- Hong Kong

- /

- Healthcare Services

- /

- SEHK:2666

Why Investors Shouldn't Be Surprised By Genertec Universal Medical Group Company Limited's (HKG:2666) Low P/E

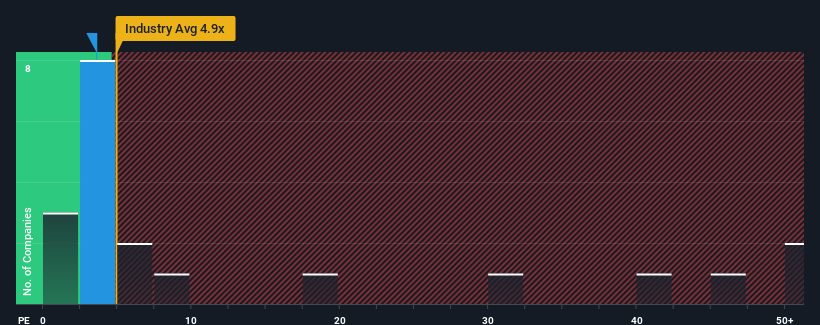

Genertec Universal Medical Group Company Limited's (HKG:2666) price-to-earnings (or "P/E") ratio of 3.6x might make it look like a strong buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 9x and even P/E's above 17x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Genertec Universal Medical Group has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Genertec Universal Medical Group

How Is Genertec Universal Medical Group's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as Genertec Universal Medical Group's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Fortunately, a few good years before that means that it was still able to grow EPS by 17% in total over the last three years. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 6.2% each year as estimated by the four analysts watching the company. That's shaping up to be materially lower than the 16% per year growth forecast for the broader market.

With this information, we can see why Genertec Universal Medical Group is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Genertec Universal Medical Group's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Genertec Universal Medical Group's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Genertec Universal Medical Group (1 doesn't sit too well with us) you should be aware of.

Of course, you might also be able to find a better stock than Genertec Universal Medical Group. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2666

Genertec Universal Medical Group

Provides financing, advisory, and medical services in the People’s Republic of China.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion