Top 3 SEHK Growth Companies With High Insider Ownership In September 2024

Reviewed by Simply Wall St

As global markets face economic uncertainties, the Hong Kong market has not been immune to these fluctuations, with the Hang Seng Index recently experiencing a notable decline. Despite this backdrop, growth companies with high insider ownership often present unique opportunities for investors due to their potential for strong alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| Laopu Gold (SEHK:6181) | 36.4% | 34.7% |

| Akeso (SEHK:9926) | 20.5% | 54.7% |

| Fenbi (SEHK:2469) | 31.2% | 22.4% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 69.8% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.7% | 78.9% |

| DPC Dash (SEHK:1405) | 38.2% | 104.2% |

| Kindstar Globalgene Technology (SEHK:9960) | 16.5% | 88% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 109.2% |

| Beijing Airdoc Technology (SEHK:2251) | 28.6% | 93.4% |

Let's uncover some gems from our specialized screener.

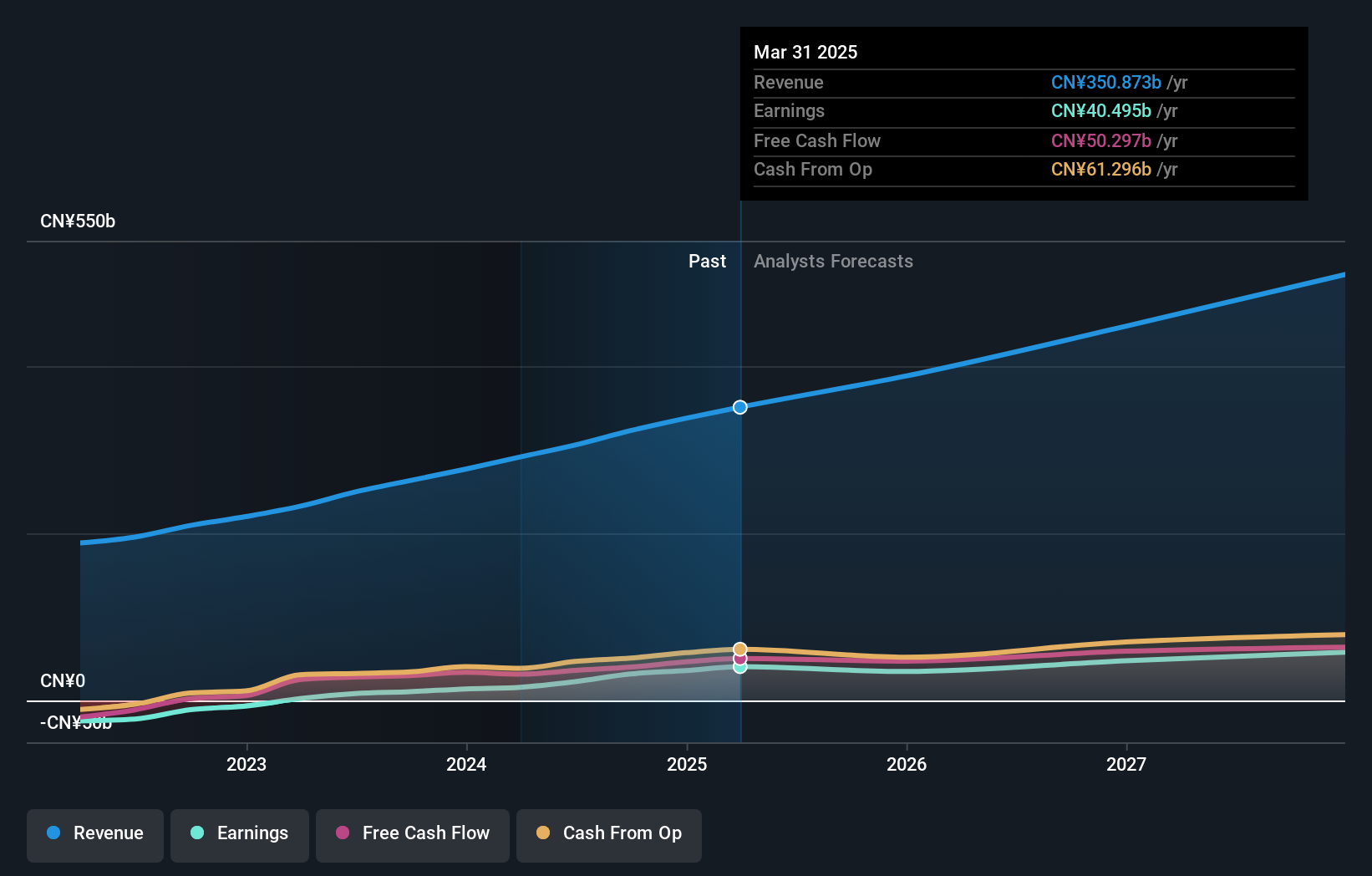

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kuaishou Technology is an investment holding company that offers live streaming, online marketing, and other services in the People’s Republic of China with a market cap of approximately HK$167.37 billion.

Operations: The company generates revenue primarily from its domestic operations (CN¥117.32 billion) and overseas activities (CN¥3.57 billion).

Insider Ownership: 19.4%

Kuaishou Technology, a growth company with high insider ownership, recently reported robust financial results for Q2 2024, with sales of CNY 30.98 billion and net income of CNY 3.98 billion. The company's earnings are forecast to grow at an annual rate of 18.8%, outpacing the Hong Kong market's average growth rate of 11.7%. Kuaishou's innovative AI initiatives, like Kling AI video generation model upgrades and new subscription programs, further strengthen its competitive edge in the digital content space.

- Navigate through the intricacies of Kuaishou Technology with our comprehensive analyst estimates report here.

- Our valuation report here indicates Kuaishou Technology may be undervalued.

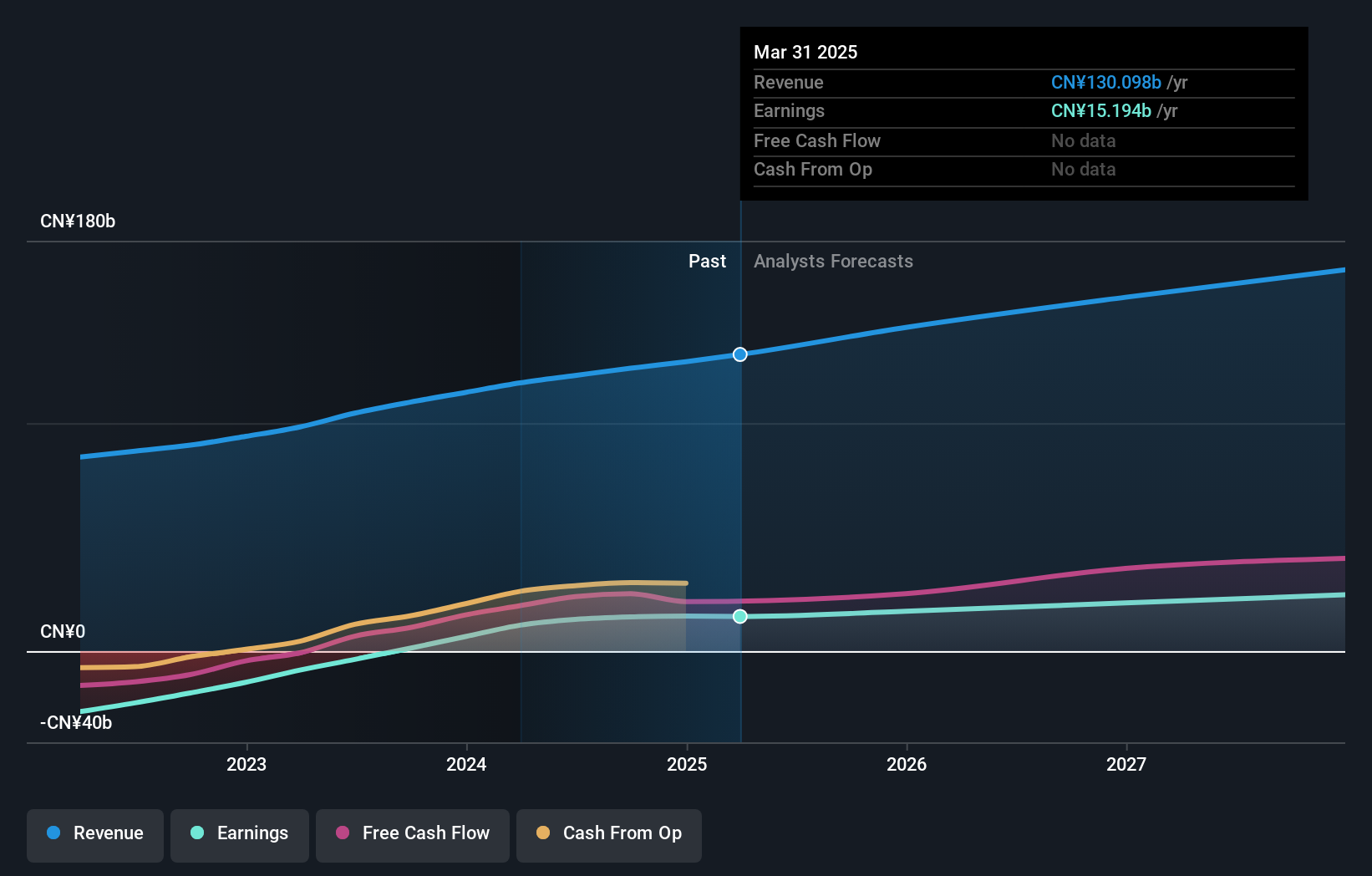

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Biocytogen Pharmaceuticals (Beijing) Co., Ltd. is a biotechnology company focused on the research and development of antibody-based drugs in China, the United States, and internationally, with a market cap of HK$2.41 billion.

Operations: The company's revenue segments include Gene Editing (CN¥75.50 million), Antibody Development (CN¥205.83 million), Animal Models Selling (CN¥354.44 million), and Pre-Clinical Pharmacology and Efficacy Evaluation (CN¥185.41 million).

Insider Ownership: 13.9%

Biocytogen Pharmaceuticals (Beijing) demonstrates strong growth potential with significant insider ownership. For the first half of 2024, sales rose to CNY 410.5 million from CNY 326.84 million year-over-year, while net loss narrowed significantly to CNY 50.67 million from CNY 189.81 million. The company benefits from high-margin antibody licensing and robust animal model sales, contributing to its rapid revenue growth forecast of 21.5% annually, well above the Hong Kong market average of 7.3%.

- Delve into the full analysis future growth report here for a deeper understanding of Biocytogen Pharmaceuticals (Beijing).

- Our expertly prepared valuation report Biocytogen Pharmaceuticals (Beijing) implies its share price may be lower than expected.

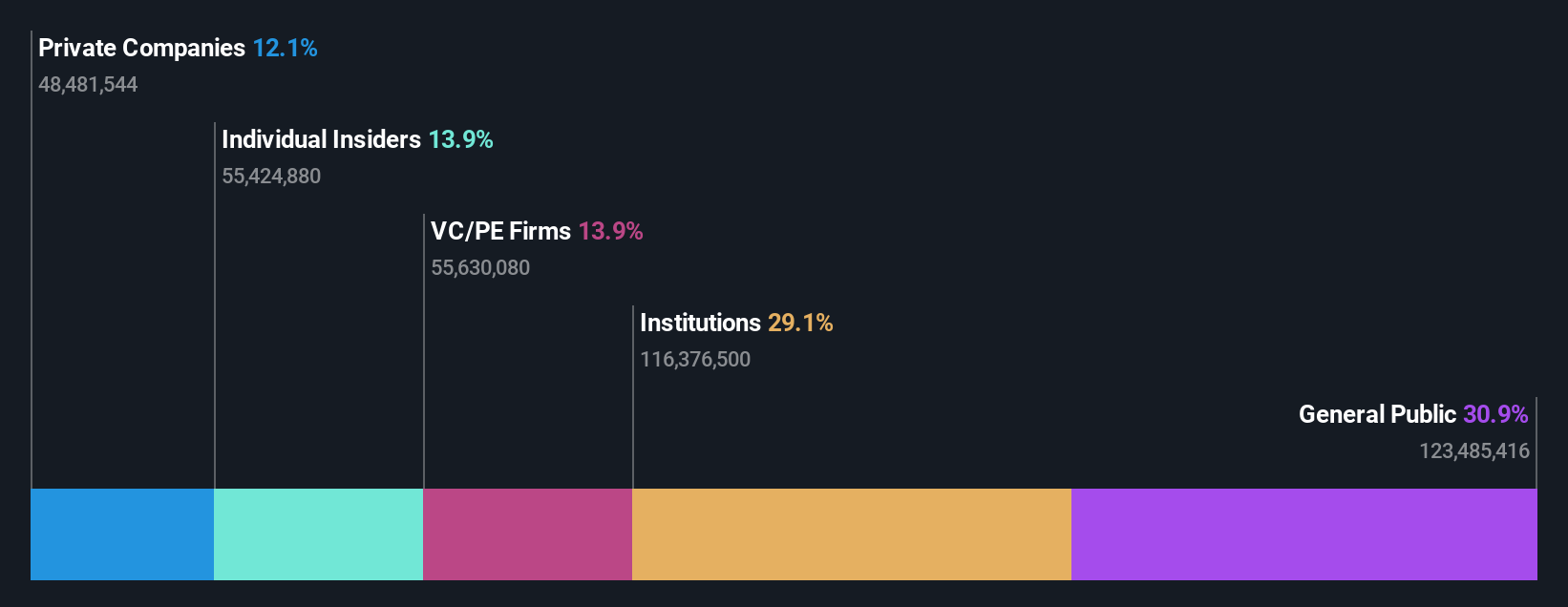

Meituan (SEHK:3690)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Meituan is a technology retail company operating in the People’s Republic of China with a market cap of approximately HK$741.67 billion.

Operations: The company's revenue segments include New Initiatives generating CN¥77.56 billion and Core Local Commerce contributing CN¥228.13 billion.

Insider Ownership: 11.6%

Meituan showcases strong growth potential with high insider ownership. The company reported significant earnings growth, with net income rising to CNY 16.72 billion for the first half of 2024, compared to CNY 8.05 billion a year ago. Meituan has also been active in share repurchases, spending HKD 7.17 billion from January to June and $2 billion from June to August on buybacks, enhancing shareholder value while maintaining robust revenue growth forecasts above the Hong Kong market average.

- Click here and access our complete growth analysis report to understand the dynamics of Meituan.

- Our comprehensive valuation report raises the possibility that Meituan is priced lower than what may be justified by its financials.

Where To Now?

- Dive into all 47 of the Fast Growing SEHK Companies With High Insider Ownership we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Biocytogen Pharmaceuticals (Beijing) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2315

Biocytogen Pharmaceuticals (Beijing)

A biotechnology company, engages in the research and development of antibody-based drugs in the People’s Republic of China, the United States, and internationally.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives