- Hong Kong

- /

- Capital Markets

- /

- SEHK:218

Shenwan Hongyuan (H.K.) (HKG:218) stock falls 11% in past week as five-year earnings and shareholder returns continue downward trend

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We really hate to see fellow investors lose their hard-earned money. Anyone who held Shenwan Hongyuan (H.K.) Limited (HKG:218) for five years would be nursing their metaphorical wounds since the share price dropped 79% in that time. We also note that the stock has performed poorly over the last year, with the share price down 30%. Furthermore, it's down 25% in about a quarter. That's not much fun for holders. Of course, this share price action may well have been influenced by the 19% decline in the broader market, throughout the period.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

View our latest analysis for Shenwan Hongyuan (H.K.)

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

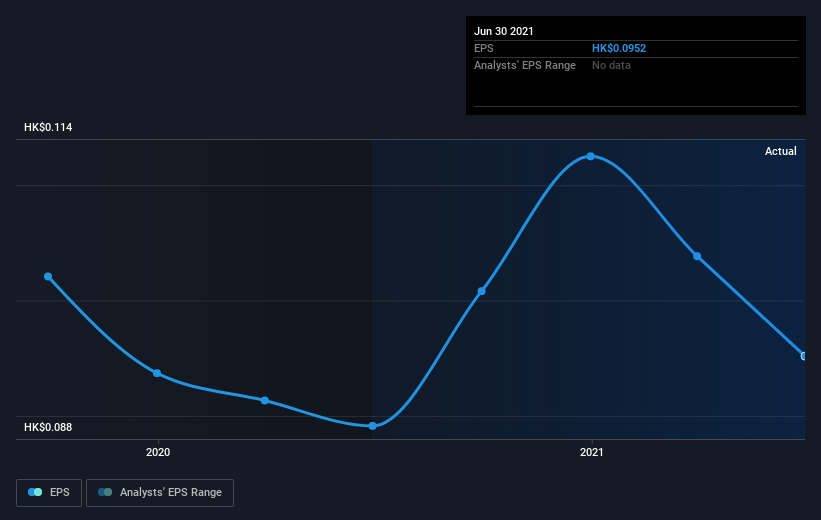

During the five years over which the share price declined, Shenwan Hongyuan (H.K.)'s earnings per share (EPS) dropped by 6.8% each year. This reduction in EPS is less than the 27% annual reduction in the share price. This implies that the market is more cautious about the business these days. The less favorable sentiment is reflected in its current P/E ratio of 7.67.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Shenwan Hongyuan (H.K.) the TSR over the last 5 years was -76%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Although it hurts that Shenwan Hongyuan (H.K.) returned a loss of 27% in the last twelve months, the broader market was actually worse, returning a loss of 31%. Given the total loss of 12% per year over five years, it seems returns have deteriorated in the last twelve months. Whilst Baron Rothschild does tell the investor "buy when there's blood in the streets, even if the blood is your own", buyers would need to examine the data carefully to be comfortable that the business itself is sound. It's always interesting to track share price performance over the longer term. But to understand Shenwan Hongyuan (H.K.) better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Shenwan Hongyuan (H.K.) you should be aware of, and 1 of them is a bit concerning.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:218

Shenwan Hongyuan (H.K.)

An investment holding company, engages in the brokerage, corporate finance, asset management, financing and loans, and investment and other businesses in Hong Kong.

Flawless balance sheet and overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026