- Hong Kong

- /

- Real Estate

- /

- SEHK:93

3 Penny Stocks With Market Caps Larger Than US$60M To Watch

Reviewed by Simply Wall St

Global markets have experienced a tumultuous week, with U.S. stocks mostly lower due to AI competition fears and mixed corporate earnings, while European indices reached new highs following the ECB's interest rate cuts. In such a volatile market landscape, identifying promising investment opportunities requires careful consideration of financial health and growth potential. Although the term "penny stocks" may seem outdated, these smaller or newer companies can still offer significant returns when backed by solid fundamentals. Let's explore several penny stocks that stand out for their financial strength and potential for growth.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.85 | HK$44.23B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.86 | £471.38M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.65 | £174.08M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.39 | MYR1.09B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$141.28M | ★★★★☆☆ |

| Lever Style (SEHK:1346) | HK$1.12 | HK$710.96M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.22 | £154.81M | ★★★★★☆ |

Click here to see the full list of 5,727 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Maike Tube Industry Holdings (SEHK:1553)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Maike Tube Industry Holdings Limited is an investment holding company that manufactures and sells steel pipe products and prefabricated pipe nipple products across China, the rest of Asia, the United States, Europe, and internationally, with a market cap of HK$529.24 million.

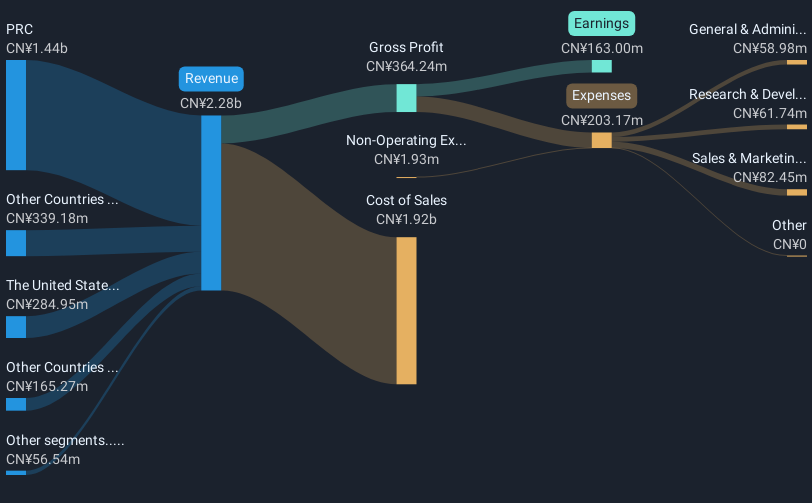

Operations: The company generates CN¥2.28 billion in revenue from its production and sales of pipe products segment.

Market Cap: HK$529.24M

Maike Tube Industry Holdings has demonstrated robust financial health with a significant reduction in its debt-to-equity ratio from 52.1% to 9.9% over five years, and it holds more cash than total debt. Despite negative operating cash flow, the company's earnings have grown consistently at 14.7% annually over the past five years, slightly accelerating to 15% last year. However, its return on equity remains low at 15.1%. Recent executive changes include Mr. Wang Ning's appointment as CEO in December 2024 and Mr. Kong Linglei rejoining the board as a non-executive director in February 2025, bringing seasoned leadership experience to the company amidst stable weekly volatility of around 7%.

- Get an in-depth perspective on Maike Tube Industry Holdings' performance by reading our balance sheet health report here.

- Gain insights into Maike Tube Industry Holdings' historical outcomes by reviewing our past performance report.

OCI International Holdings (SEHK:329)

Simply Wall St Financial Health Rating: ★★★★★★

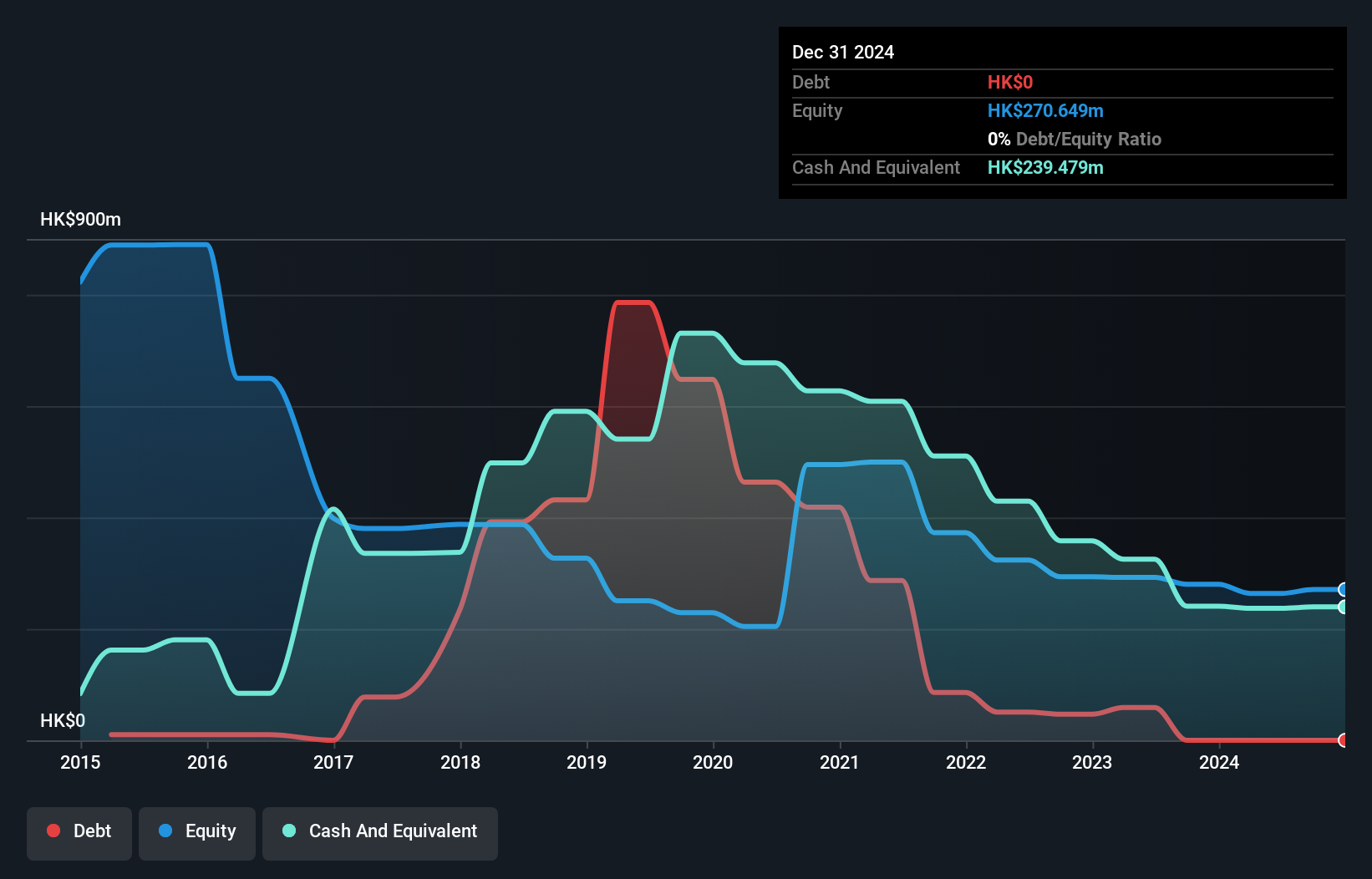

Overview: OCI International Holdings Limited is an investment holding company that offers asset management services in Hong Kong and the People’s Republic of China, with a market cap of HK$524.91 million.

Operations: OCI International Holdings generates its revenue from asset management (HK$27.19 million), trading of wines and beverages (HK$64.64 million), securities trading and investments (loss of HK$11.05 million), and investment and financial advisory services (HK$0.53 million).

Market Cap: HK$524.91M

OCI International Holdings, with a market cap of HK$524.91 million, operates in asset management and trading sectors but remains unprofitable. Despite its negative return on equity at -10.87%, the company boasts a robust financial position with no debt and short-term assets (HK$275.6M) comfortably covering both short (HK$26.8M) and long-term liabilities (HK$4.3M). The firm has managed to maintain a positive cash flow, ensuring over three years of cash runway even without profitability improvements. Recent board changes include appointing Ms. Guo Ting Ting as non-executive director, potentially bringing fresh strategic insights amidst high stock volatility compared to peers in Hong Kong.

- Click here and access our complete financial health analysis report to understand the dynamics of OCI International Holdings.

- Understand OCI International Holdings' track record by examining our performance history report.

Zero Fintech Group (SEHK:93)

Simply Wall St Financial Health Rating: ★★★★☆☆

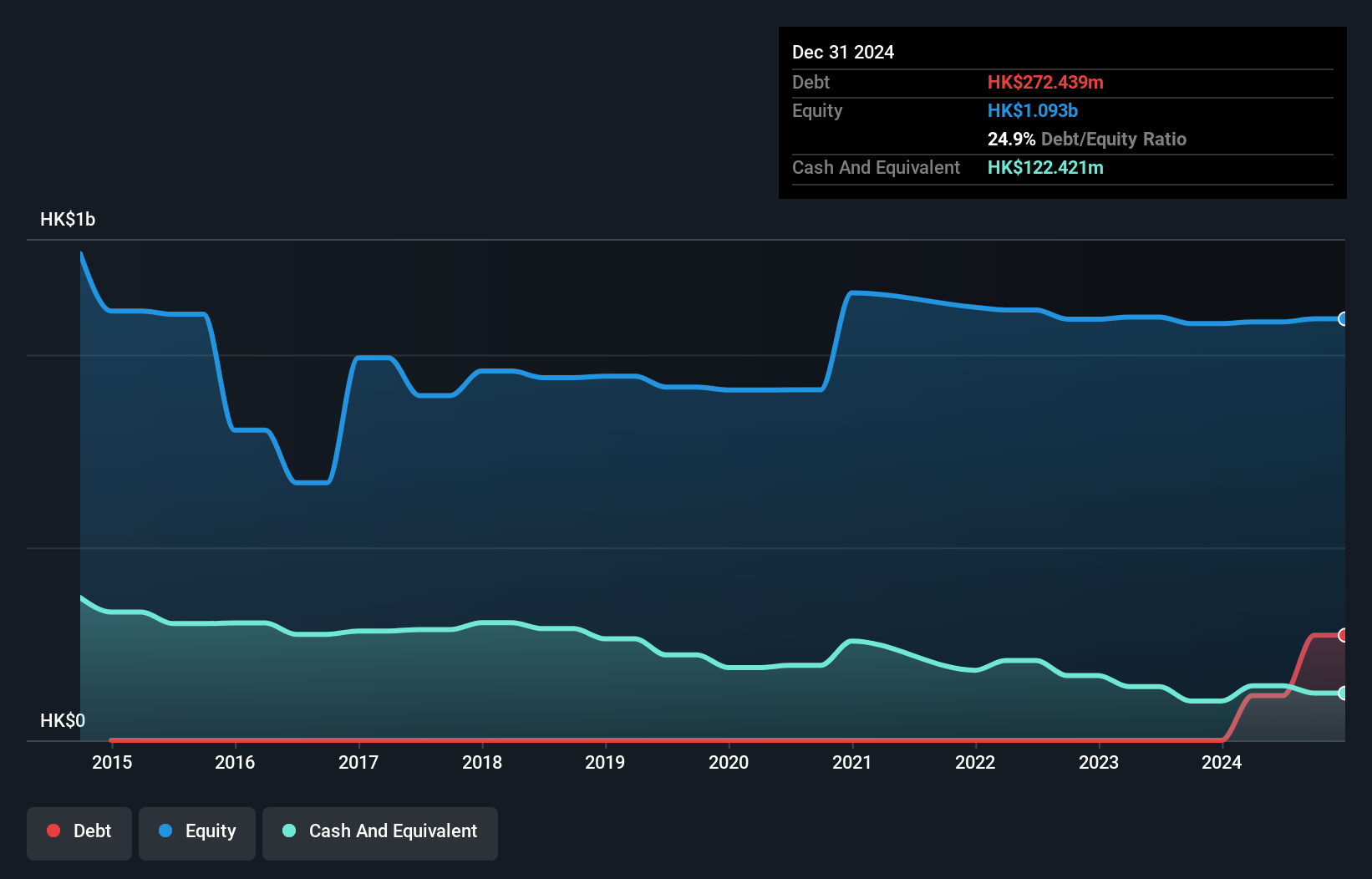

Overview: Zero Fintech Group Limited is an investment holding company that focuses on investing in, developing, and selling real estate properties in the People’s Republic of China and Hong Kong, with a market capitalization of HK$1.76 billion.

Operations: The company's revenue is derived from two segments: Money Lending, contributing HK$217.17 million, and Property Development and Investment, generating HK$1.57 billion.

Market Cap: HK$1.76B

Zero Fintech Group Limited, with a market cap of HK$1.76 billion, derives significant revenue from property development and money lending in China and Hong Kong. The company maintains a strong liquidity position, as short-term assets (HK$457.9 million) cover both short (HK$26.9 million) and long-term liabilities (HK$116.8 million). Despite facing a large one-off loss impacting recent financial results, Zero Fintech remains profitable over the past five years with earnings growth averaging 38.5% annually. However, recent challenges include negative earnings growth (-23.6%) over the last year and low return on equity at 1.2%.

- Dive into the specifics of Zero Fintech Group here with our thorough balance sheet health report.

- Gain insights into Zero Fintech Group's past trends and performance with our report on the company's historical track record.

Make It Happen

- Gain an insight into the universe of 5,727 Penny Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zero Fintech Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:93

Zero Fintech Group

Engages in property investment and development in the People’s Republic of China and Hong Kong.

Solid track record with mediocre balance sheet.

Market Insights

Community Narratives