- Hong Kong

- /

- Hospitality

- /

- SEHK:3690

Will Meituan's (SEHK:3690) Offshore Yuan Bond Talks Reveal a Shift in Its Funding Playbook?

Reviewed by Simply Wall St

- In recent days, Meituan was reported to be considering its first-ever issuance of offshore yuan-denominated bonds, also called dim sum bonds, in preliminary discussions with investment banks. This potential step suggests Meituan may be evaluating alternative funding sources and global investor engagement as part of its broader financial strategy.

- We will assess how Meituan's consideration of offshore yuan-denominated bonds could influence its capital structure and investment outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Meituan Investment Narrative Recap

For an investor to be comfortable holding Meituan, it generally requires confidence in the company’s ability to expand its ecosystem and maintain strong user engagement, even as core urban markets mature. The recent consideration of offshore yuan-denominated bonds does not appear to significantly shift the biggest near-term catalyst, expanding into new geographies like Brazil, or alter the most pressing risk: margin pressure from fierce competition and ongoing sector-wide subsidies.

One announcement that stands out in light of this news is Meituan’s recent commitment of US$1 billion over five years to launch its international food delivery brand, Keeta, in Brazil. This expansion directly supports the company’s growth ambitions and underscores the need for continued access to capital, reinforcing why alternative funding channels like dim sum bonds are being explored as part of Meituan’s capital strategy.

However, investors should also be mindful that, while new capital sources provide flexibility, intensified competition and subsidy-driven price wars could continue to pressure margins if...

Read the full narrative on Meituan (it's free!)

Meituan's narrative projects CN¥496.8 billion revenue and CN¥48.4 billion earnings by 2028. This requires 11.3% yearly revenue growth and an increase of CN¥18.9 billion in earnings from the current CN¥29.5 billion.

Uncover how Meituan's forecasts yield a HK$135.63 fair value, a 40% upside to its current price.

Exploring Other Perspectives

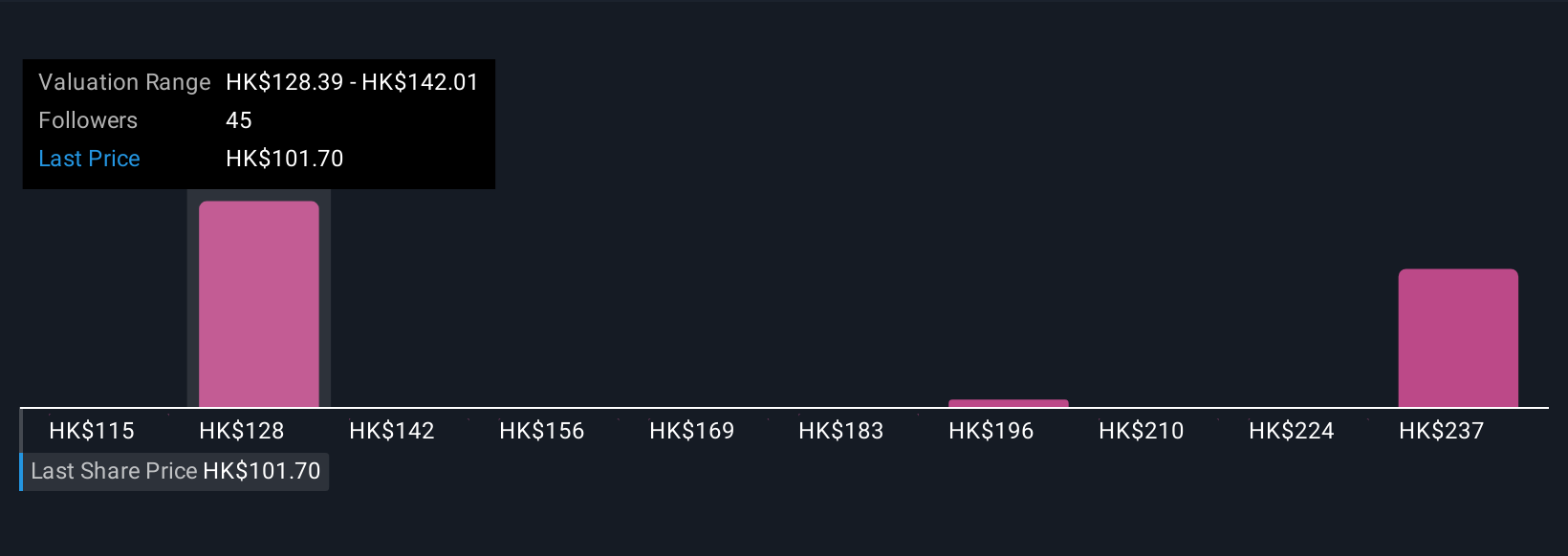

Simply Wall St Community members provided 9 distinct fair value estimates for Meituan, spanning from HK$114.78 up to HK$228.58 per share. With such wide-ranging views, considering the current industry-wide margin pressure tied to rising subsidies is essential for evaluating future profitability and your own investment thesis.

Explore 9 other fair value estimates on Meituan - why the stock might be worth just HK$114.78!

Build Your Own Meituan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Meituan research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Meituan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Meituan's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3690

Meituan

Operates as a technology driven retail company in the People’s Republic of China, Hong Kong, Macao, Taiwan, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives