- Hong Kong

- /

- Hospitality

- /

- SEHK:200

Melco International Development (HKG:200 shareholders incur further losses as stock declines 6.6% this week, taking five-year losses to 74%

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. We really hate to see fellow investors lose their hard-earned money. Imagine if you held Melco International Development Limited (HKG:200) for half a decade as the share price tanked 74%. And we doubt long term believers are the only worried holders, since the stock price has declined 45% over the last twelve months. Shareholders have had an even rougher run lately, with the share price down 23% in the last 90 days.

After losing 6.6% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Melco International Development

Melco International Development wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years Melco International Development saw its revenue shrink by 24% per year. That's definitely a weaker result than most pre-profit companies report. So it's not that strange that the share price dropped 12% per year in that period. We don't think this is a particularly promising picture. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

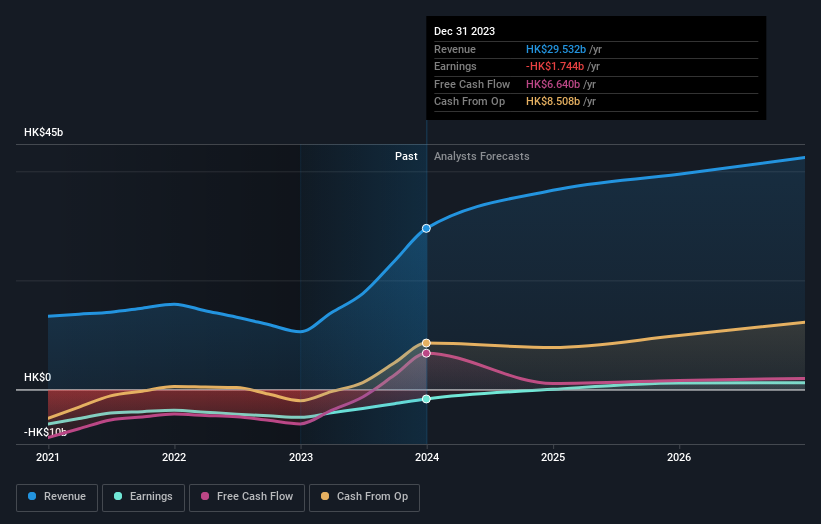

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. You can see what analysts are predicting for Melco International Development in this interactive graph of future profit estimates.

A Different Perspective

We regret to report that Melco International Development shareholders are down 45% for the year. Unfortunately, that's worse than the broader market decline of 2.4%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 12% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Melco International Development by clicking this link.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:200

Melco International Development

An investment holding company, engages in the leisure and entertainment business in Macau, the Philippines, and Cyprus.

Undervalued with high growth potential.