- Hong Kong

- /

- Hospitality

- /

- SEHK:880

How SJM Holdings' (SEHK:880) Sharp Profit Decline Will Impact Investor Sentiment and Strategy

Reviewed by Sasha Jovanovic

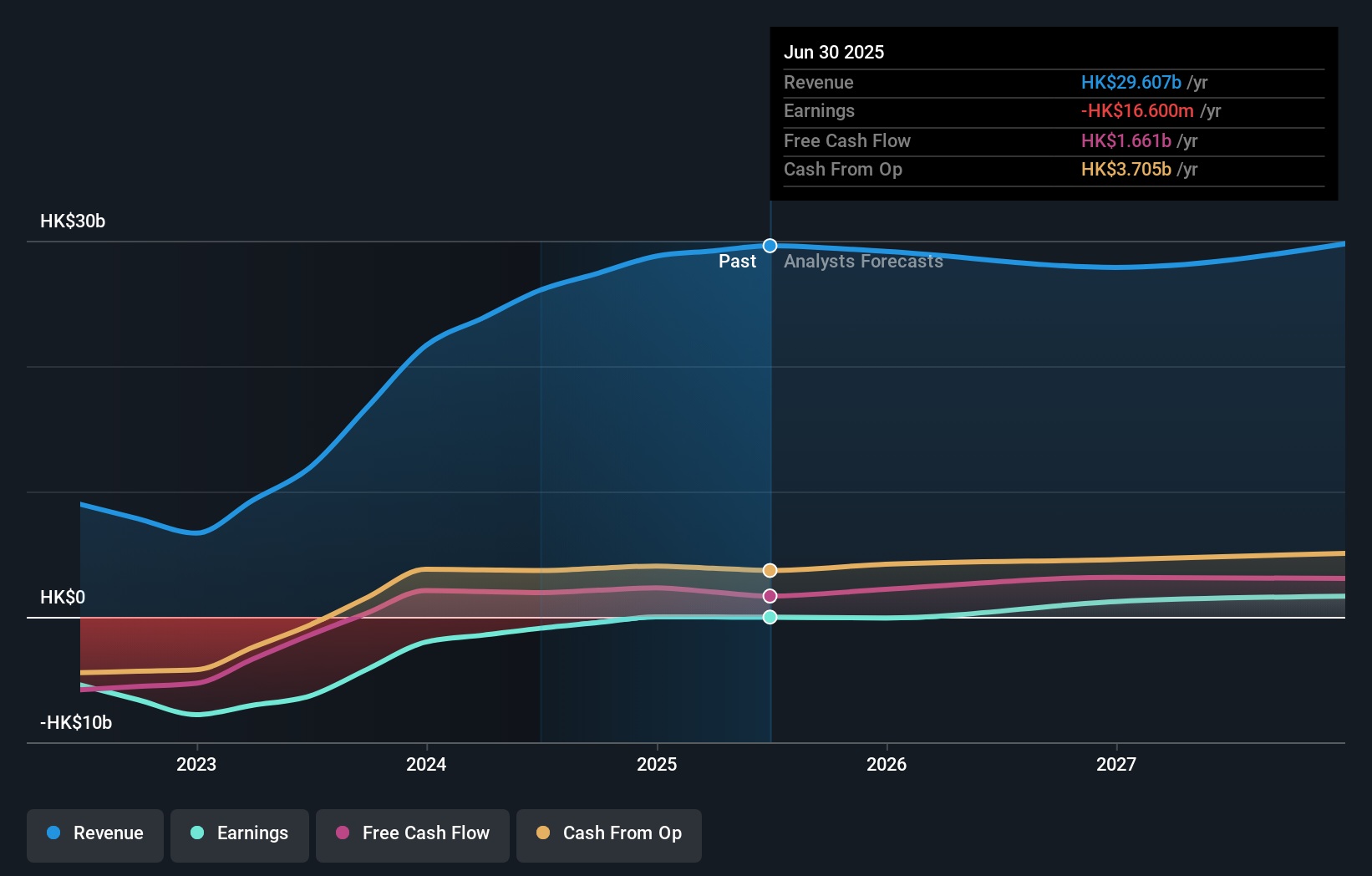

- SJM Holdings recently reported its third quarter 2025 results, revealing a 15% decline in adjusted EBITDA and a 91.1% decrease in net profit year-on-year, with both total net revenue and net gaming revenue also dropping compared to the prior year.

- This sharp drop in profitability highlights a challenging period for the company's core gaming operations in Macau, pointing to underlying headwinds in the operating environment.

- We'll explore how the significant year-on-year decline in profitability shapes SJM Holdings' current investment narrative and future outlook.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

What Is SJM Holdings' Investment Narrative?

To believe in SJM Holdings as a shareholder, you have to be confident in Macau’s gaming and tourism recovery, and the company’s ability to stabilize revenue in the face of ongoing volatility. The recently reported Q3 2025 results, with a sharp fall in both EBITDA and net profit, throw new light on short-term risks and suggest that the expected path back to profitability is becoming less predictable. Previously, investors might have focused on forecasts of revenue and earnings growth, as well as the company’s perceived value relative to peers. However, this earnings miss could challenge confidence in near-term catalysts such as market share gains or improvements in gaming visitation. Risks related to regulatory change, weak consumer demand, and slower-than-expected rebound in Macau must now be weighed more heavily. The recent performance undoubtedly heightens the need to reassess whether the headwinds are temporary or a sign of deeper challenges. On the other hand, the recent profit slump is a risk that cannot be ignored.

SJM Holdings' shares have been on the rise but are still potentially undervalued by 29%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on SJM Holdings - why the stock might be worth as much as 8% more than the current price!

Build Your Own SJM Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SJM Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free SJM Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SJM Holdings' overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:880

SJM Holdings

An investment holding company, owns, develops, and operates casinos and integrated entertainment resorts in Macau.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives