- Hong Kong

- /

- Hospitality

- /

- SEHK:45

We Think Shareholders May Want To Consider A Review Of The Hongkong and Shanghai Hotels, Limited's (HKG:45) CEO Compensation Package

The Hongkong and Shanghai Hotels, Limited (HKG:45) has not performed well recently and CEO Clement Kwok will probably need to up their game. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 21 May 2021. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. We present the case why we think CEO compensation is out of sync with company performance.

View our latest analysis for Hongkong and Shanghai Hotels

How Does Total Compensation For Clement Kwok Compare With Other Companies In The Industry?

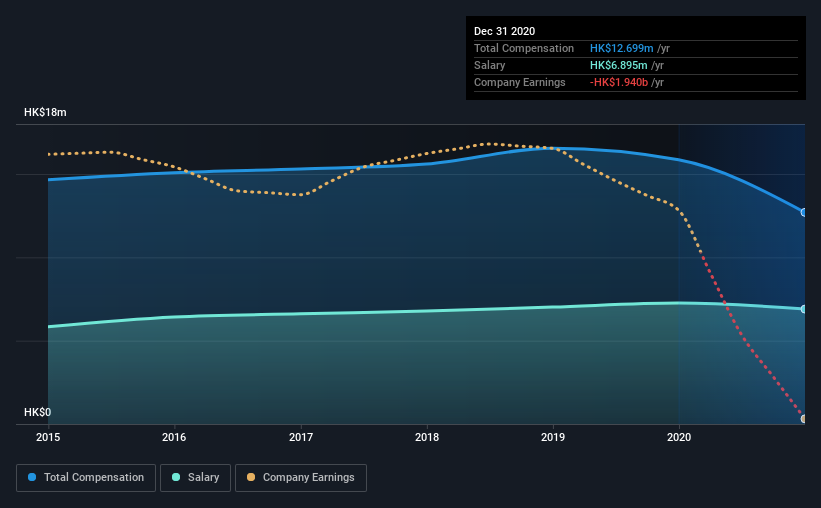

According to our data, The Hongkong and Shanghai Hotels, Limited has a market capitalization of HK$13b, and paid its CEO total annual compensation worth HK$13m over the year to December 2020. Notably, that's a decrease of 20% over the year before. In particular, the salary of HK$6.90m, makes up a fairly large portion of the total compensation being paid to the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between HK$7.8b and HK$25b had a median total CEO compensation of HK$7.7m. Accordingly, our analysis reveals that The Hongkong and Shanghai Hotels, Limited pays Clement Kwok north of the industry median. Moreover, Clement Kwok also holds HK$5.9m worth of Hongkong and Shanghai Hotels stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | HK$6.9m | HK$7.3m | 54% |

| Other | HK$5.8m | HK$8.6m | 46% |

| Total Compensation | HK$13m | HK$16m | 100% |

Speaking on an industry level, nearly 87% of total compensation represents salary, while the remainder of 13% is other remuneration. It's interesting to note that Hongkong and Shanghai Hotels allocates a smaller portion of compensation to salary in comparison to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at The Hongkong and Shanghai Hotels, Limited's Growth Numbers

Over the last three years, The Hongkong and Shanghai Hotels, Limited has shrunk its earnings per share by 98% per year. It saw its revenue drop 54% over the last year.

Few shareholders would be pleased to read that EPS have declined. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has The Hongkong and Shanghai Hotels, Limited Been A Good Investment?

The return of -32% over three years would not have pleased The Hongkong and Shanghai Hotels, Limited shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

Shareholders may want to check for free if Hongkong and Shanghai Hotels insiders are buying or selling shares.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hongkong and Shanghai Hotels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:45

Hongkong and Shanghai Hotels

An investment holding company, owns, develops, and manages hotels, and commercial and residential properties in China, rest of Asia, the United States, and Europe.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives