- Hong Kong

- /

- Industrials

- /

- SEHK:8095

Market Still Lacking Some Conviction On Beijing Beida Jade Bird Universal Sci-Tech Company Limited (HKG:8095)

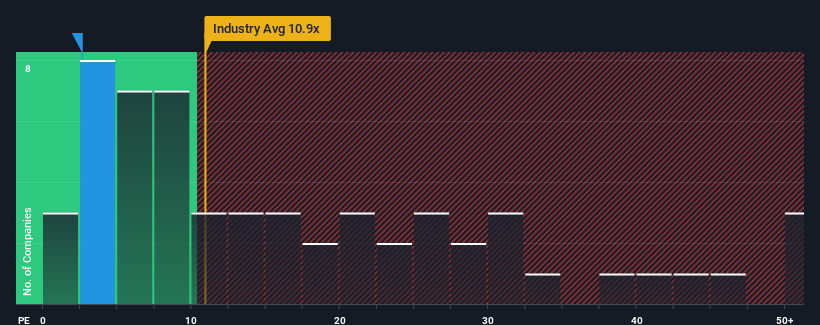

When close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 10x, you may consider Beijing Beida Jade Bird Universal Sci-Tech Company Limited (HKG:8095) as a highly attractive investment with its 2.6x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

As an illustration, earnings have deteriorated at Beijing Beida Jade Bird Universal Sci-Tech over the last year, which is not ideal at all. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Beijing Beida Jade Bird Universal Sci-Tech

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Beijing Beida Jade Bird Universal Sci-Tech's is when the company's growth is on track to lag the market decidedly.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 41%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 177% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

This is in contrast to the rest of the market, which is expected to grow by 22% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Beijing Beida Jade Bird Universal Sci-Tech is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Beijing Beida Jade Bird Universal Sci-Tech revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

It is also worth noting that we have found 4 warning signs for Beijing Beida Jade Bird Universal Sci-Tech that you need to take into consideration.

You might be able to find a better investment than Beijing Beida Jade Bird Universal Sci-Tech. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Beijing Beida Jade Bird Universal Sci-Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8095

Beijing Beida Jade Bird Universal Sci-Tech

An investment holding company, engages in the trading of metallic products and tourism development in the People’s Republic of China, Hong Kong, and the United States.

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026