- Hong Kong

- /

- Consumer Services

- /

- SEHK:382

Should You Be Adding Edvantage Group Holdings (HKG:382) To Your Watchlist Today?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Edvantage Group Holdings (HKG:382). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Edvantage Group Holdings

How Fast Is Edvantage Group Holdings Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That means EPS growth is considered a real positive by most successful long-term investors. Impressively, Edvantage Group Holdings has grown EPS by 18% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

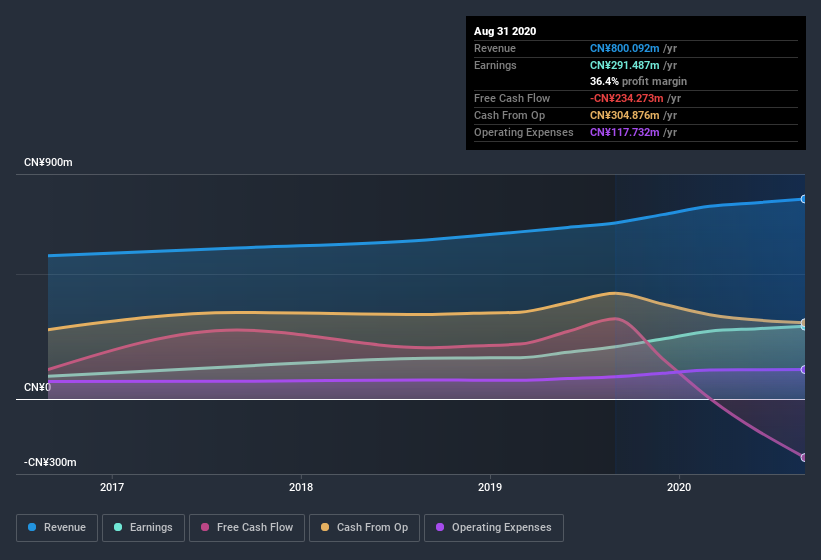

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Edvantage Group Holdings maintained stable EBIT margins over the last year, all while growing revenue 14% to CN¥800m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Edvantage Group Holdings?

Are Edvantage Group Holdings Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Like a sturdy phalanx Edvantage Group Holdings insiders have stood united by refusing to sell shares over the last year. But the bigger deal is that the CEO & Executive Director, Yi Man Liu, paid CN¥949k to buy shares at an average price of CN¥7.30.

Should You Add Edvantage Group Holdings To Your Watchlist?

You can't deny that Edvantage Group Holdings has grown its earnings per share at a very impressive rate. That's attractive. The growth rate whets my appetite for research, and the insider buying only increases my interest in the stock. To put it succinctly; Edvantage Group Holdings is a strong candidate for your watchlist. It is worth noting though that we have found 3 warning signs for Edvantage Group Holdings (1 is concerning!) that you need to take into consideration.

As a growth investor I do like to see insider buying. But Edvantage Group Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Edvantage Group Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Edvantage Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:382

Edvantage Group Holdings

An investment holding company, operates private higher and vocational education institutions in the People’s Republic of China, Australia, and Singapore.

Undervalued with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives