- Hong Kong

- /

- Hospitality

- /

- SEHK:1992

Little Excitement Around Fosun Tourism Group's (HKG:1992) Revenues As Shares Take 31% Pounding

Unfortunately for some shareholders, the Fosun Tourism Group (HKG:1992) share price has dived 31% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 65% loss during that time.

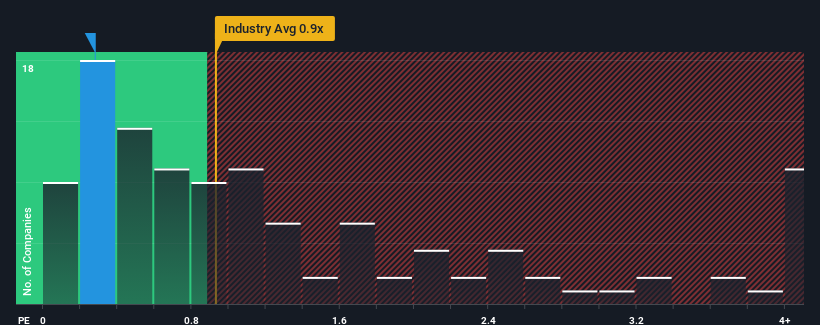

In spite of the heavy fall in price, Fosun Tourism Group may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.3x, since almost half of all companies in the Hospitality industry in Hong Kong have P/S ratios greater than 0.9x and even P/S higher than 3x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Fosun Tourism Group

How Has Fosun Tourism Group Performed Recently?

There hasn't been much to differentiate Fosun Tourism Group's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. Those who are bullish on Fosun Tourism Group will be hoping that this isn't the case.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Fosun Tourism Group.Do Revenue Forecasts Match The Low P/S Ratio?

Fosun Tourism Group's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 26% last year. As a result, it also grew revenue by 27% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 14% during the coming year according to the eight analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 42%, which is noticeably more attractive.

In light of this, it's understandable that Fosun Tourism Group's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Fosun Tourism Group's P/S

Fosun Tourism Group's P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Fosun Tourism Group's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Plus, you should also learn about these 2 warning signs we've spotted with Fosun Tourism Group (including 1 which is a bit concerning).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1992

Fosun Tourism Group

An investment holding company, provides tourism and leisure solutions in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Moderate growth potential with acceptable track record.

Market Insights

Community Narratives