- Hong Kong

- /

- Consumer Services

- /

- SEHK:8341

Lacklustre Performance Is Driving Aeso Holding Limited's (HKG:8341) 31% Price Drop

The Aeso Holding Limited (HKG:8341) share price has fared very poorly over the last month, falling by a substantial 31%. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 22%.

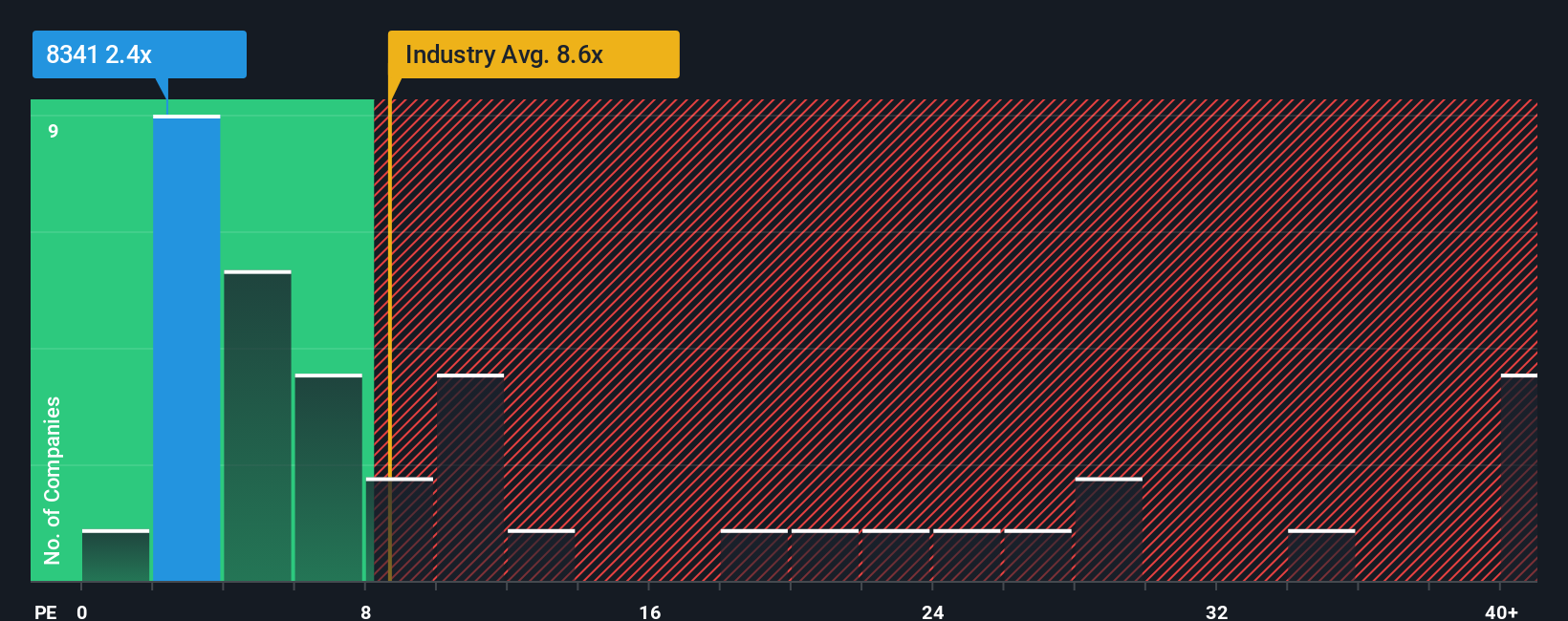

Following the heavy fall in price, Aeso Holding may be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 2.4x, since almost half of all companies in Hong Kong have P/E ratios greater than 12x and even P/E's higher than 26x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

For instance, Aeso Holding's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Aeso Holding

How Is Aeso Holding's Growth Trending?

In order to justify its P/E ratio, Aeso Holding would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 27%. As a result, earnings from three years ago have also fallen 28% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 19% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's understandable that Aeso Holding's P/E would sit below the majority of other companies. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Bottom Line On Aeso Holding's P/E

Aeso Holding's P/E looks about as weak as its stock price lately. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Aeso Holding revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for Aeso Holding you should be aware of.

If these risks are making you reconsider your opinion on Aeso Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8341

Aeso Holding

An investment holding company, provides fitting-out and renovation services in Hong Kong.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success