- Hong Kong

- /

- Capital Markets

- /

- SEHK:245

China Vered Financial Holding (HKG:245 shareholders incur further losses as stock declines 19% this week, taking five-year losses to 47%

While not a mind-blowing move, it is good to see that the China Vered Financial Holding Corporation Limited (HKG:245) share price has gained 20% in the last three months. But that doesn't change the fact that the returns over the last five years have been less than pleasing. You would have done a lot better buying an index fund, since the stock has dropped 47% in that half decade.

With the stock having lost 19% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for China Vered Financial Holding

Because China Vered Financial Holding made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over half a decade China Vered Financial Holding reduced its trailing twelve month revenue by 2.7% for each year. That's not what investors generally want to see. The stock hasn't done well for shareholders in the last five years, falling 8%, annualized. But it doesn't surprise given the falling revenue. It might be worth watching for signs of a turnaround - buyers are probably expecting one.

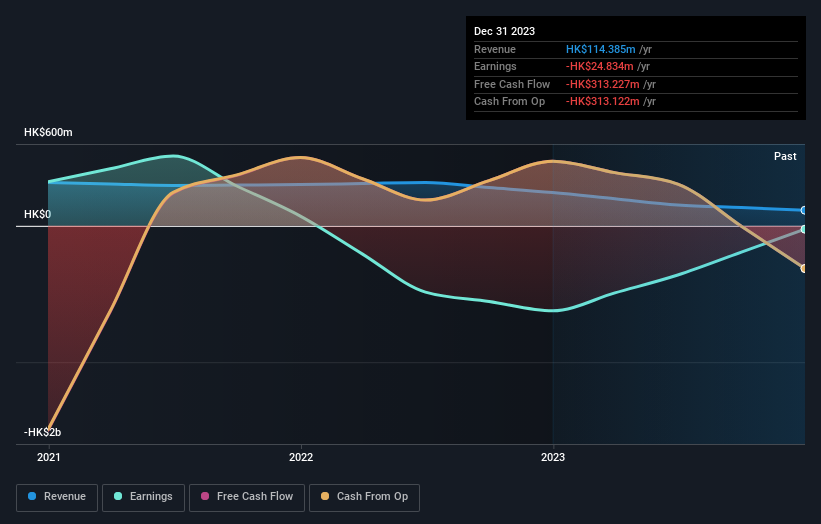

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's good to see that China Vered Financial Holding has rewarded shareholders with a total shareholder return of 34% in the last twelve months. Notably the five-year annualised TSR loss of 8% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 2 warning signs we've spotted with China Vered Financial Holding (including 1 which is a bit concerning) .

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:245

China Vered Financial Holding

An investment holding company, provides asset management, consultancy, financing, and securities advisory and brokerage services in Hong Kong, Mainland China, Japan, and Canada.

Flawless balance sheet minimal.