- Hong Kong

- /

- Hospitality

- /

- SEHK:1928

Sands China (SEHK:1928): Assessing Valuation After Leading Macao’s Tech Innovation Initiative in Lisbon

Reviewed by Simply Wall St

Sands China (SEHK:1928) recently led a group of Macao enterprises and startups to a five-day technology innovation event in Lisbon. The initiative included attending the Web Summit and participating in cross-border collaboration workshops, reflecting Macao’s growing focus on smart tourism and tech-driven development.

See our latest analysis for Sands China.

Sands China's willingness to take the lead on tech innovation and international partnerships has coincided with a 1-year total shareholder return of 11.9%. Despite short-term share price headwinds, recent momentum and these strategic efforts may be shifting perceptions around growth prospects and risk for investors.

If Sands China's cross-border moves got you thinking about what fast-growing, high-insider-ownership companies are out there, now is the time to explore fast growing stocks with high insider ownership

But with shares up nearly 12% this year and the market valuing Sands China at a significant discount to analyst targets, the key question is whether this creates an attractive entry point or if future growth is already reflected in the price.

Price-to-Earnings of 23.4x: Is it justified?

With Sands China trading at a price-to-earnings ratio of 23.4x, the stock commands a clear premium over its industry peers, even as its last close price sits at HK$20.66.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each dollar of the company's earnings. For Sands China, this higher P/E suggests the market is pricing in a brighter earnings outlook than what is currently typical for the hospitality sector in Hong Kong.

However, when compared to the peer average P/E of just 15.5x, it becomes clear that Sands China's stock is seen as more expensive. The gap is even wider considering the estimated fair P/E ratio of 21.3x. This means the market's valuation is running a bit ahead of what underlying fundamentals might support.

Explore the SWS fair ratio for Sands China

Result: Price-to-Earnings of 23.4x (OVERVALUED)

However, persistent revenue pressures and historically weak long-term returns could quickly challenge optimism if growth stalls or if market sentiment shifts.

Find out about the key risks to this Sands China narrative.

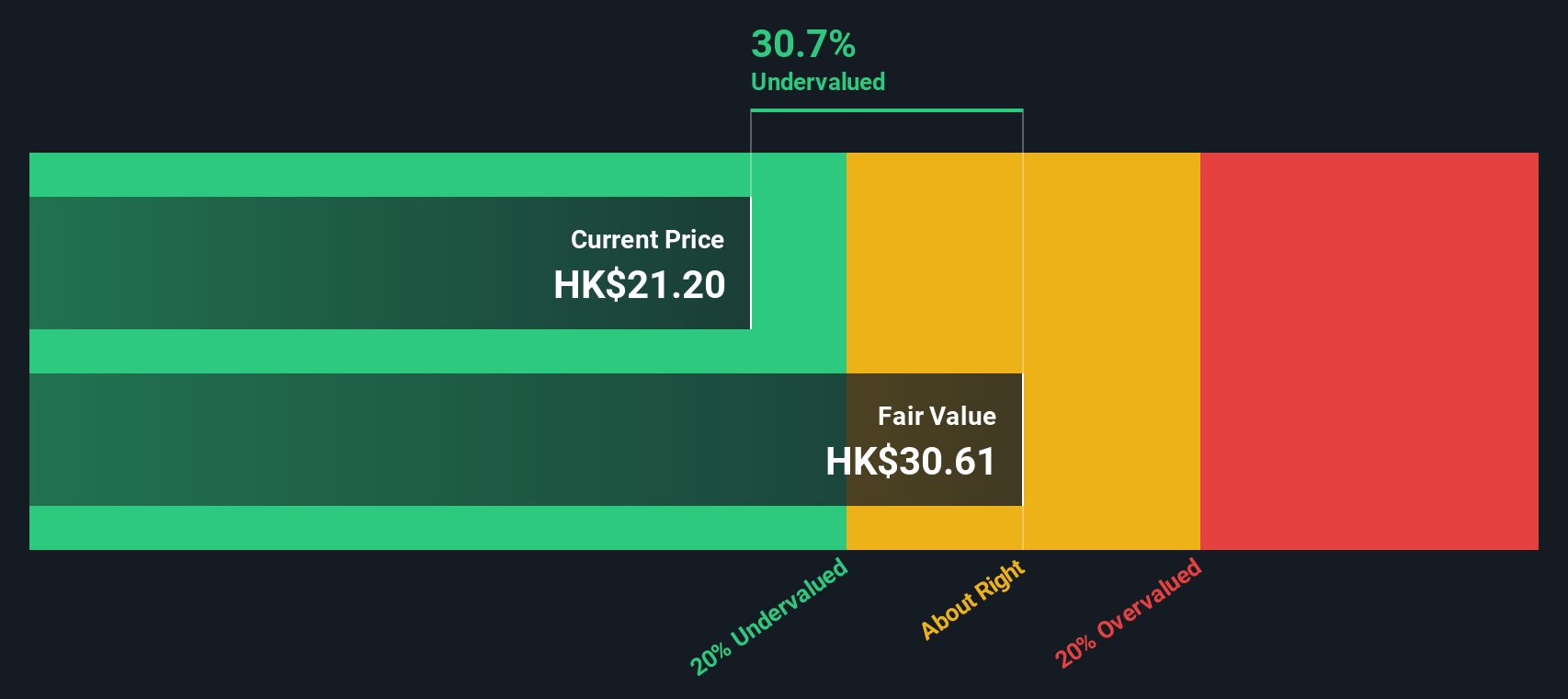

Another View: Discounted Cash Flow Suggests Upside

While the market views Sands China as expensive compared to industry averages, our DCF model presents a different picture. It estimates the shares are trading at a 31.8% discount to fair value. This suggests the price could have room to move higher if cash flow projections hold up. Which perspective will prove right in the months ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sands China for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 925 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sands China Narrative

If you want to dig into the numbers yourself and see a different angle, it’s quick and easy to construct your own story of Sands China. Do it your way

A great starting point for your Sands China research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. Simply Wall Street packs smart filters that can surface the next investment you’ll want on your radar.

- Tap into fast, stable cash flow by checking out these 925 undervalued stocks based on cash flows that consistently trade below their intrinsic worth and could be poised for a strong run.

- Catch the surge in healthcare breakthroughs when you review these 30 healthcare AI stocks pushing boundaries in medical diagnostics, patient care, and artificial intelligence.

- Secure your passive income strategy as you evaluate these 15 dividend stocks with yields > 3% offering consistent yields above 3% for long-term portfolio growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1928

Sands China

Develops, owns, and operates integrated resorts and casinos in Macao.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success