- Hong Kong

- /

- Hospitality

- /

- SEHK:1928

3 SEHK Stocks Estimated To Be Up To 49.7% Below Intrinsic Value

Reviewed by Simply Wall St

In recent weeks, the Hong Kong market has faced a challenging environment, with the Hang Seng Index declining by 1.03% amid global economic uncertainties and stimulus measures from China. Despite these headwinds, opportunities may exist for investors seeking undervalued stocks that are trading below their intrinsic value, offering potential for growth as market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| BYD Electronic (International) (SEHK:285) | HK$34.30 | HK$68.13 | 49.7% |

| Giant Biogene Holding (SEHK:2367) | HK$52.95 | HK$98.97 | 46.5% |

| Kuaishou Technology (SEHK:1024) | HK$45.90 | HK$88.36 | 48.1% |

| MicroPort NeuroScientific (SEHK:2172) | HK$9.79 | HK$18.82 | 48% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$29.00 | HK$55.64 | 47.9% |

| Hangzhou SF Intra-city Industrial (SEHK:9699) | HK$10.14 | HK$19.45 | 47.9% |

| Semiconductor Manufacturing International (SEHK:981) | HK$28.80 | HK$54.38 | 47% |

| DPC Dash (SEHK:1405) | HK$65.50 | HK$130.67 | 49.9% |

| Digital China Holdings (SEHK:861) | HK$2.88 | HK$5.73 | 49.7% |

| Sands China (SEHK:1928) | HK$19.86 | HK$38.69 | 48.7% |

We're going to check out a few of the best picks from our screener tool.

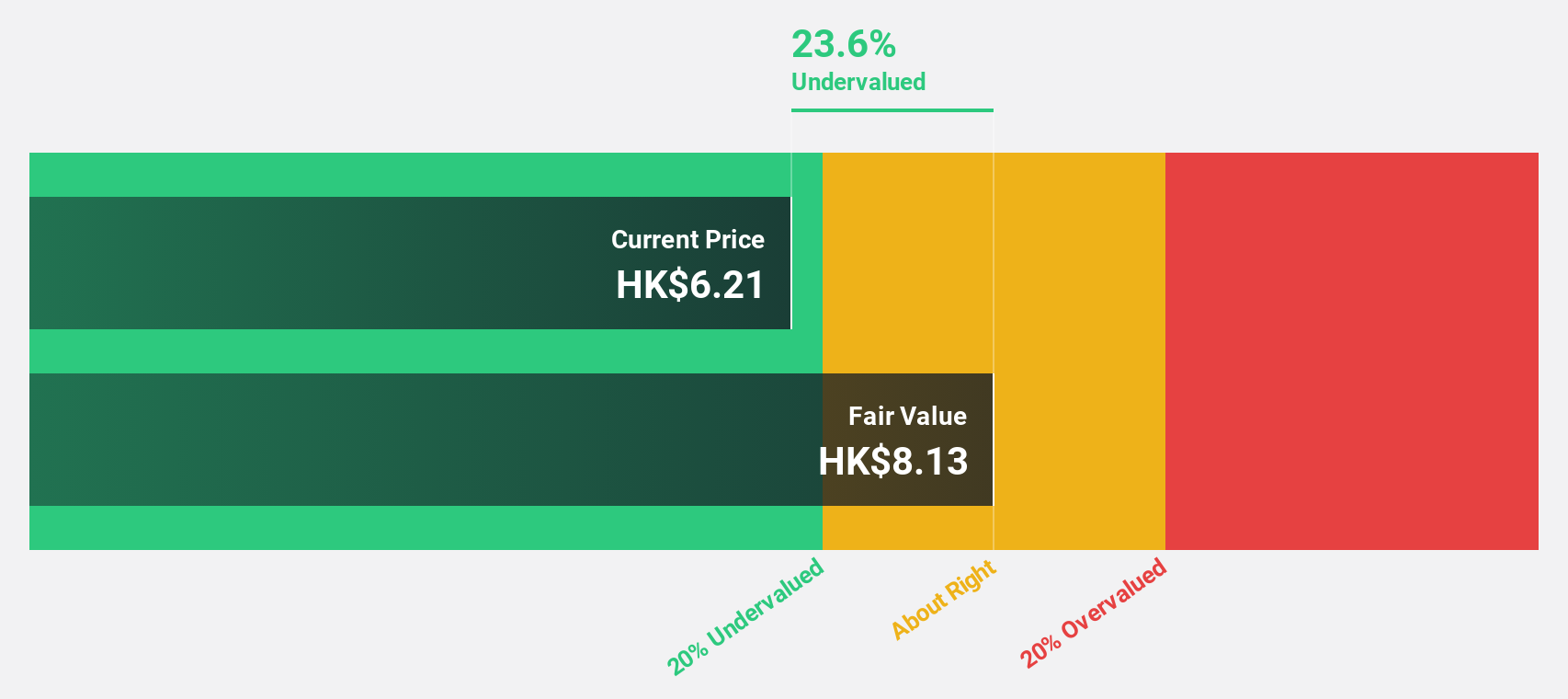

Plover Bay Technologies (SEHK:1523)

Overview: Plover Bay Technologies Limited is an investment holding company that designs, develops, and markets software-defined wide area network routers, with a market capitalization of HK$6.01 billion.

Operations: The company's revenue segments include $15.19 million from sales of SD-WAN routers for fixed first connectivity, $59.87 million from sales of SD-WAN routers for mobile first connectivity, and $31.86 million from software licenses and warranty and support services.

Estimated Discount To Fair Value: 46.1%

Plover Bay Technologies is trading at HK$5.46, significantly below its estimated fair value of HK$10.14, indicating undervaluation based on cash flows. With earnings growth forecasted at 17.3% annually, outpacing the Hong Kong market's 12.2%, and a high return on equity projected in three years, the company shows strong financial prospects despite an unstable dividend track record. Recent executive changes may enhance board diversity and expertise in legal affairs.

- The analysis detailed in our Plover Bay Technologies growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Plover Bay Technologies.

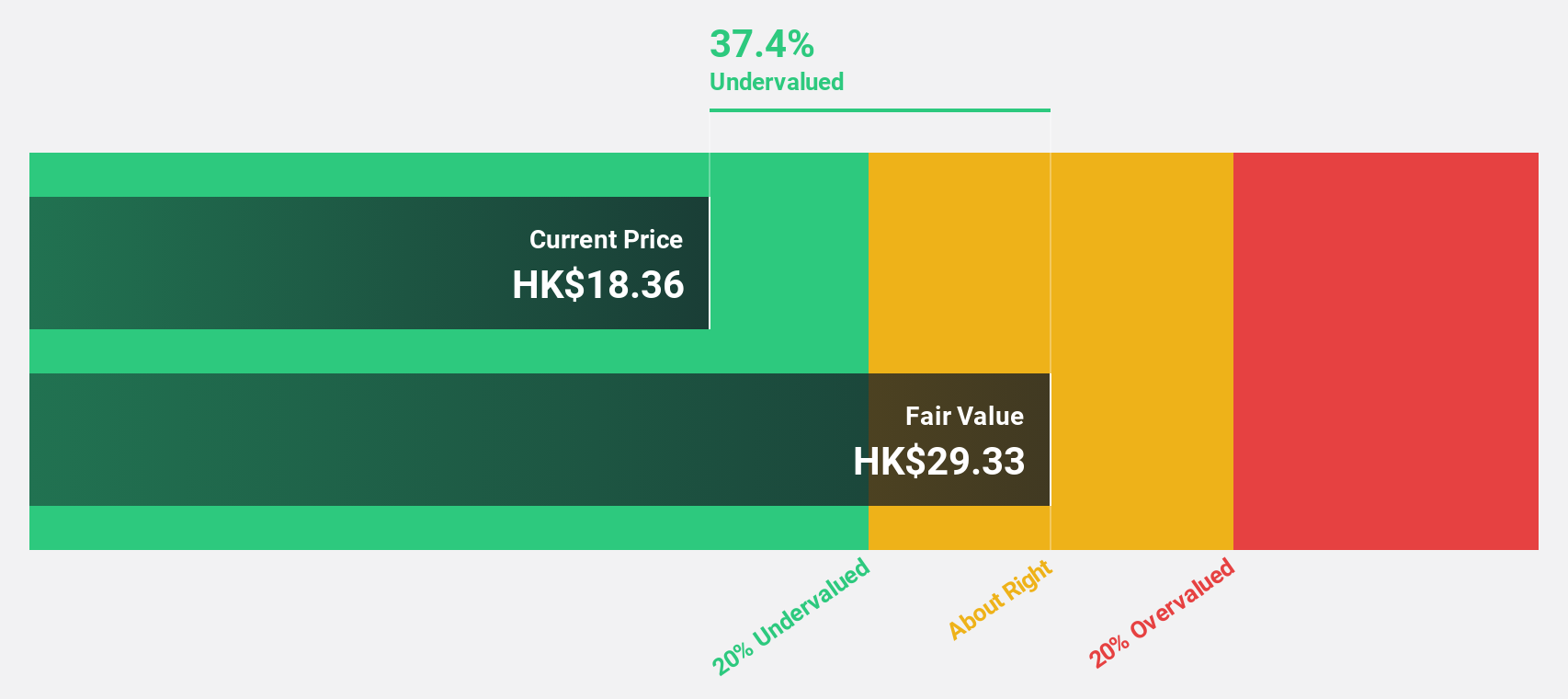

Sands China (SEHK:1928)

Overview: Sands China Ltd. develops, owns, and operates integrated resorts and casinos in Macao with a market cap of HK$160.73 billion.

Operations: The company's revenue segments include The Venetian Macao at $2.93 billion, The Londoner Macao at $2.11 billion, The Parisian Macao at $961 million, The Plaza Macao at $776 million, Sands Macao at $319 million, and Ferry and Other Operations at $109 million.

Estimated Discount To Fair Value: 48.7%

Sands China trades at HK$19.86, well below its estimated fair value of HK$38.69, highlighting potential undervaluation based on cash flows. Despite high debt levels, earnings are forecast to grow 19.47% annually, surpassing the Hong Kong market average of 12.2%. Recent refinancing through a HKD 19.5 billion credit facility may strengthen liquidity for operational needs and growth initiatives in Macao's tourism sector following a profitable year with robust revenue gains.

- Insights from our recent growth report point to a promising forecast for Sands China's business outlook.

- Get an in-depth perspective on Sands China's balance sheet by reading our health report here.

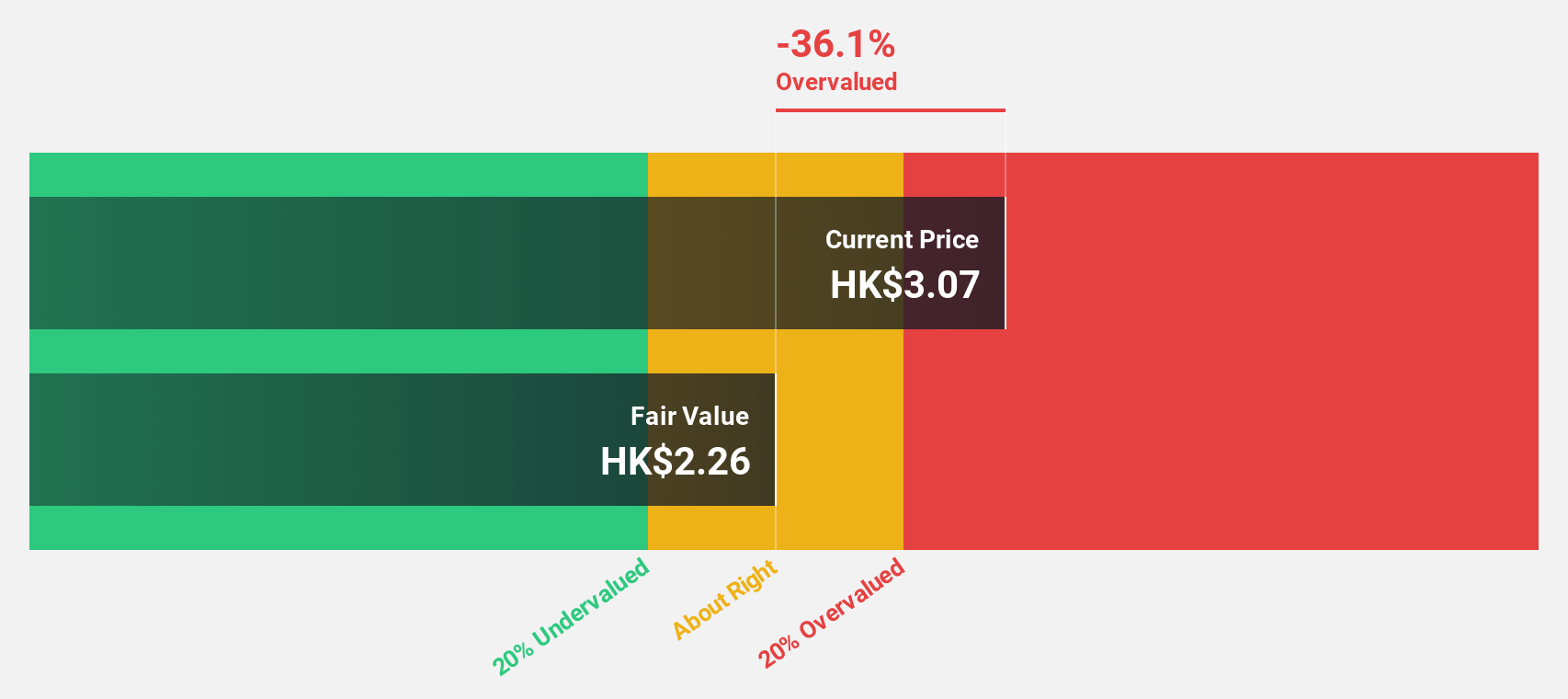

Digital China Holdings (SEHK:861)

Overview: Digital China Holdings Limited is an investment holding company that offers big data products and solutions to government and enterprise customers mainly in Mainland China, with a market capitalization of HK$4.82 billion.

Operations: The company generates revenue from several segments, with CN¥3.39 billion from big data products and solutions, CN¥5.31 billion from software and operating services, and CN¥10.03 billion from traditional and localization services.

Estimated Discount To Fair Value: 49.7%

Digital China Holdings, trading at HK$2.88, is significantly undervalued with an estimated fair value of HK$5.73. Despite recent profit declines due to competition and increased expenses, its revenue growth forecast of 9.8% annually surpasses the Hong Kong market average of 7.4%. Earnings are expected to grow substantially over the next three years as profitability improves, although return on equity remains low at a projected 7.6%.

- Upon reviewing our latest growth report, Digital China Holdings' projected financial performance appears quite optimistic.

- Take a closer look at Digital China Holdings' balance sheet health here in our report.

Make It Happen

- Gain an insight into the universe of 40 Undervalued SEHK Stocks Based On Cash Flows by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1928

Sands China

Develops, owns, and operates integrated resorts and casinos in Macao.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives