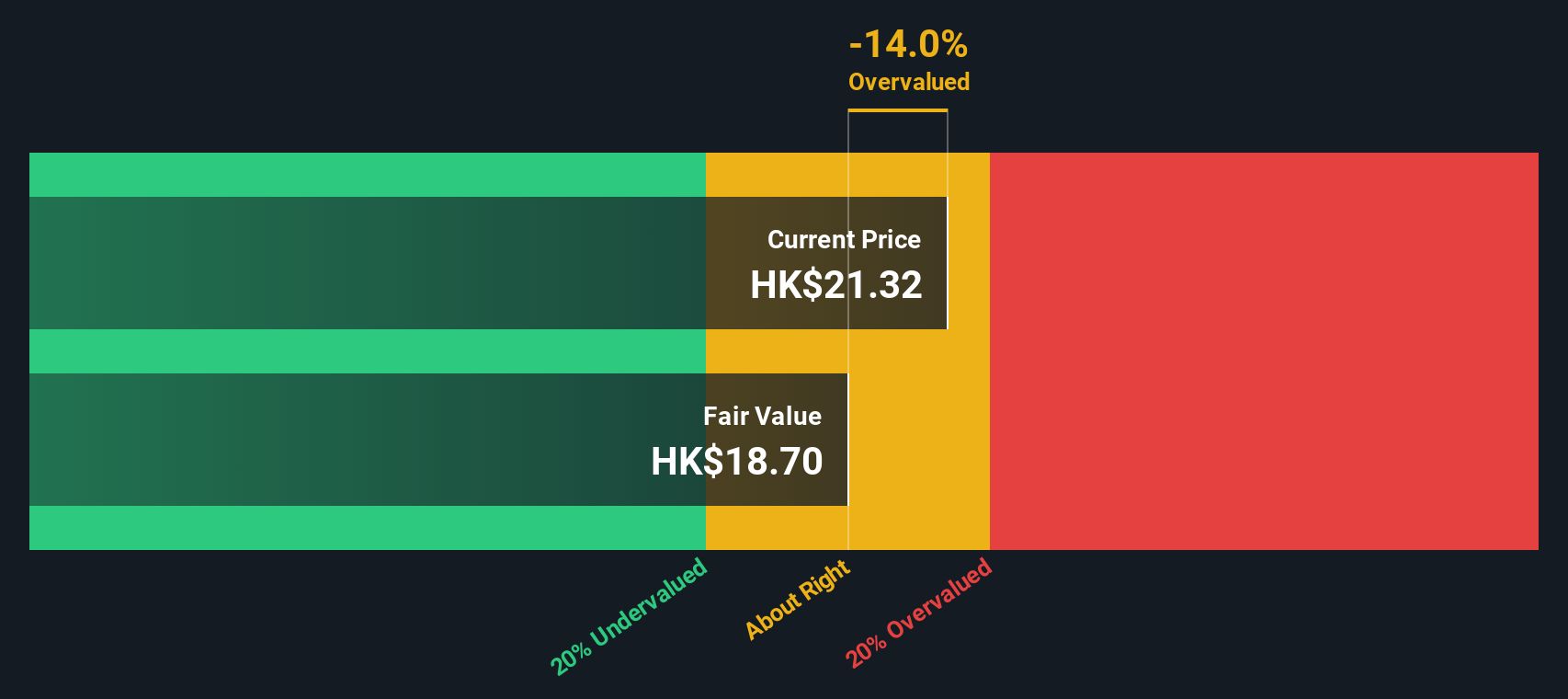

Looking at valuation from another angle, our SWS DCF model provides a more cautious perspective. Based on discounted cash flow, China International Capital appears to be trading above its estimated fair value. This suggests the share price might already be factoring in a good deal of the company’s optimism. If so, is there really a discount here, or are buyers taking on more risk than it seems?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out China International Capital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 844 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own China International Capital Narrative

If you’d like to challenge these views or dig into the numbers yourself, you can shape your own perspective on China International Capital in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding China International Capital.

Looking for more investment ideas?

Let smarter research guide your next move. Exceptional opportunities are out there, but only for those who actively seek them before the crowd catches on.

- Uncover yield potential and boost your portfolio's income profile by reviewing these 20 dividend stocks with yields > 3% offering payouts greater than 3%.

- Capitalize on tech disruption and momentum by tapping into these 26 AI penny stocks harnessing artificial intelligence across fast-moving sectors.

- Claim a head start on the market’s undervalued gems by analyzing these 844 undervalued stocks based on cash flows poised for compelling upside based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3908

China International Capital

Provides financial services in Mainland China and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives