- Hong Kong

- /

- Diversified Financial

- /

- SEHK:3877

Investors Who Bought CSSC (Hong Kong) Shipping (HKG:3877) Shares A Year Ago Are Now Up 11%

On average, over time, stock markets tend to rise higher. This makes investing attractive. But if when you choose to buy stocks, some of them will be below average performers. For example, the CSSC (Hong Kong) Shipping Company Limited (HKG:3877), share price is up over the last year, but its gain of 11% trails the market return. CSSC (Hong Kong) Shipping hasn't been listed for long, so it's still not clear if it is a long term winner.

Check out our latest analysis for CSSC (Hong Kong) Shipping

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year, CSSC (Hong Kong) Shipping actually saw its earnings per share drop 5.8%.

This means it's unlikely the market is judging the company based on earnings growth. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

We haven't seen CSSC (Hong Kong) Shipping increase dividend payments yet, so the yield probably hasn't helped drive the share higher. It saw it's revenue decline by 23% over twelve months. Usually that correlates with a lower share price, but let's face it, the gyrations of the market are sometimes only as clear as mud.

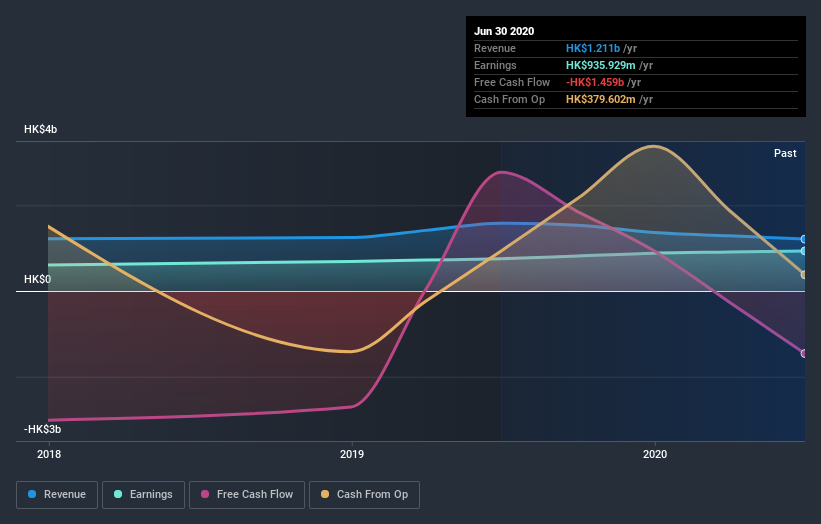

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on CSSC (Hong Kong) Shipping's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, CSSC (Hong Kong) Shipping's TSR for the last year was 21%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

CSSC (Hong Kong) Shipping shareholders have gained 21% for the year (even including dividends). The bad news is that's no better than the average market return, which was roughly 42%. The stock trailed the market by 6.5% in that time, testament to the power of passive investing. But a weak quarter certainly doesn't diminish the longer-term achievements of the business. It's always interesting to track share price performance over the longer term. But to understand CSSC (Hong Kong) Shipping better, we need to consider many other factors. For instance, we've identified 2 warning signs for CSSC (Hong Kong) Shipping (1 is a bit unpleasant) that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade CSSC (Hong Kong) Shipping, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3877

CSSC (Hong Kong) Shipping

Operates as a shipyard-affiliated leasing company in People Republic of China, Asia, the United States, and Europe.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives