- Hong Kong

- /

- Capital Markets

- /

- SEHK:1328

Undiscovered Gems in Asia with Strong Fundamentals for July 2025

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by robust U.S. job growth and mixed economic signals from major regions such as Japan and China, investors are increasingly turning their attention to small-cap stocks, which have shown strong performance in recent weeks. In this dynamic environment, identifying stocks with solid fundamentals becomes crucial for those looking to uncover potential opportunities in the Asian market.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wuxi Double Elephant Micro Fibre MaterialLtd | 6.32% | 9.86% | 52.64% | ★★★★★★ |

| Yashima Denki | 2.40% | 0.14% | 21.00% | ★★★★★★ |

| QuickLtd | 0.67% | 10.29% | 16.51% | ★★★★★★ |

| Araya Industrial | 17.96% | 3.77% | 10.32% | ★★★★★★ |

| Co-Tech Development | 3.46% | 0.29% | 2.02% | ★★★★★★ |

| Hong Leong Finance | 0.07% | 6.89% | 6.61% | ★★★★★☆ |

| Hunan Investment GroupLtd | 4.50% | 25.84% | 15.32% | ★★★★★☆ |

| Praise Victor Industrial | 85.87% | 1.77% | 44.52% | ★★★★★☆ |

| HannStar Board | 68.83% | -2.82% | -3.15% | ★★★★☆☆ |

| Silvery Dragon Prestressed MaterialsLTD Tianjin | 34.13% | 1.81% | 9.01% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Goldstream Investment (SEHK:1328)

Simply Wall St Value Rating: ★★★★★★

Overview: Goldstream Investment Limited is an investment holding company focused on investment management and strategic direct investments in the People’s Republic of China and Hong Kong, with a market capitalization of approximately HK$3.23 billion.

Operations: Goldstream Investment generates revenue primarily from its investment management (IM) business, contributing HK$25.53 million, and strategic direct investment (SDI) business, which accounts for HK$71.97 million. The SDI segment is the larger contributor to the company's overall revenue mix.

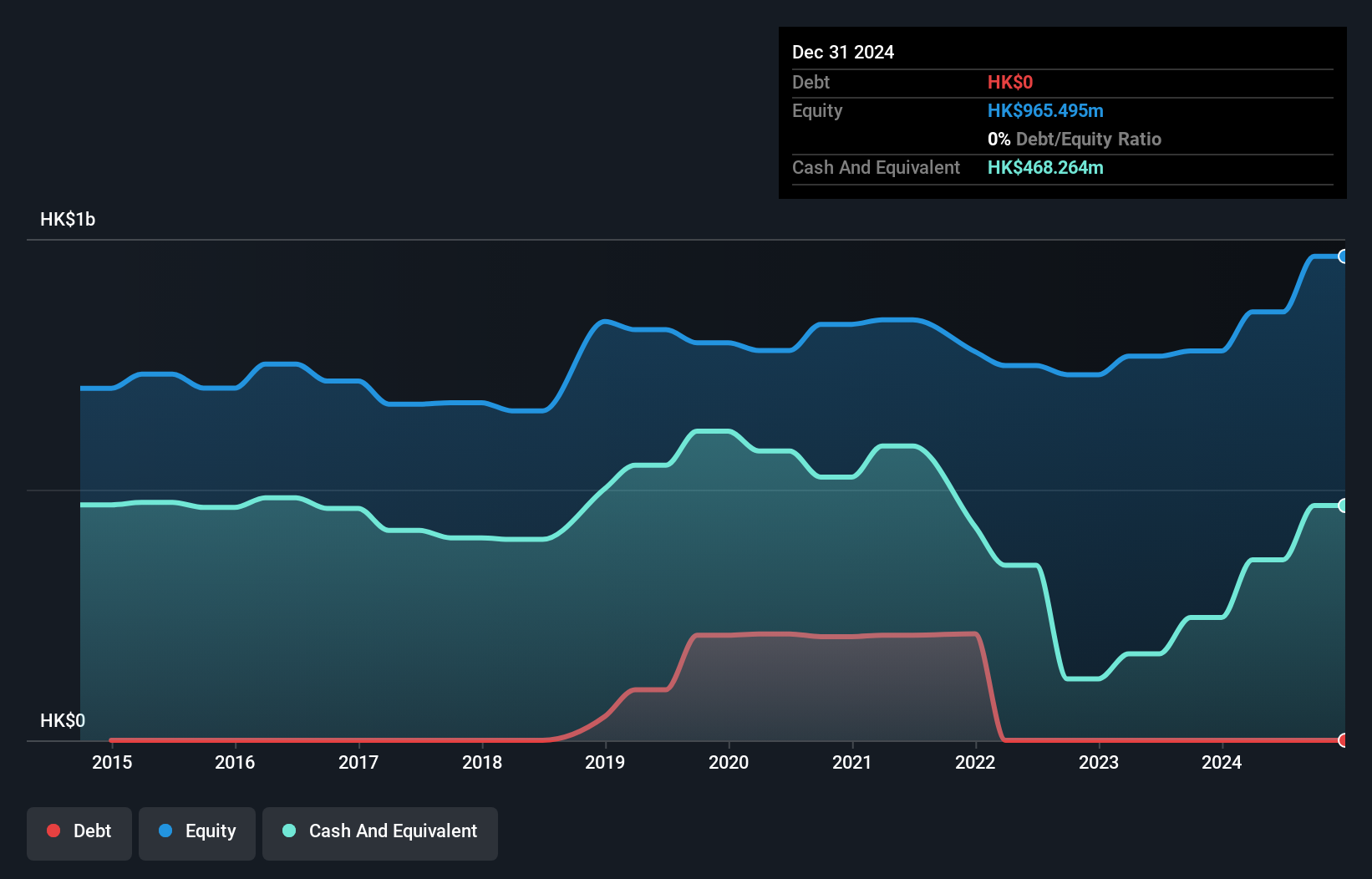

Goldstream Investment, a nimble player on the Asian stage, has shown impressive financial discipline by eliminating its debt over the past five years from a 26.4% debt-to-equity ratio. This financial freedom complements its robust earnings growth of 45.2%, outpacing the Capital Markets industry average of 23.9%. Despite recent share price volatility, Goldstream's high-quality earnings and positive free cash flow underscore its operational strength. The recent announcement to repurchase up to 25.66 million shares aims to enhance net asset value per share, signaling confidence in future performance and shareholder value enhancement strategies.

- Take a closer look at Goldstream Investment's potential here in our health report.

Explore historical data to track Goldstream Investment's performance over time in our Past section.

China Chunlai Education Group (SEHK:1969)

Simply Wall St Value Rating: ★★★★★☆

Overview: China Chunlai Education Group Co., Ltd., along with its subsidiaries, operates private higher education institutions in China and has a market capitalization of HK$6.06 billion.

Operations: Chunlai Education generates revenue primarily from the operation of private higher education institutions, amounting to CN¥1.71 billion. The company focuses on delivering educational services within China.

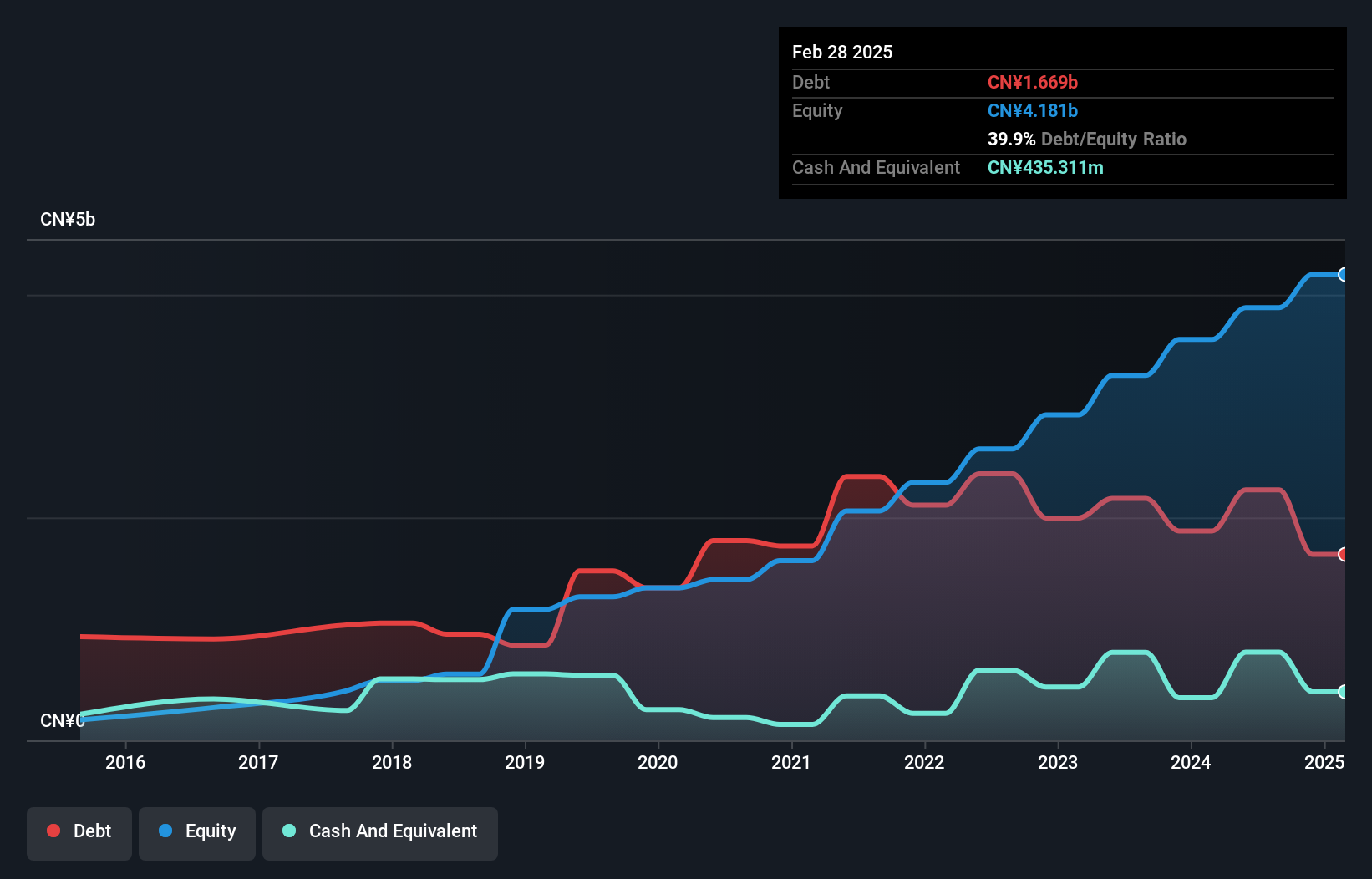

China Chunlai Education Group, a notable player in the education sector, has been making strides with its recent financial performance. The company reported sales of CNY 890.72 million for the half year ending February 2025, up from CNY 813.91 million a year earlier, while net income increased to CNY 406.56 million from CNY 384.27 million. Trading at a significant discount of 64% below estimated fair value suggests potential upside for investors seeking value opportunities in Asia's education market. With earnings growth of 8.6% surpassing industry averages and a satisfactory net debt to equity ratio of 29%, Chunlai appears well-positioned financially amidst its peers.

- Click here and access our complete health analysis report to understand the dynamics of China Chunlai Education Group.

Gain insights into China Chunlai Education Group's past trends and performance with our Past report.

Vobile Group (SEHK:3738)

Simply Wall St Value Rating: ★★★★★☆

Overview: Vobile Group Limited is an investment holding company that offers software as a service for digital content asset protection and transactions across the United States, Mainland China, and other international markets, with a market cap of HK$9.17 billion.

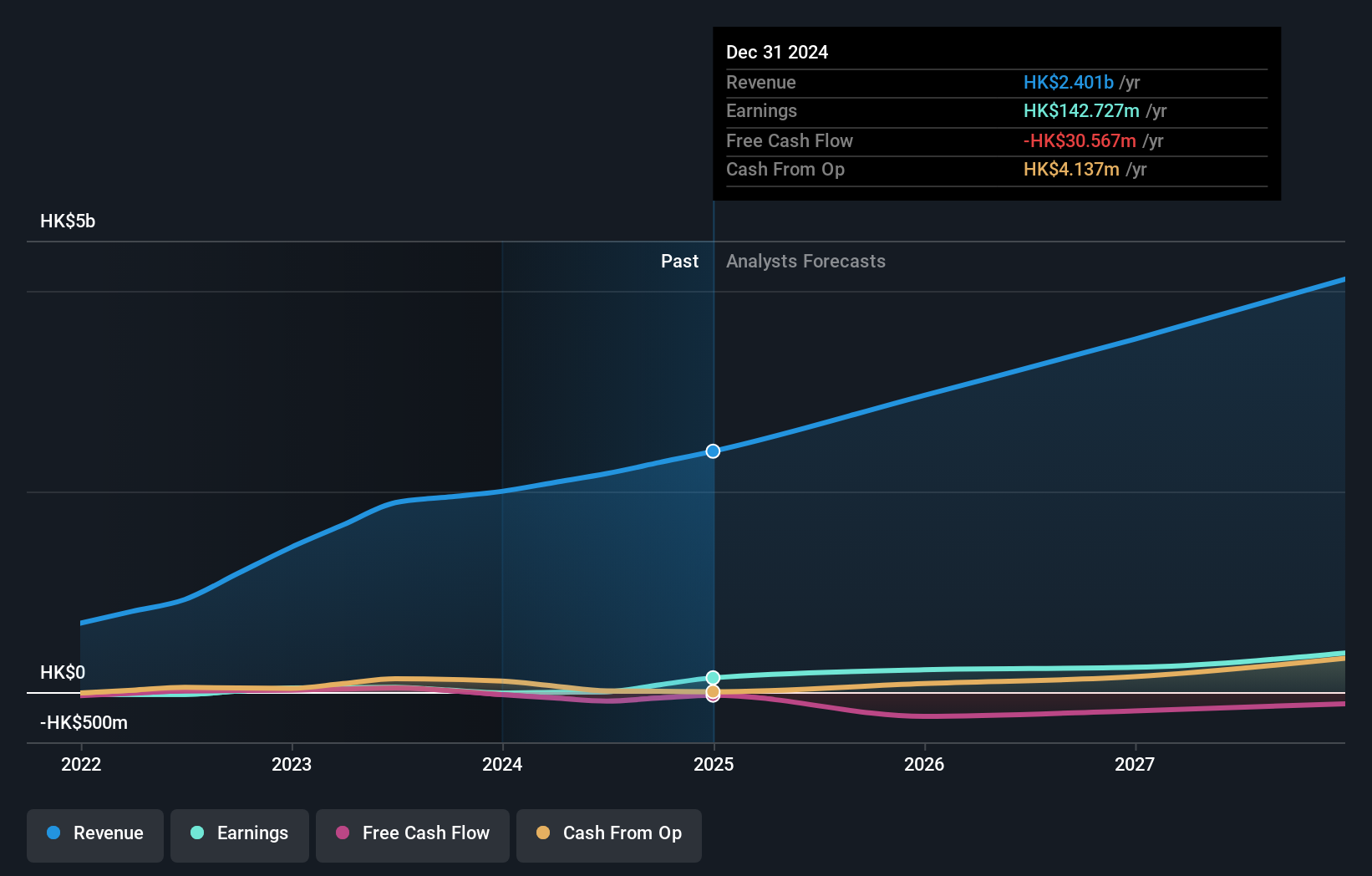

Operations: Vobile Group generates revenue primarily from its software as a service (SaaS) offerings, amounting to HK$2.40 billion. The company's financial performance is highlighted by its gross profit margin trend, which reflects its operational efficiency and cost management in delivering SaaS solutions.

Vobile Group, a small cap player in the digital content space, has recently turned profitable, setting it apart from the software industry's slight dip of 0.5%. Their strategic collaboration with Shanghai Film Group aims to enhance their content asset operation platform and global video center. Over five years, Vobile's debt to equity ratio impressively dropped from 142.5% to 43.5%, while interest payments are comfortably covered by EBIT at 3.1x coverage. Despite not being free cash flow positive, earnings are forecasted to grow at a robust pace of 28.55% annually, suggesting promising future prospects for this dynamic company.

Summing It All Up

- Gain an insight into the universe of 2605 Asian Undiscovered Gems With Strong Fundamentals by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1328

Goldstream Investment

An investment holding company, engages in the investment management (IM) and strategic direct investment (SDI) businesses in the People’s Republic of China and Hong Kong.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives