- Hong Kong

- /

- Industrials

- /

- SEHK:8095

How Much Did Beijing Beida Jade Bird Universal Sci-Tech's(HKG:8095) Shareholders Earn From Share Price Movements Over The Last Five Years?

Some stocks are best avoided. It hits us in the gut when we see fellow investors suffer a loss. For example, we sympathize with anyone who was caught holding Beijing Beida Jade Bird Universal Sci-Tech Company Limited (HKG:8095) during the five years that saw its share price drop a whopping 71%. And some of the more recent buyers are probably worried, too, with the stock falling 39% in the last year. More recently, the share price has dropped a further 8.8% in a month.

See our latest analysis for Beijing Beida Jade Bird Universal Sci-Tech

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

While the share price declined over five years, Beijing Beida Jade Bird Universal Sci-Tech actually managed to increase EPS by an average of 3.4% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

Based on these numbers, we'd venture that the market may have been over-optimistic about forecast growth, half a decade ago. Having said that, we might get a better idea of what's going on with the stock by looking at other metrics.

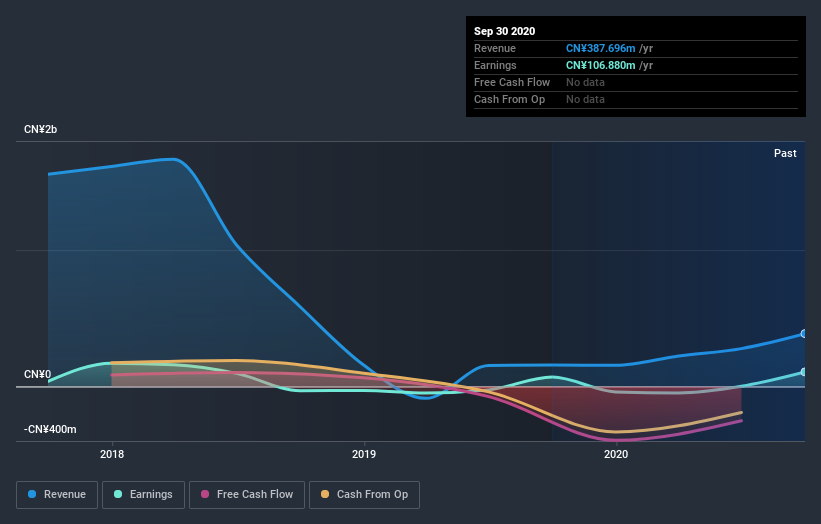

Arguably, the revenue drop of 32% a year for half a decade suggests that the company can't grow in the long term. This has probably encouraged some shareholders to sell down the stock.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Beijing Beida Jade Bird Universal Sci-Tech's financial health with this free report on its balance sheet.

A Different Perspective

Investors in Beijing Beida Jade Bird Universal Sci-Tech had a tough year, with a total loss of 39%, against a market gain of about 24%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Beijing Beida Jade Bird Universal Sci-Tech (at least 1 which shouldn't be ignored) , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading Beijing Beida Jade Bird Universal Sci-Tech or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Beijing Beida Jade Bird Universal Sci-Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8095

Beijing Beida Jade Bird Universal Sci-Tech

An investment holding company, engages in the trading of metallic products and tourism development in the People’s Republic of China, Hong Kong, and the United States.

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives