- Hong Kong

- /

- Hospitality

- /

- SEHK:880

SJM Holdings Limited's (HKG:880) 29% Jump Shows Its Popularity With Investors

SJM Holdings Limited (HKG:880) shareholders have had their patience rewarded with a 29% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 28% in the last twelve months.

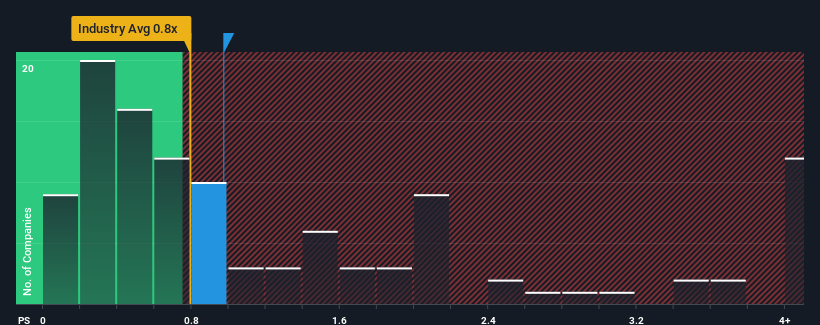

Even after such a large jump in price, there still wouldn't be many who think SJM Holdings' price-to-sales (or "P/S") ratio of 1x is worth a mention when the median P/S in Hong Kong's Hospitality industry is similar at about 0.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for SJM Holdings

How Has SJM Holdings Performed Recently?

SJM Holdings certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think SJM Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For SJM Holdings?

The only time you'd be comfortable seeing a P/S like SJM Holdings' is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 224%. The strong recent performance means it was also able to grow revenue by 188% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the twelve analysts covering the company suggest revenue should grow by 15% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 16% per annum, which is not materially different.

With this in mind, it makes sense that SJM Holdings' P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

SJM Holdings appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've seen that SJM Holdings maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

And what about other risks? Every company has them, and we've spotted 1 warning sign for SJM Holdings you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:880

SJM Holdings

An investment holding company, owns, develops, and operates casinos and integrated entertainment resorts in Macau.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026