- Hong Kong

- /

- Consumer Services

- /

- SEHK:2469

Why We're Not Concerned Yet About Fenbi Ltd.'s (HKG:2469) 35% Share Price Plunge

The Fenbi Ltd. (HKG:2469) share price has fared very poorly over the last month, falling by a substantial 35%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 43% share price drop.

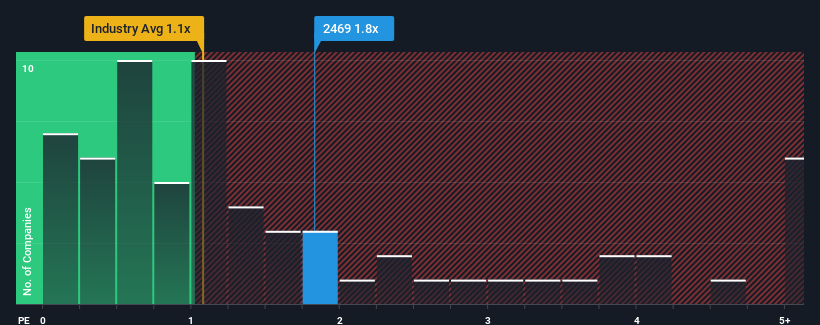

Although its price has dipped substantially, when almost half of the companies in Hong Kong's Consumer Services industry have price-to-sales ratios (or "P/S") below 1.1x, you may still consider Fenbi as a stock probably not worth researching with its 1.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Fenbi

How Has Fenbi Performed Recently?

Fenbi could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Fenbi's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Fenbi?

Fenbi's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 7.5%. This was backed up an excellent period prior to see revenue up by 42% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 20% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 16% each year, which is noticeably less attractive.

With this information, we can see why Fenbi is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Fenbi's P/S Mean For Investors?

Despite the recent share price weakness, Fenbi's P/S remains higher than most other companies in the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Fenbi's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Fenbi with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2469

Fenbi

An investment holding company, provides non-formal vocational education and training services in the People’s Republic of China.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives