- Hong Kong

- /

- Capital Markets

- /

- SEHK:3678

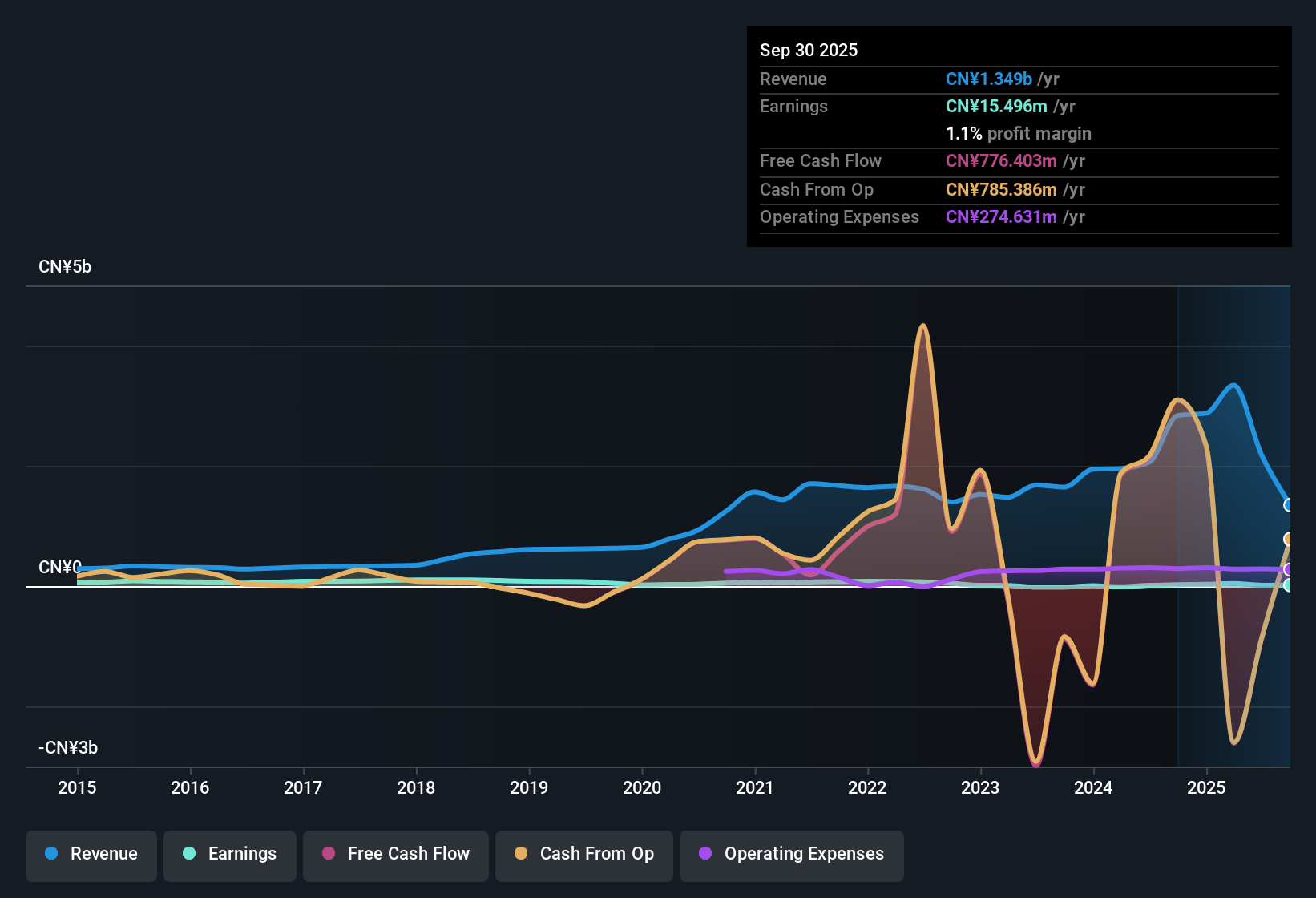

Soho Holly Futures (SEHK:3678): One-Off Gain Drives Profit, Masking Ongoing Earnings Decline

Reviewed by Simply Wall St

Soho Holly Futures (SEHK:3678) posted a net profit margin of 1.1%, up from 0.8% a year ago. However, earnings have declined sharply by 34% per year over the last five years. The most recent annual results included a one-off gain of CN¥8.9 million, making this year’s numbers less useful for judging true underlying performance. With negative earnings growth recorded this year and profit figures heavily influenced by non-recurring items, investors are left weighing the value-focused price-to-sales ratio of 2.7x against a history of inconsistent profitability.

See our full analysis for Soho Holly Futures.Now we will see how these results stack up against the broader market narratives for Soho Holly Futures, and which assumptions may need to be questioned.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Gain Skews Yearly Profit Picture

- The most recent annual profit includes a one-off gain of CN¥8.9 million, which overstates the company’s underlying performance for the period.

- Relying on this figure creates a tension with the positive take seen in mainstream narratives.

- What’s surprising is that underlying earnings, once you strip out this non-recurring item, offer little evidence of sustained improvement. Past five-year earnings have shrunk by 34% per year.

- The consensus narrative notes that such temporary boosts can mask real profitability trends and make it risky for investors to claim that the business is showing material momentum.

- For investors focusing on recurring performance, it is clear this year’s bottom line is not a reliable indicator of future earnings power.

📊 Read the full Soho Holly Futures Consensus Narrative.

Negative Earnings Growth Persists Despite Margin Uptick

- Earnings growth remained negative this year, even with reported net profit margins rising to 1.1% from 0.8% the previous year.

- What is notable here is that, despite this small margin lift,

- Critics highlight the five-year trend of sharply falling earnings, which calls into question whether incremental improvements in margins are enough to offset a fundamentally declining business.

- Mainstream analysis stresses that single-year margin improvements may be quickly reversed, especially in industries where competitive and regulatory pressures stay high without signs of sustainable turnaround in core operations.

Valuation Screens Cheap, But Quality Remains a Hurdle

- The price-to-sales ratio stands at 2.7x, notably below the Hong Kong Capital Markets average (4.8x) and peer group levels (9.4x), making Soho Holly Futures appear inexpensive on face value.

- However, prevailing market analysis points out that

- This valuation gap could simply reflect well-understood risks, like the history of earnings declines and lack of high-quality recurring profits.

- Investors searching for bargains should be cautious, since a low price tag often signals persistent structural challenges in the eyes of institutional market watchers.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Soho Holly Futures's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Soho Holly Futures has struggled with shrinking earnings, unreliable profit boosts from one-off items, and it does not have a track record of consistent long-term growth.

If steady improvements matter to you, check out stable growth stocks screener (2122 results) for companies delivering reliable earnings and revenue expansion year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3678

Soho Holly Futures

Operates as a futures company in Mainland China and Hong Kong.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives