Stock Analysis

- Hong Kong

- /

- Capital Markets

- /

- SEHK:218

Strong week for Shenwan Hongyuan (H.K.) (HKG:218) shareholders doesn't alleviate pain of five-year loss

While not a mind-blowing move, it is good to see that the Shenwan Hongyuan (H.K.) Limited (HKG:218) share price has gained 20% in the last three months. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Like a ship taking on water, the share price has sunk 74% in that time. The recent bounce might mean the long decline is over, but we are not confident. The real question is whether the business can leave its past behind and improve itself over the years ahead.

The recent uptick of 14% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Check out our latest analysis for Shenwan Hongyuan (H.K.)

Shenwan Hongyuan (H.K.) wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last five years Shenwan Hongyuan (H.K.) saw its revenue shrink by 10.0% per year. That puts it in an unattractive cohort, to put it mildly. So it's not altogether surprising to see the share price down 12% per year in the same time period. This kind of price performance makes us very wary, especially when combined with falling revenue. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

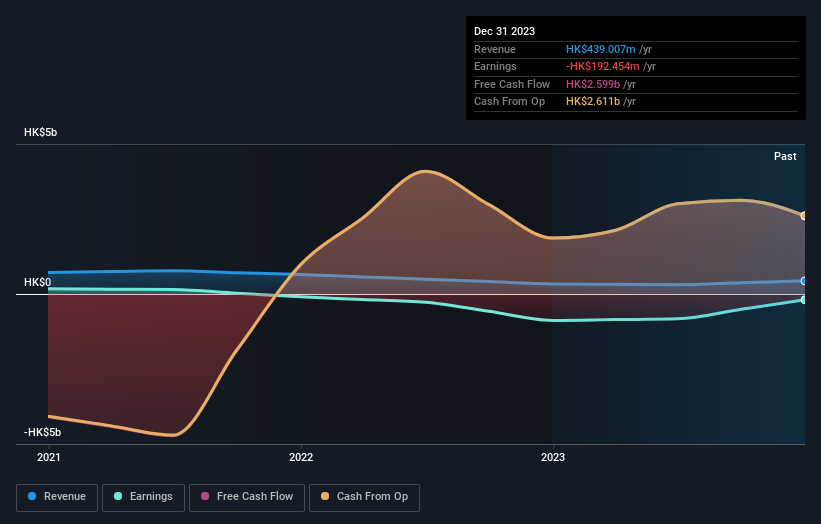

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Shenwan Hongyuan (H.K.)'s balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Shenwan Hongyuan (H.K.)'s total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Shenwan Hongyuan (H.K.)'s TSR of was a loss of 71% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Shenwan Hongyuan (H.K.) shareholders are down 7.7% for the year, but the market itself is up 5.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 11% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It's always interesting to track share price performance over the longer term. But to understand Shenwan Hongyuan (H.K.) better, we need to consider many other factors. To that end, you should learn about the 2 warning signs we've spotted with Shenwan Hongyuan (H.K.) (including 1 which is a bit unpleasant) .

We will like Shenwan Hongyuan (H.K.) better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:218

Shenwan Hongyuan (H.K.)

Engages in the brokerage, corporate finance, asset management, financing and loans, and investment and other businesses in Hong Kong.

Excellent balance sheet and slightly overvalued.