When Bar Pacific Group Holdings Limited (HKG:8432) reported its results to March 2023 its auditors, Baker Tilly Hong Kong Limited could not be sure that it would be able to continue as a going concern in the next year. It is therefore fair to assume that, based on those financials, the company should strengthen its balance sheet in the short term, perhaps by issuing shares.

Given its situation, it may not be in a good position to raise capital on favorable terms. So shareholders should absolutely be taking a close look at how risky the balance sheet is. The big consideration is whether it can repay its debt, since in the worst case scenario, creditors could force the company to bankruptcy.

View our latest analysis for Bar Pacific Group Holdings

How Much Debt Does Bar Pacific Group Holdings Carry?

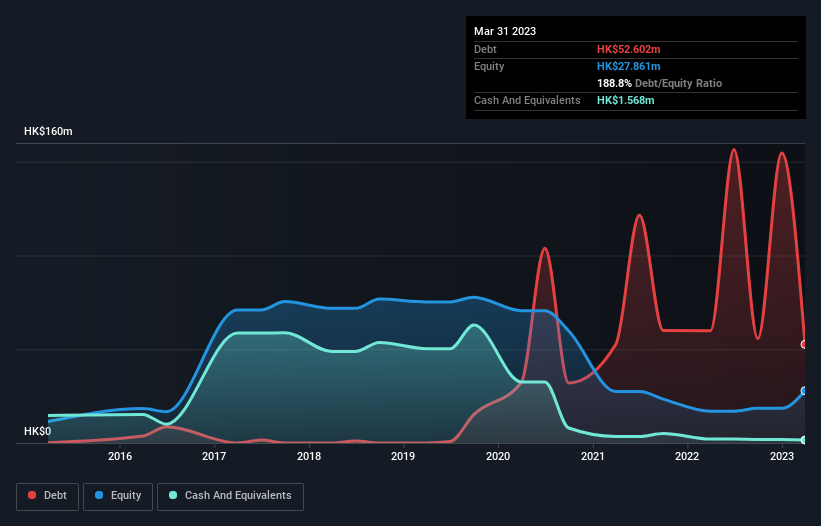

As you can see below, Bar Pacific Group Holdings had HK$52.6m of debt at March 2023, down from HK$59.9m a year prior. However, it does have HK$1.57m in cash offsetting this, leading to net debt of about HK$51.0m.

A Look At Bar Pacific Group Holdings' Liabilities

We can see from the most recent balance sheet that Bar Pacific Group Holdings had liabilities of HK$112.9m falling due within a year, and liabilities of HK$63.5m due beyond that. Offsetting this, it had HK$1.57m in cash and HK$2.23m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by HK$172.6m.

The deficiency here weighs heavily on the HK$84.3m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, Bar Pacific Group Holdings would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Bar Pacific Group Holdings's debt to EBITDA ratio (3.6) suggests that it uses some debt, its interest cover is very weak, at 1.1, suggesting high leverage. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. One redeeming factor for Bar Pacific Group Holdings is that it turned last year's EBIT loss into a gain of HK$4.5m, over the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Bar Pacific Group Holdings will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Happily for any shareholders, Bar Pacific Group Holdings actually produced more free cash flow than EBIT over the last year. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

On the face of it, Bar Pacific Group Holdings's interest cover left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Overall, we think it's fair to say that Bar Pacific Group Holdings has enough debt that there are some real risks around the balance sheet. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. Some investors may be interested in buying high risk stocks at the right price, but we prefer to avoid a company after its auditor has expressed any uncertainty about its ability to continue as a going concern. Our preference is to invest in companies that always make sure the auditor has confidence that the company will continue as a going concern. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example Bar Pacific Group Holdings has 3 warning signs (and 1 which is a bit concerning) we think you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Bar Pacific Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8432

Bar Pacific Group Holdings

An investment holding company, operates a chain of bars and restaurants under the Bar Pacific, Pacific, Moon Ocean, and Katachi brands in Hong Kong and People’s Republic of China.

Good value with imperfect balance sheet.

Market Insights

Community Narratives