- Hong Kong

- /

- Consumer Services

- /

- SEHK:1969

How Much Of China Chunlai Education Group Co., Ltd. (HKG:1969) Do Insiders Own?

If you want to know who really controls China Chunlai Education Group Co., Ltd. (HKG:1969), then you'll have to look at the makeup of its share registry. Insiders often own a large chunk of younger, smaller, companies while huge companies tend to have institutions as shareholders. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

With a market capitalization of HK$1.5b, China Chunlai Education Group is a small cap stock, so it might not be well known by many institutional investors. Taking a look at our data on the ownership groups (below), it seems that institutions are not on the share registry. Let's take a closer look to see what the different types of shareholders can tell us about China Chunlai Education Group.

See our latest analysis for China Chunlai Education Group

What Does The Lack Of Institutional Ownership Tell Us About China Chunlai Education Group?

Institutional investors often avoid companies that are too small, too illiquid or too risky for their tastes. But it's unusual to see larger companies without any institutional investors.

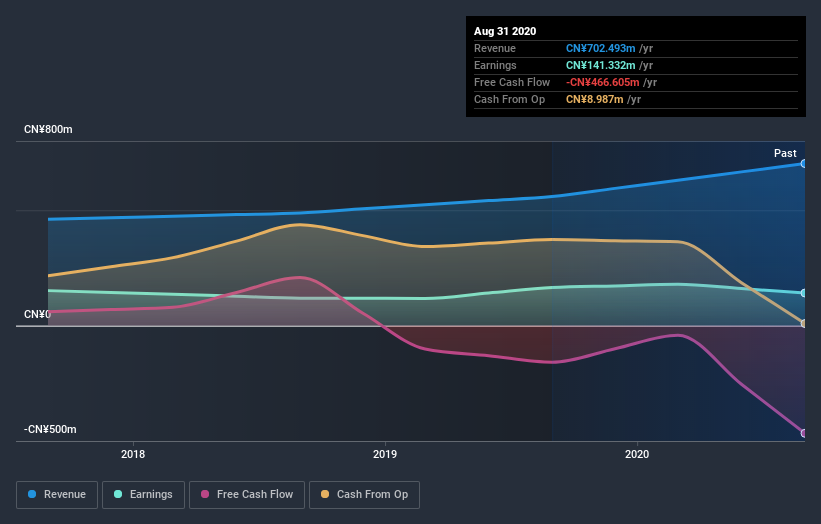

There are multiple explanations for why institutions don't own a stock. The most common is that the company is too small relative to funds under management, so the institution does not bother to look closely at the company. On the other hand, it's always possible that professional investors are avoiding a company because they don't think it's the best place for their money. Institutional investors may not find the historic growth of the business impressive, or there might be other factors at play. You can see the past revenue performance of China Chunlai Education Group, for yourself, below.

Hedge funds don't have many shares in China Chunlai Education Group. Because actions speak louder than words, we consider it a good sign when insiders own a significant stake in a company. In China Chunlai Education Group's case, its Senior Key Executive, Junyu Hou, is the largest shareholder, holding 75% of shares outstanding. Xiang Rong International Limited is the second largest shareholder owning 5.5% of common stock, and Xiaohui Hao holds about 0.08% of the company stock. Interestingly, the third-largest shareholder, Xiaohui Hao is also a Vice Chairman, again, indicating strong insider ownership amongst the company's top shareholders.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of China Chunlai Education Group

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our most recent data indicates that insiders own the majority of China Chunlai Education Group Co., Ltd.. This means they can collectively make decisions for the company. So they have a HK$1.1b stake in this HK$1.5b business. It is good to see this level of investment. You can check here to see if those insiders have been buying recently.

General Public Ownership

The general public holds a 19% stake in China Chunlai Education Group. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Private Company Ownership

We can see that Private Companies own 5.5%, of the shares on issue. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with China Chunlai Education Group (at least 2 which don't sit too well with us) , and understanding them should be part of your investment process.

If you would prefer check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, backed by strong financial data.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you’re looking to trade China Chunlai Education Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1969

China Chunlai Education Group

Provides private higher education services in the People’s Republic of China.

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success