- Hong Kong

- /

- Capital Markets

- /

- SEHK:3329

If You Had Bought BOCOM International Holdings' (HKG:3329) Shares Three Years Ago You Would Be Down 58%

As an investor its worth striving to ensure your overall portfolio beats the market average. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. Unfortunately, that's been the case for longer term BOCOM International Holdings Company Limited (HKG:3329) shareholders, since the share price is down 58% in the last three years, falling well short of the market decline of around 4.0%.

Check out our latest analysis for BOCOM International Holdings

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Although the share price is down over three years, BOCOM International Holdings actually managed to grow EPS by 7.6% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We note that the dividend seems healthy enough, so that probably doesn't explain the share price drop. It's good to see that BOCOM International Holdings has increased its revenue over the last three years. But it's not clear to us why the share price is down. It might be worth diving deeper into the fundamentals, lest an opportunity goes begging.

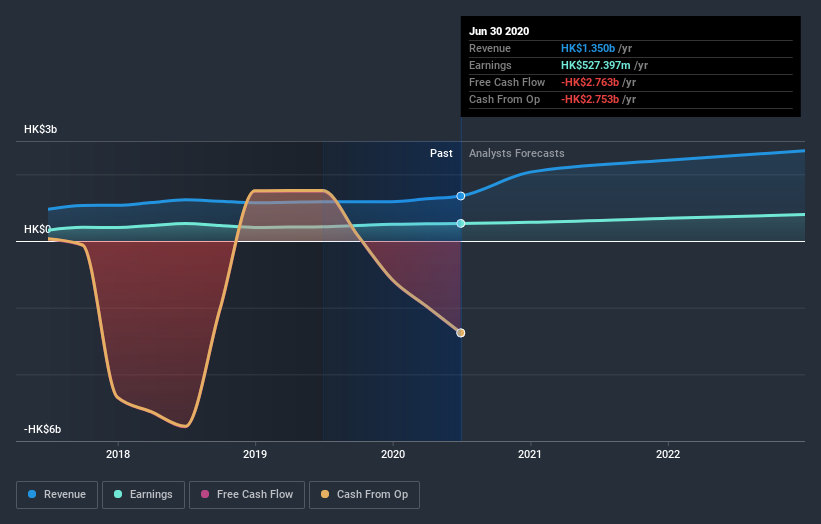

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that BOCOM International Holdings has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for BOCOM International Holdings in this interactive graph of future profit estimates.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for BOCOM International Holdings the TSR over the last 3 years was -49%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

BOCOM International Holdings produced a TSR of 0.6% over the last year. It's always nice to make money but this return falls short of the market return which was about 10% for the year. The silver lining is that the recent rise is far preferable to the annual loss of 14% that shareholders have suffered over the last three years. We hope the turnaround in fortunes continues. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 3 warning signs for BOCOM International Holdings you should be aware of, and 2 of them shouldn't be ignored.

We will like BOCOM International Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading BOCOM International Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BOCOM International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3329

BOCOM International Holdings

An investment holding company, provides securities brokerage, margin financing, corporate finance and underwriting, investment and loans, asset management, and advisory businesses in Hong Kong and Mainland China.

Mediocre balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026