- Hong Kong

- /

- Hospitality

- /

- SEHK:308

There's Reason For Concern Over China Travel International Investment Hong Kong Limited's (HKG:308) Massive 95% Price Jump

China Travel International Investment Hong Kong Limited (HKG:308) shareholders have had their patience rewarded with a 95% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 70% in the last year.

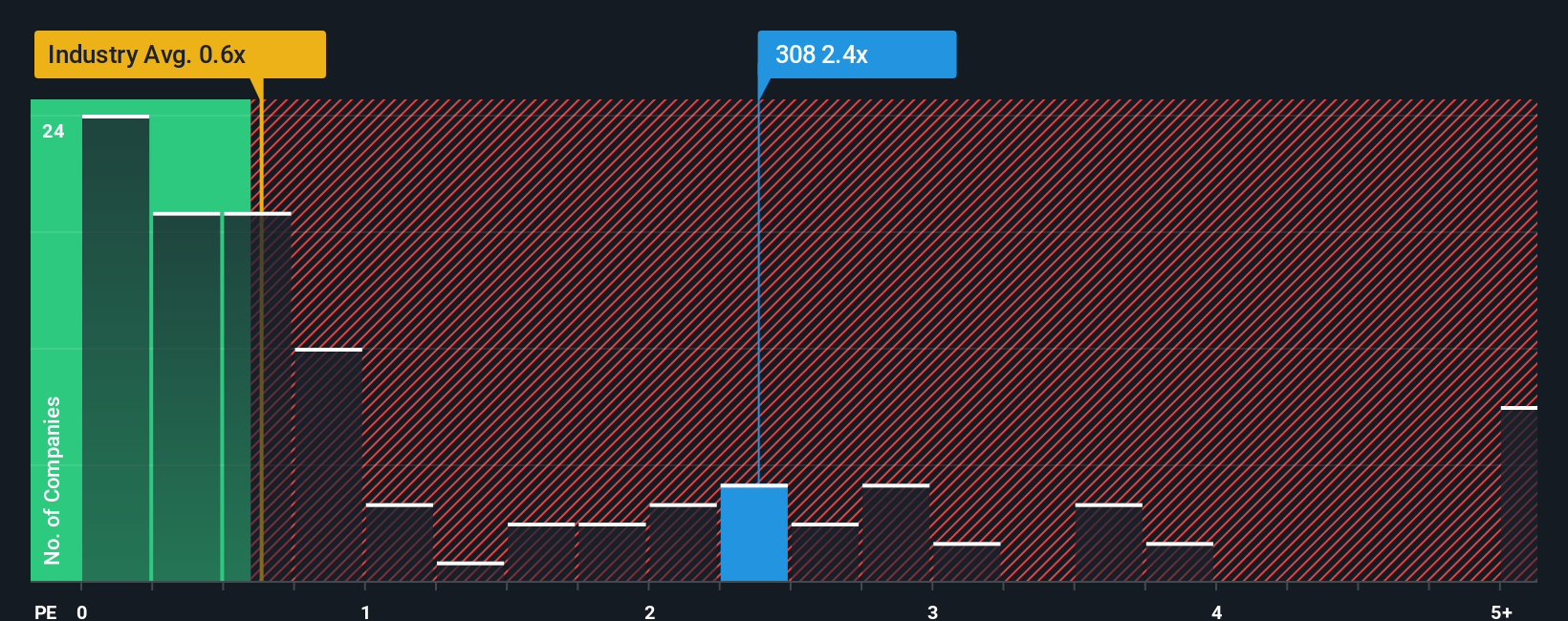

After such a large jump in price, when almost half of the companies in Hong Kong's Hospitality industry have price-to-sales ratios (or "P/S") below 0.6x, you may consider China Travel International Investment Hong Kong as a stock probably not worth researching with its 2.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for China Travel International Investment Hong Kong

What Does China Travel International Investment Hong Kong's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, China Travel International Investment Hong Kong has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on China Travel International Investment Hong Kong will help you uncover what's on the horizon.How Is China Travel International Investment Hong Kong's Revenue Growth Trending?

China Travel International Investment Hong Kong's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.0% last year. The latest three year period has also seen a 27% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 6.6% per annum as estimated by the three analysts watching the company. That's shaping up to be materially lower than the 13% per annum growth forecast for the broader industry.

In light of this, it's alarming that China Travel International Investment Hong Kong's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On China Travel International Investment Hong Kong's P/S

China Travel International Investment Hong Kong's P/S is on the rise since its shares have risen strongly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see China Travel International Investment Hong Kong trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 3 warning signs for China Travel International Investment Hong Kong (1 is a bit concerning!) that we have uncovered.

If these risks are making you reconsider your opinion on China Travel International Investment Hong Kong, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:308

China Travel International Investment Hong Kong

Provides travel and tourism services.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives