- Hong Kong

- /

- Hospitality

- /

- SEHK:419

If You Had Bought Huayi Tencent Entertainment (HKG:419) Stock Three Years Ago, You'd Be Sitting On A 71% Loss, Today

It is a pleasure to report that the Huayi Tencent Entertainment Company Limited (HKG:419) is up 36% in the last quarter. But that doesn't change the fact that the returns over the last three years have been stomach churning. To wit, the share price sky-dived 71% in that time. So it's about time shareholders saw some gains. But the more important question is whether the underlying business can justify a higher price still.

See our latest analysis for Huayi Tencent Entertainment

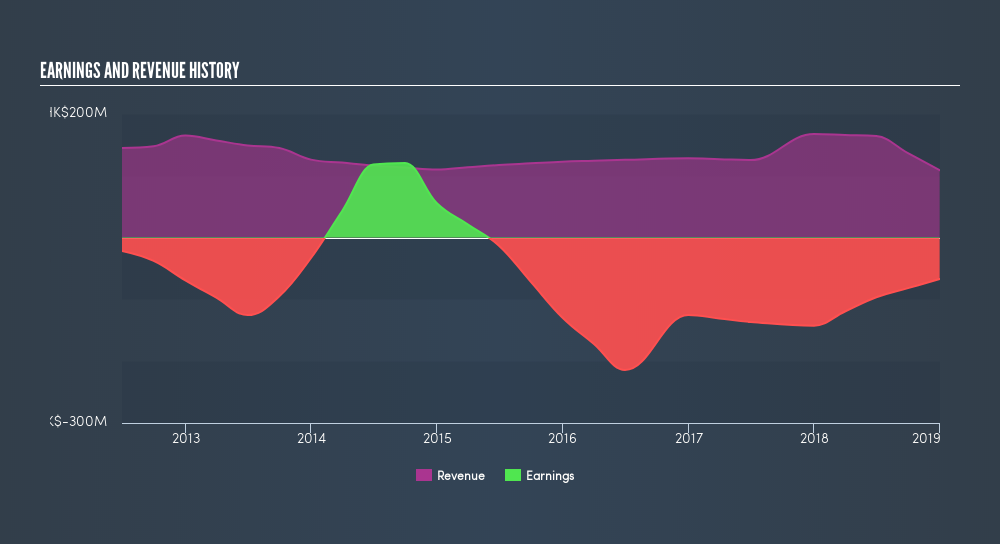

Given that Huayi Tencent Entertainment didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Huayi Tencent Entertainment saw its revenue grow by 5.3% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. Nonetheless, it's fair to say the rapidly declining share price (down 34%, compound, over three years) suggests the market is very disappointed with this level of growth. We generally don't try to 'catch the falling knife'. Before considering a purchase, take a look at the losses the company is racking up.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

This free interactive report on Huayi Tencent Entertainment's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Huayi Tencent Entertainment's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. We note that Huayi Tencent Entertainment's TSR, at -71% is higher than its share price return of -71%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

We regret to report that Huayi Tencent Entertainment shareholders are down 32% for the year. Unfortunately, that's worse than the broader market decline of 3.2%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 2.4% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this freelist of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:419

Hony Media Group

Offers digitized operation services for the healthcare industry in Mainland China and internationally.

Low and slightly overvalued.

Market Insights

Community Narratives