- Hong Kong

- /

- Hospitality

- /

- SEHK:8432

Health Check: How Prudently Does Bar Pacific Group Holdings (HKG:8432) Use Debt?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Bar Pacific Group Holdings Limited (HKG:8432) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Bar Pacific Group Holdings

How Much Debt Does Bar Pacific Group Holdings Carry?

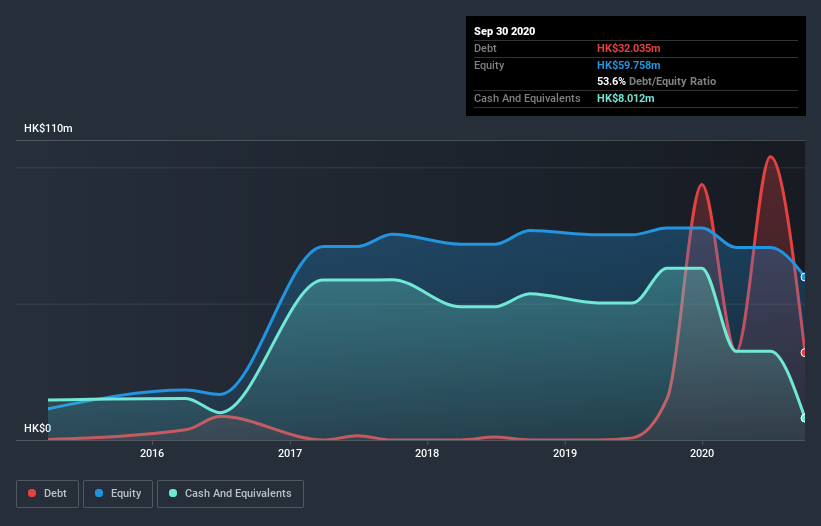

As you can see below, at the end of September 2020, Bar Pacific Group Holdings had HK$32.0m of debt, up from HK$15.2m a year ago. Click the image for more detail. However, it also had HK$8.01m in cash, and so its net debt is HK$24.0m.

How Healthy Is Bar Pacific Group Holdings's Balance Sheet?

We can see from the most recent balance sheet that Bar Pacific Group Holdings had liabilities of HK$68.6m falling due within a year, and liabilities of HK$57.5m due beyond that. Offsetting these obligations, it had cash of HK$8.01m as well as receivables valued at HK$3.60m due within 12 months. So it has liabilities totalling HK$114.5m more than its cash and near-term receivables, combined.

This deficit casts a shadow over the HK$61.1m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Bar Pacific Group Holdings would likely require a major re-capitalisation if it had to pay its creditors today. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Bar Pacific Group Holdings will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Bar Pacific Group Holdings made a loss at the EBIT level, and saw its revenue drop to HK$126m, which is a fall of 20%. That makes us nervous, to say the least.

Caveat Emptor

While Bar Pacific Group Holdings's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Its EBIT loss was a whopping HK$13m. When we look at that alongside the significant liabilities, we're not particularly confident about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. Not least because it had negative free cash flow of HK$1.8m over the last twelve months. So suffice it to say we consider the stock to be risky. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Bar Pacific Group Holdings (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading Bar Pacific Group Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bar Pacific Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:8432

Bar Pacific Group Holdings

An investment holding company, operates a chain of bars and restaurants under the Bar Pacific, Pacific, Moon Ocean, and Katachi brands in Hong Kong and People’s Republic of China.

Good value with imperfect balance sheet.

Market Insights

Community Narratives