- Hong Kong

- /

- Hospitality

- /

- SEHK:2255

Haichang Ocean Park Holdings Ltd. (HKG:2255) Shares Slammed 44% But Getting In Cheap Might Be Difficult Regardless

Haichang Ocean Park Holdings Ltd. (HKG:2255) shares have had a horrible month, losing 44% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 55% loss during that time.

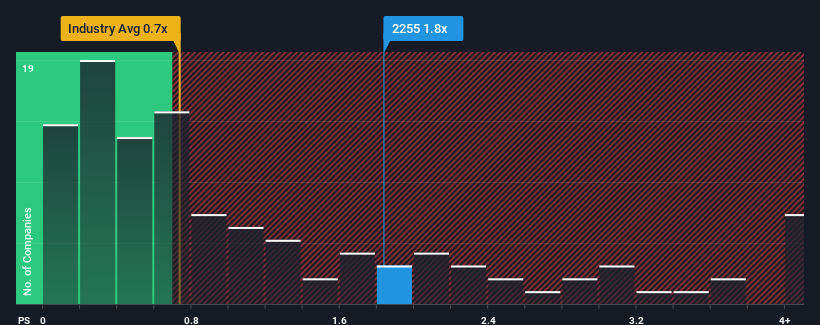

Even after such a large drop in price, given close to half the companies operating in Hong Kong's Hospitality industry have price-to-sales ratios (or "P/S") below 0.7x, you may still consider Haichang Ocean Park Holdings as a stock to potentially avoid with its 1.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Haichang Ocean Park Holdings

What Does Haichang Ocean Park Holdings' P/S Mean For Shareholders?

Recent times have been advantageous for Haichang Ocean Park Holdings as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Haichang Ocean Park Holdings will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Haichang Ocean Park Holdings?

In order to justify its P/S ratio, Haichang Ocean Park Holdings would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 45% last year. However, this wasn't enough as the latest three year period has seen the company endure a nasty 14% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 50% over the next year. That's shaping up to be materially higher than the 17% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Haichang Ocean Park Holdings' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Despite the recent share price weakness, Haichang Ocean Park Holdings' P/S remains higher than most other companies in the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into Haichang Ocean Park Holdings shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Haichang Ocean Park Holdings with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Haichang Ocean Park Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2255

Haichang Ocean Park Holdings

Engages in developing and constructing theme parks in the People’s Republic of China.

Reasonable growth potential with imperfect balance sheet.

Market Insights

Community Narratives