- Hong Kong

- /

- Hospitality

- /

- SEHK:8475

Here's Why Shareholders Should Examine K Group Holdings Limited's (HKG:8475) CEO Compensation Package More Closely

K Group Holdings Limited (HKG:8475) has not performed well recently and CEO Levi Ho will probably need to up their game. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 23 February 2022. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. The data we present below explains why we think CEO compensation is not consistent with recent performance.

See our latest analysis for K Group Holdings

How Does Total Compensation For Levi Ho Compare With Other Companies In The Industry?

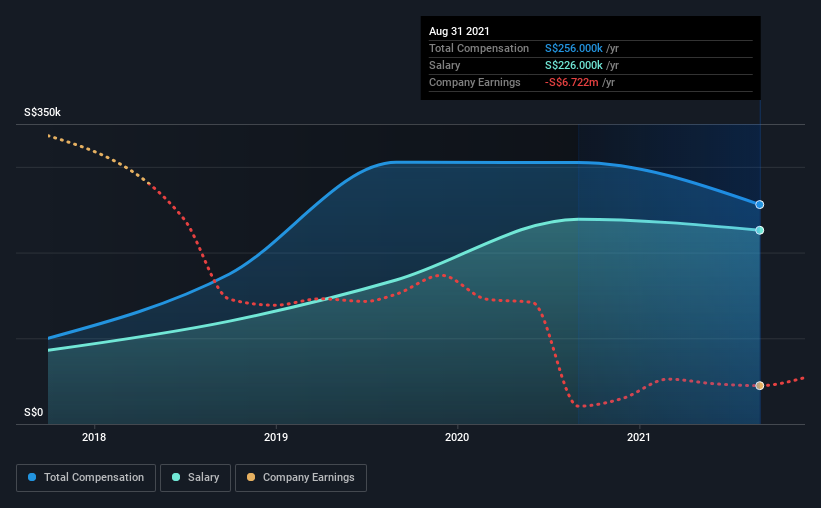

According to our data, K Group Holdings Limited has a market capitalization of HK$40m, and paid its CEO total annual compensation worth S$256k over the year to August 2021. Notably, that's a decrease of 16% over the year before. Notably, the salary which is S$226.0k, represents most of the total compensation being paid.

On comparing similar-sized companies in the industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was S$334k. From this we gather that Levi Ho is paid around the median for CEOs in the industry.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | S$226k | S$239k | 88% |

| Other | S$30k | S$66k | 12% |

| Total Compensation | S$256k | S$305k | 100% |

Talking in terms of the industry, salary represented approximately 90% of total compensation out of all the companies we analyzed, while other remuneration made up 10% of the pie. K Group Holdings is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

K Group Holdings Limited's Growth

Over the last three years, K Group Holdings Limited has shrunk its earnings per share by 16% per year. It saw its revenue drop 1.9% over the last year.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has K Group Holdings Limited Been A Good Investment?

With a total shareholder return of -59% over three years, K Group Holdings Limited shareholders would by and large be disappointed. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 3 warning signs for K Group Holdings that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're here to simplify it.

Discover if E-Station Green Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8475

E-Station Green Technology Group

An investment holding company, engages in the restaurant and catering business in Singapore, Hong Kong, and the People's Republic of China.

Medium-low risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026