- Hong Kong

- /

- Diversified Financial

- /

- SEHK:1606

Assessing China Development Bank Financial Leasing (SEHK:1606) Valuation Following a Year of Strong Returns and Revenue Growth

Reviewed by Simply Wall St

China Development Bank Financial Leasing (SEHK:1606) has been in the spotlight lately following its steady performance over the past year. Its shares returned 46% during that period. The company’s revenue has grown by 20% year-over-year, signaling solid business fundamentals.

See our latest analysis for China Development Bank Financial Leasing.

Momentum has mostly held up for China Development Bank Financial Leasing, with shares sitting at HK$1.69 and the company delivering a 45.8% total return for investors over the past year. The three-year total return of 115% underlines confidence in its longer-term prospects, even as short-term price movements modestly fluctuate.

If steady gains like these have you thinking bigger, now might be a smart time to broaden your search and discover fast growing stocks with high insider ownership

With strong returns and clear revenue growth, the key question now is whether China Development Bank Financial Leasing is still undervalued, or if the market has already anticipated all future gains and there is little room for upside.

Price-to-Earnings of 3.9x: Is it justified?

With a price-to-earnings ratio of just 3.9x at the last close of HK$1.69, China Development Bank Financial Leasing trades well below its industry peers, signaling a potentially undervalued opportunity in the sector.

The price-to-earnings (P/E) ratio is a key valuation multiple, calculated by dividing the share price by earnings per share. It helps investors gauge how much they are paying for each dollar of company profit. A lower ratio can indicate undervaluation or market skepticism about future growth.

At 3.9x, the P/E ratio is far below both the peer average of 11.3x and the industry average of 16.3x. This suggests the market might be significantly underpricing the company’s earnings potential. Furthermore, this multiple sits well beneath the estimated fair Price-to-Earnings ratio of 10.1x, a level that reflects sector norms and company fundamentals, and could be a reference point for future market re-rating.

Explore the SWS fair ratio for China Development Bank Financial Leasing

Result: Price-to-Earnings of 3.9x (UNDERVALUED)

However, risks remain if growth slows or if market sentiment weakens. These factors could quickly erase recent gains and shift the outlook for investors.

Find out about the key risks to this China Development Bank Financial Leasing narrative.

Another View: What Does the DCF Model Suggest?

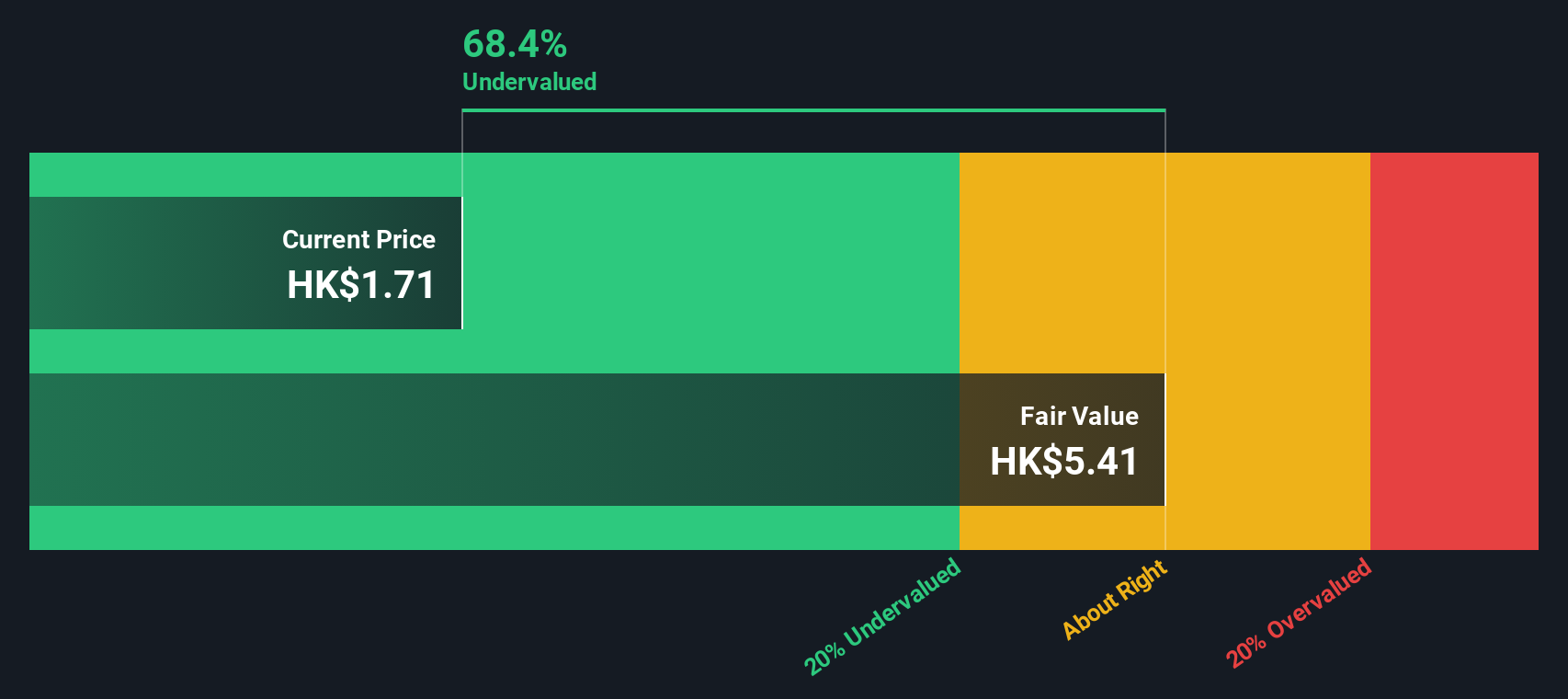

Switching to a different lens, the SWS DCF model also points to significant undervaluation for China Development Bank Financial Leasing. At HK$1.69, shares trade well below the DCF fair value estimate of HK$5.43. This alternative approach also hints at room for upside. However, do both methods really tell the whole story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out China Development Bank Financial Leasing for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 894 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own China Development Bank Financial Leasing Narrative

If you see the data differently, or want to investigate for yourself, it's easy to build your own view in just a few minutes. Do it your way

A great starting point for your China Development Bank Financial Leasing research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop at just one opportunity. Give yourself the edge by searching for stocks poised for growth, hidden value, and powerful momentum in markets others might overlook.

- Spot high-potential companies on the verge of a breakthrough by starting with these 3587 penny stocks with strong financials.

- Capture the upside from revolutionary technology trends with the innovative picks found in these 27 AI penny stocks.

- Lock in strong yields and grow your income by browsing these 18 dividend stocks with yields > 3% offering over 3% returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1606

China Development Bank Financial Leasing

China Development Bank Financial Leasing Co., Ltd.

Undervalued with proven track record.

Market Insights

Community Narratives