- Hong Kong

- /

- Capital Markets

- /

- SEHK:388

HKEX (SEHK:388) Margin Expansion Reinforces Bullish Narrative Despite Premium Valuation

Reviewed by Simply Wall St

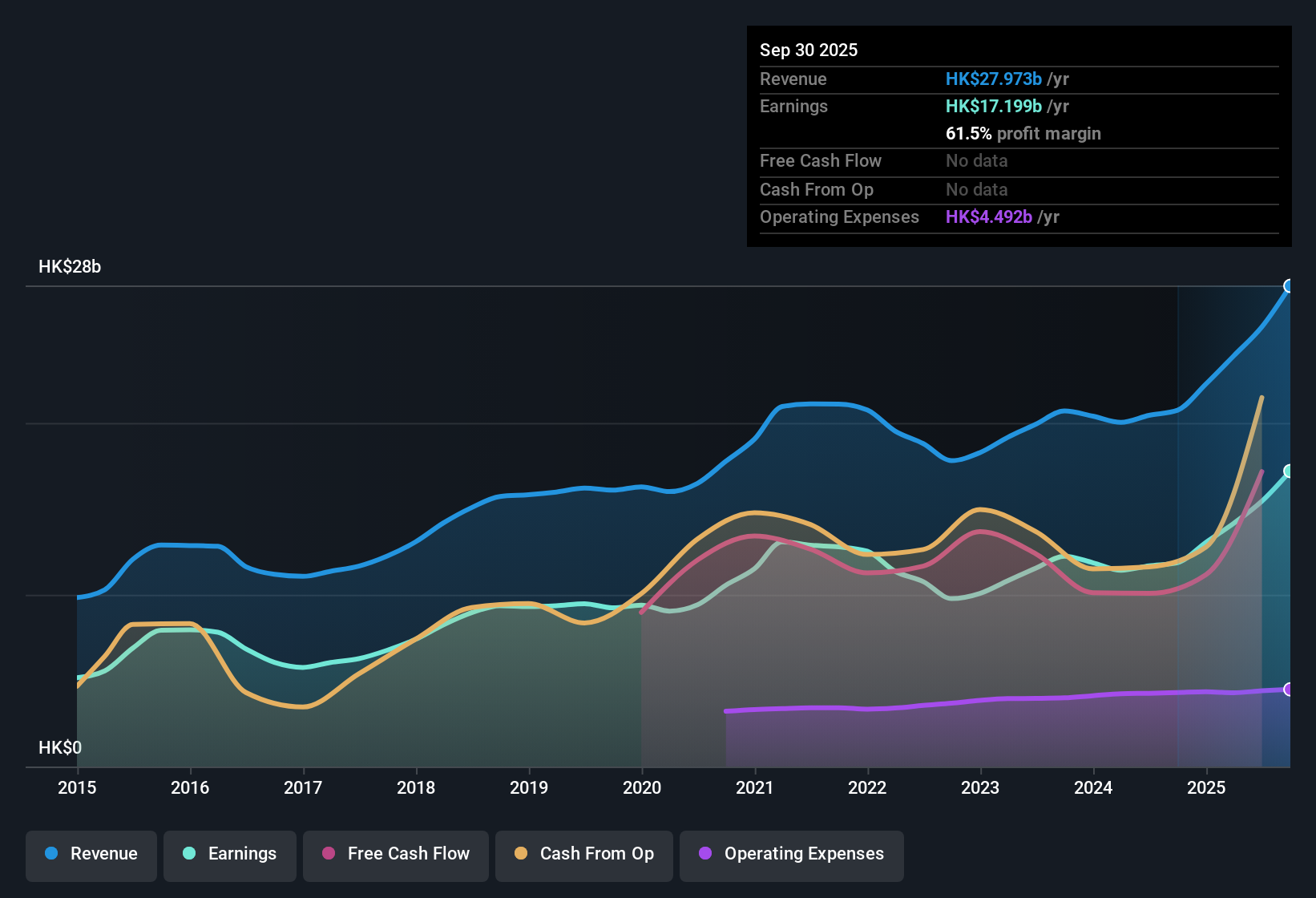

Hong Kong Exchanges and Clearing (SEHK:388) booked 32.3% earnings growth in the latest period, pushing its five-year average to a more modest 3% per year. Net profit margins also rose from 57.1% to 60.3%. Meanwhile, revenue is projected to grow at 3% annually, which trails the Hong Kong market’s 8.5% average. The stock is trading at a premium with a 35.4x Price-to-Earnings Ratio. Looking ahead, earnings growth of 5.6% per year is on the table; however, this remains well below the broader market’s 11.7% average, setting a cautious tone for investors focused on future gains.

See our full analysis for Hong Kong Exchanges and Clearing.Next, we’ll put these headline-grabbing results side by side with the dominant narratives around HKEX, highlighting where the numbers support consensus views and where they may challenge expectations.

See what the community is saying about Hong Kong Exchanges and Clearing

Net Margins Outpace Industry Peers

- Profit margins climbed to 60.3%, outstripping most exchange peers, and analysts expect further expansion to 63.2% over the next three years.

- According to analysts' consensus view, strong margin performance heavily supports the narrative that strategic investments in fintech and efficiency are making HKEX more resilient.

- This margin strength is seen as a counterweight to slower expected revenue growth of 3% per year, which trails the Hong Kong market average of 8.5%.

- Consensus narrative notes that sustained high margins, combined with diversification into new product lines, position HKEX well despite cyclical revenue pressure.

- What’s notable is that profitability is forecast to improve even as revenue growth lags the broader market, which underpins confidence in HKEX's business model.

Consensus sees these results as key to understanding whether HKEX can maintain its leadership if Asia’s financial system keeps evolving.

📊 Read the full Hong Kong Exchanges and Clearing Consensus Narrative.

Valuation Premium Widens Versus Sector

- HKEX trades at a 35.4x Price-to-Earnings Ratio, significantly surpassing the industry’s 23x and peer group’s 12.6x multiples, while still sitting below the projected 40.6x PE required by analysts’ forecasts for FY 2028.

- Consensus narrative flags that the share price at HK$433.0 sits 80% above a DCF fair value of HK$240.36, and is also ahead of the one permitted price target of HK$500.67.

- This gap raises the bar for the next few years. Earnings growth must accelerate or valuation expectations need to moderate for the shares to remain attractive.

- The expected moderate EPS growth rate of 5.6% per year, compared to the sector’s 11.7%, adds a note of caution for value-focused investors.

Analysts Divided on Price Upside

- The analyst price target of HK$500.67 gives HKEX upside of about 16% from its current share price of HK$433.0, but target estimates range widely, with the most cautious as low as HK$340.0.

- Consensus narrative highlights that conviction in HKEX’s future hinges on solidifying new revenue streams and sustaining premium margins.

- Analysts agree the next few years are critical, with ambitious forecasts for earnings (up to HK$19.3 billion by 2028) facing both competitive threats and ongoing macro uncertainty.

- While bulls note that trading volumes and product innovation align with Asia’s economic rise, bears point to rising regulatory risk and potential margin compression.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Hong Kong Exchanges and Clearing on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on HKEX’s results? Transform your insights into a unique narrative in just a few minutes. Do it your way

A great starting point for your Hong Kong Exchanges and Clearing research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While HKEX’s premium valuation and slower-than-market earnings growth could limit future upside, the current setup may not suit value-focused investors.

If you’re searching for more sensible valuations and better risk-reward, check out these 845 undervalued stocks based on cash flows that might offer stronger fundamentals for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hong Kong Exchanges and Clearing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:388

Hong Kong Exchanges and Clearing

Owns and operates stock and futures exchanges, and related clearing houses in Hong Kong, the United Kingdom, and Mainland China.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives