- Hong Kong

- /

- Capital Markets

- /

- SEHK:1428

Why Did Bright Smart Securities (SEHK:1428) Boost Profits Despite Lower Revenue This Half-Year?

Reviewed by Sasha Jovanovic

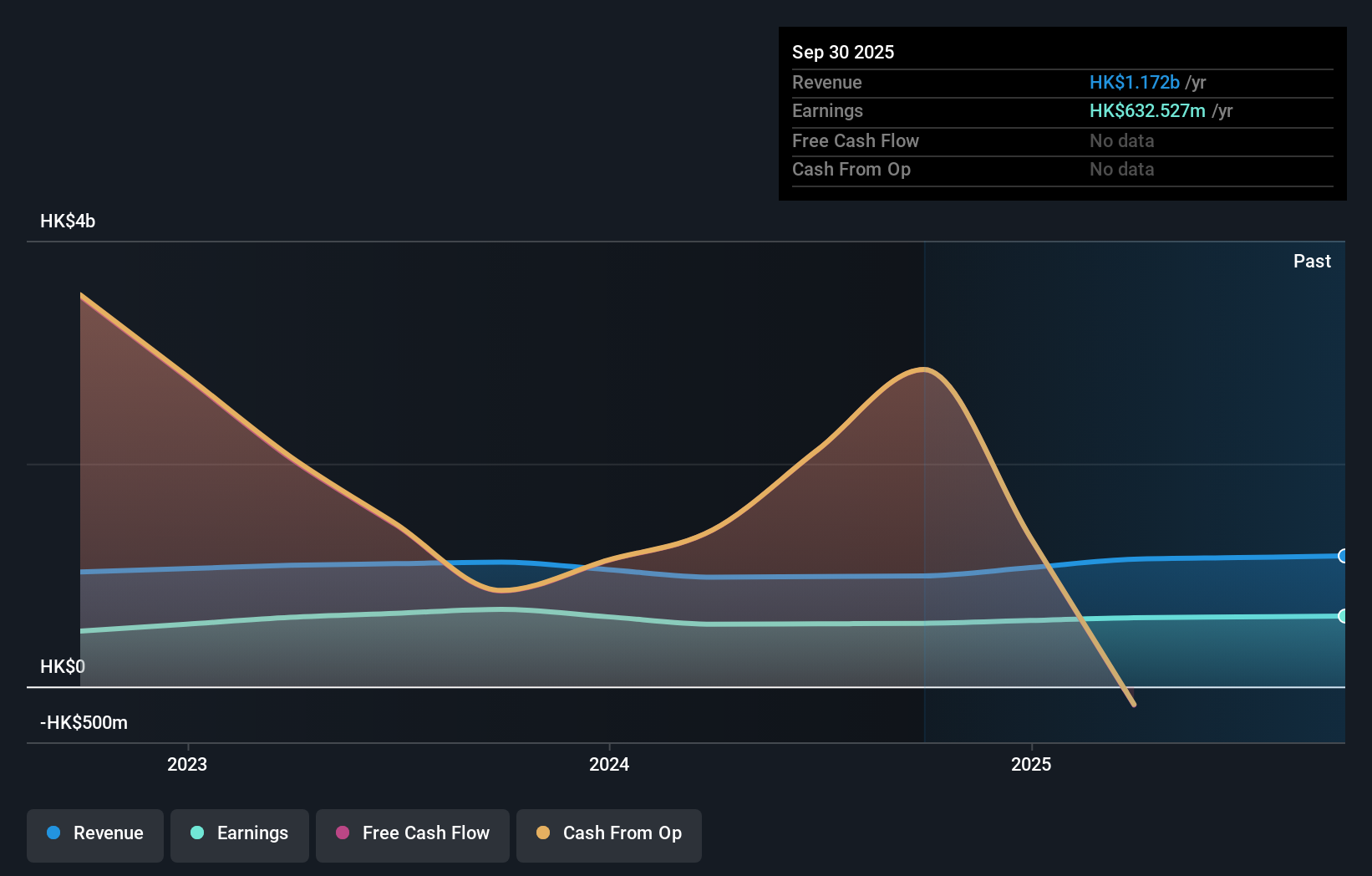

- Bright Smart Securities & Commodities Group Limited has announced its half-year earnings for the period ended September 30, 2025, reporting revenue of HK$630.56 million and net income of HK$326.92 million.

- While revenue edged slightly lower compared to the same period last year, the company succeeded in lifting both net income and earnings per share.

- With improved profitability despite lower revenue, we'll explore what these results mean for Bright Smart Securities & Commodities Group's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Bright Smart Securities & Commodities Group's Investment Narrative?

For anyone considering Bright Smart Securities & Commodities Group as part of their portfolio, the bigger picture hinges on both its profitability and how it navigates regulatory and market shifts in Hong Kong's finance sector. The latest half-year results, showing higher net income and earnings per share even as revenue slipped, offer some reassurance about management's ability to control costs and sustain margins. This could ease some immediate concerns about profitability following recent share price swings, but also shifts the focus more firmly onto the quality and sustainability of those earnings over time. The proposed acquisition by Innovatech Empowerment remains a central catalyst, and regulatory scrutiny or delays could impact sentiment or deal completion. Ultimately, the biggest near-term risks revolve around execution on corporate actions and ongoing revenue pressures, with the latest results suggesting that these remain live issues but have not shifted materially just yet. On the other hand, ongoing volatility in share price is something investors should watch closely.

Bright Smart Securities & Commodities Group's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Bright Smart Securities & Commodities Group - why the stock might be worth 41% less than the current price!

Build Your Own Bright Smart Securities & Commodities Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bright Smart Securities & Commodities Group research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Bright Smart Securities & Commodities Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bright Smart Securities & Commodities Group's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bright Smart Securities & Commodities Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1428

Bright Smart Securities & Commodities Group

An investment holding company, provides financial services in Hong Kong.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026