- Singapore

- /

- Real Estate

- /

- SGX:CLN

Asian Penny Stocks Spotlight: Allied Group And Two Rising Contenders

Reviewed by Simply Wall St

As global markets react to economic shifts, such as weakening U.S. labor data and fluctuating interest rate expectations, investors are increasingly looking towards Asia for opportunities. Penny stocks, though often considered a relic of past market eras, continue to offer intriguing possibilities due to their affordability and potential for growth. In this article, we explore several Asian penny stocks that stand out for their financial strength and potential upside in the current market landscape.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB3.86 | THB3.81B | ✅ 4 ⚠️ 0 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$2.98 | HK$2.43B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.61 | HK$995.82M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.57 | HK$2.14B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.925 | SGD374.89M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.88 | THB2.93B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.15 | SGD12.4B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.90 | THB9.9B | ✅ 3 ⚠️ 3 View Analysis > |

| Lum Chang Holdings (SGX:L19) | SGD0.42 | SGD157.34M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 987 stocks from our Asian Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Allied Group (SEHK:373)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Allied Group Limited is an investment holding company involved in property investment and development as well as financial services across Hong Kong, the People's Republic of China, Europe, and internationally, with a market cap of HK$8.12 billion.

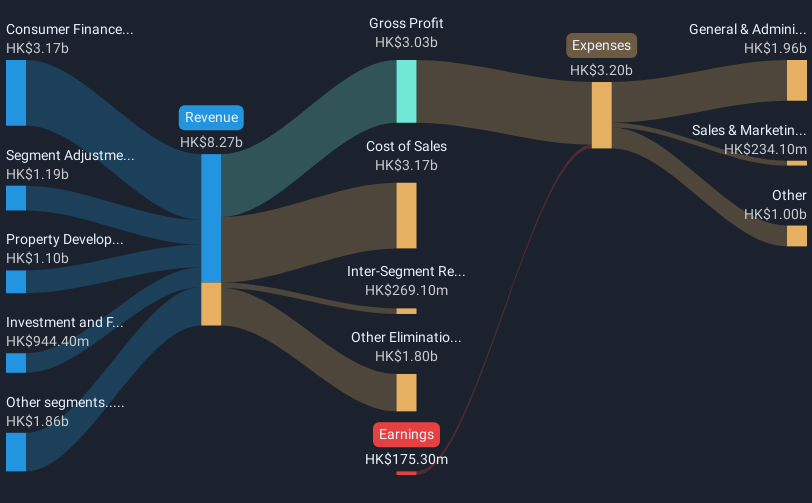

Operations: The company's revenue is primarily derived from Property Development (HK$7.61 billion), Consumer Finance (HK$3.18 billion), Healthcare Services (HK$1.54 billion), and other segments including Investment and Finance (HK$715.1 million) and Property Investment (HK$891.3 million).

Market Cap: HK$8.12B

Allied Group's recent financial performance shows a significant turnaround, with half-year revenue reaching HK$12.08 billion and net income of HK$1.69 billion, marking a shift from previous losses. This improvement is largely due to successful property handovers in Shanghai and increased investment income. Despite its profitability, the company's return on equity remains low at 3.3%, and its debt coverage by operating cash flow is insufficient at 12.4%. However, Allied Group benefits from high-quality earnings, reduced debt levels over five years, stable weekly volatility, and an experienced management team with strong tenure averages.

- Unlock comprehensive insights into our analysis of Allied Group stock in this financial health report.

- Understand Allied Group's track record by examining our performance history report.

China Overseas Grand Oceans Group (SEHK:81)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: China Overseas Grand Oceans Group Limited is an investment holding company that focuses on investing in, developing, and leasing real estate properties in the People's Republic of China and Hong Kong, with a market cap of HK$8.76 billion.

Operations: The company's revenue is primarily generated from Property Development, which accounts for CN¥38.08 billion, and Commercial Property Operations, contributing CN¥508.16 million.

Market Cap: HK$8.76B

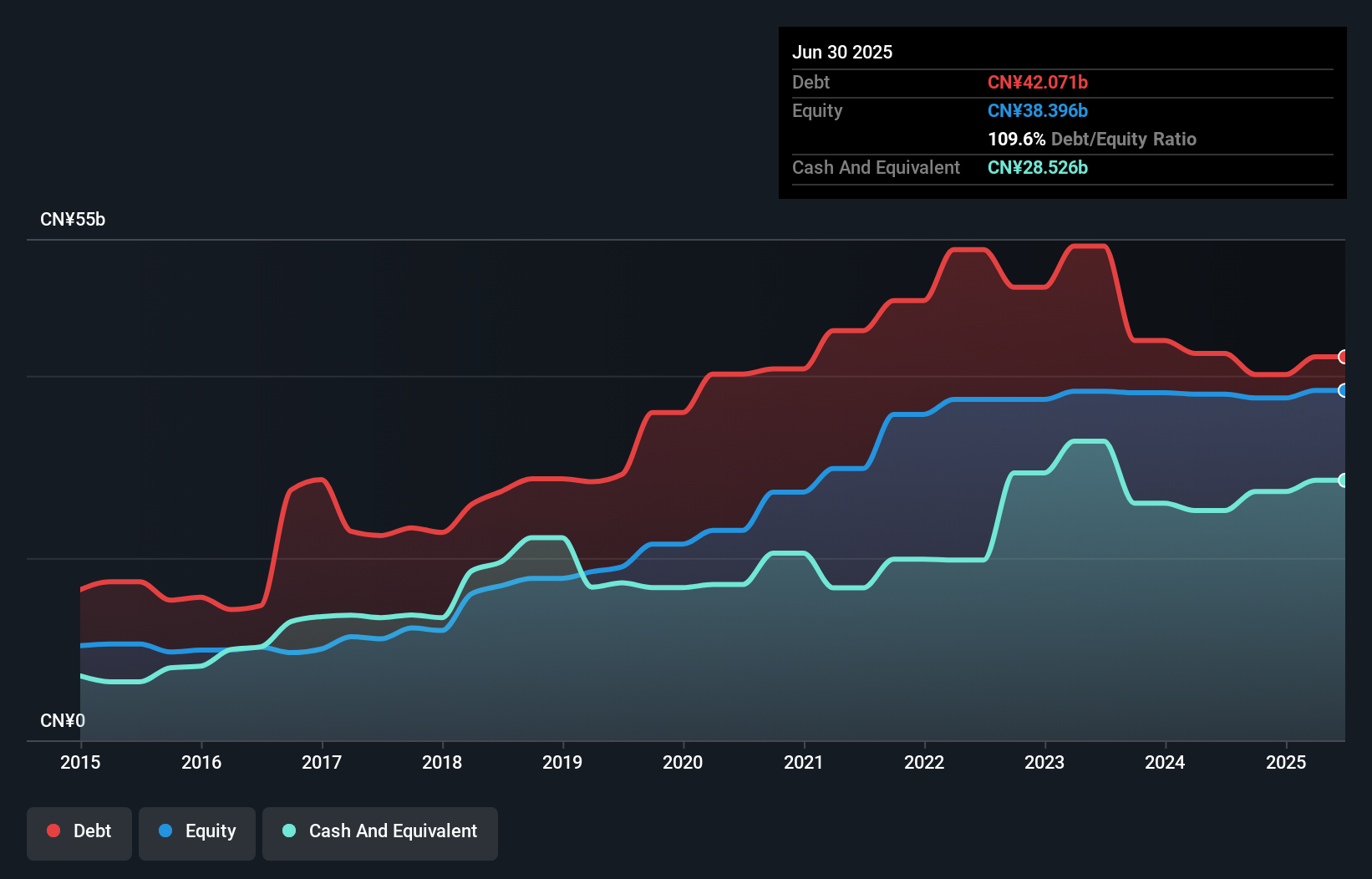

China Overseas Grand Oceans Group's recent performance reflects challenges in the real estate sector, with half-year sales dropping to CN¥14.54 billion from CN¥21.85 billion a year earlier and net income declining to CN¥283.84 million from CN¥884.59 million. Despite this, the company maintains a satisfactory net debt to equity ratio of 34.6% and benefits from strong short-term asset coverage over liabilities, totaling CN¥120.4 billion against long-term liabilities of CN¥28.7 billion. Recent financing arrangements include a RMB 3 billion facility agreement requiring China Overseas Land & Investment Limited to remain its largest shareholder, ensuring financial stability amidst market volatility.

- Navigate through the intricacies of China Overseas Grand Oceans Group with our comprehensive balance sheet health report here.

- Understand China Overseas Grand Oceans Group's earnings outlook by examining our growth report.

APAC Realty (SGX:CLN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: APAC Realty Limited is an investment holding company offering real estate services in Singapore, Indonesia, Vietnam, and internationally with a market cap of SGD307.25 million.

Operations: The company generates revenue primarily through real estate brokerage income amounting to SGD629.51 million, supplemented by rental income of SGD2.68 million.

Market Cap: SGD307.25M

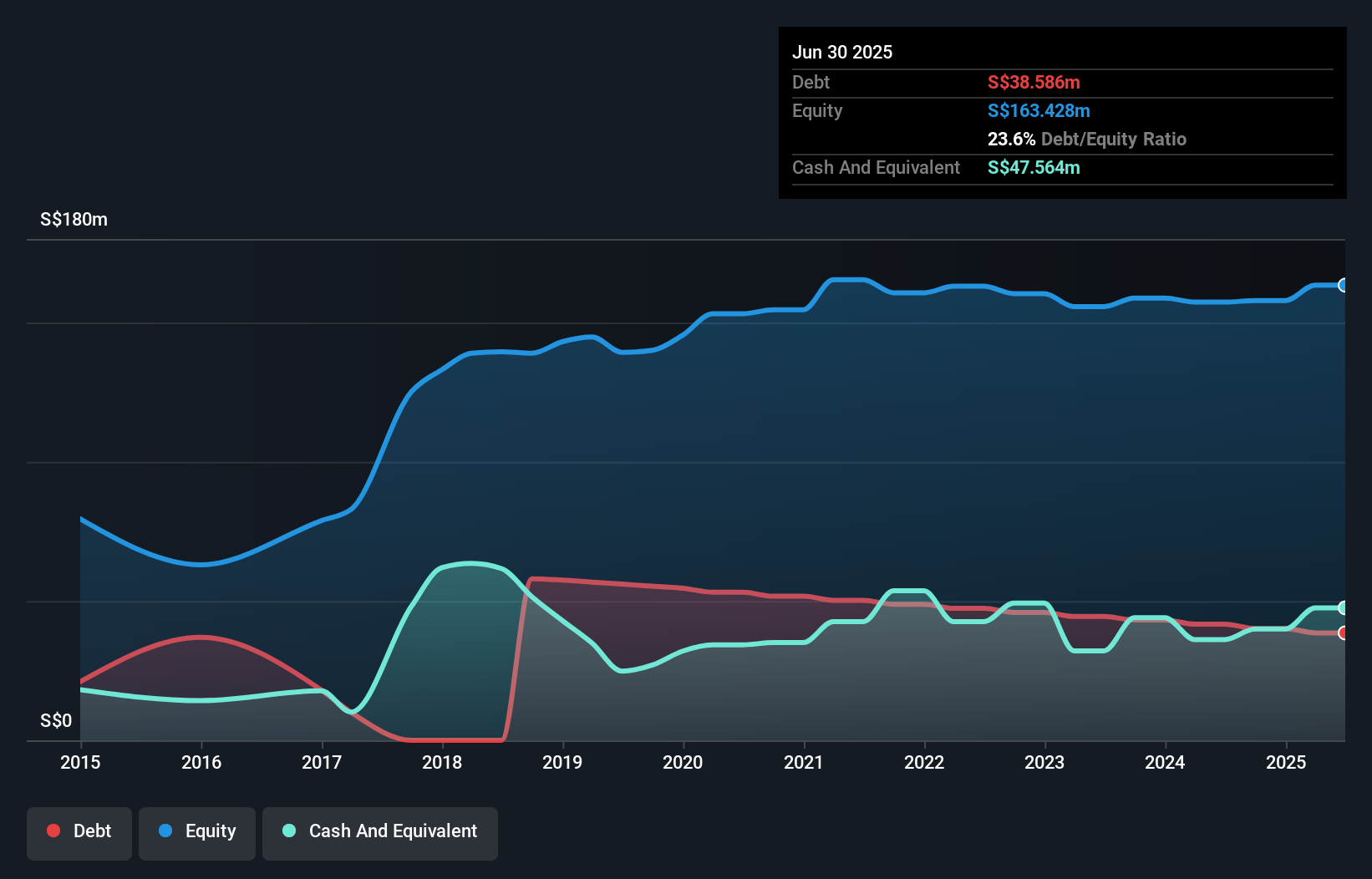

APAC Realty Limited's recent half-year results show a revenue increase to SGD341.5 million from SGD265.16 million, with net income rising to SGD11.25 million from SGD4.07 million year-on-year, indicating improved financial performance despite the real estate sector's volatility. The management team and board are experienced, and the company maintains strong liquidity with short-term assets exceeding liabilities and more cash than debt, reflecting prudent financial management. However, while earnings have grown significantly over the past year, they remain below industry growth rates, and return on equity is low at 8.6%. The dividend payout ratio of 78.1% suggests commitment to shareholder returns but raises questions about its sustainability given current earnings coverage challenges.

- Take a closer look at APAC Realty's potential here in our financial health report.

- Review our growth performance report to gain insights into APAC Realty's future.

Make It Happen

- Get an in-depth perspective on all 987 Asian Penny Stocks by using our screener here.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:CLN

APAC Realty

An investment holding company, provides real estate services in Singapore, Indonesia, Vietnam, and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives