- Hong Kong

- /

- Consumer Finance

- /

- SEHK:1577

Quanzhou Huixin Micro-Credit (HKG:1577) Has Re-Affirmed Its Dividend Of HK$0.061

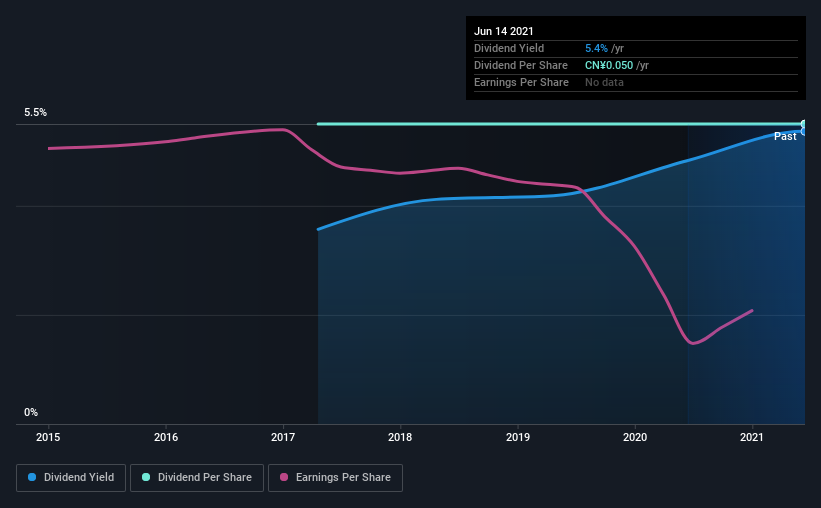

Quanzhou Huixin Micro-Credit Co., Ltd.'s (HKG:1577) investors are due to receive a payment of HK$0.061 per share on 16th of August. Based on this payment, the dividend yield on the company's stock will be 5.4%, which is an attractive boost to shareholder returns.

See our latest analysis for Quanzhou Huixin Micro-Credit

Quanzhou Huixin Micro-Credit Is Paying Out More Than It Is Earning

A big dividend yield for a few years doesn't mean much if it can't be sustained. Prior to this announcement, Quanzhou Huixin Micro-Credit's dividend made up quite a large proportion of earnings but only 58% of free cash flows. Since the dividend is just paying out cash to shareholders, we care more about the cash payout ratio from which we can see plenty is being left over for reinvestment in the business.

Looking forward, EPS could fall by 16.7% if the company can't turn things around from the last few years. If the dividend continues along the path it has been on recently, the payout ratio in 12 months could be 133%, which is definitely a bit high to be sustainable going forward.

Quanzhou Huixin Micro-Credit Doesn't Have A Long Payment History

Looking back, the dividend has been stable, but the company hasn't been paying a dividend for very long so we can't be confident that the dividend will remain stable through all economic environments. The last annual payment of CN¥0.05 was flat on the first annual payment 4 years ago. We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

The Dividend Has Limited Growth Potential

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. However, initial appearances might be deceiving. Quanzhou Huixin Micro-Credit's earnings per share has shrunk at 17% a year over the past five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in.

In Summary

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 4 warning signs for Quanzhou Huixin Micro-Credit (of which 1 doesn't sit too well with us!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Quanzhou Huixin Micro-credit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1577

Quanzhou Huixin Micro-credit

A microfinance company, provides various short-term financing solutions to entrepreneurial individuals, small and medium-sized enterprises, and microenterprises in the People’s Republic of China.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives