- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:1797

Here's Why Koolearn Technology Holding Limited's (HKG:1797) CEO Compensation Is The Least Of Shareholders Concerns

Performance at Koolearn Technology Holding Limited (HKG:1797) has been rather uninspiring recently and shareholders may be wondering how CEO Dongxu Sun plans to fix this. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 03 November 2022. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. In our opinion, CEO compensation does not look excessive and we discuss why.

Our analysis indicates that 1797 is potentially undervalued!

How Does Total Compensation For Dongxu Sun Compare With Other Companies In The Industry?

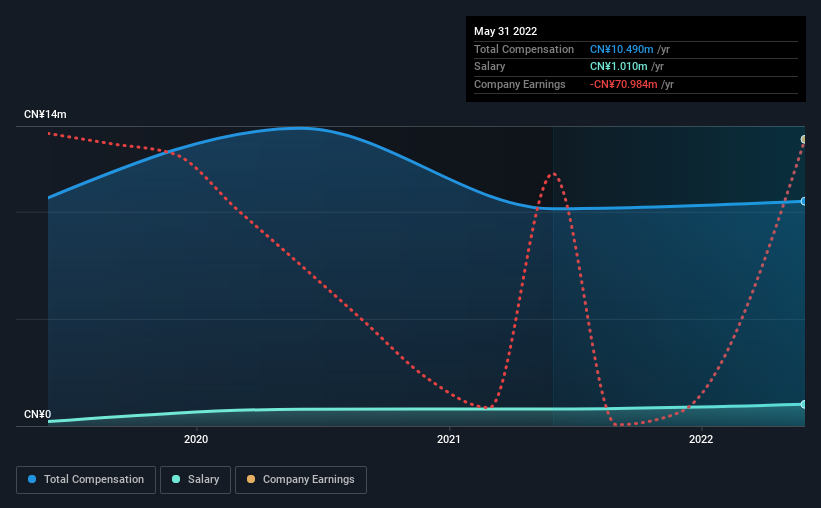

At the time of writing, our data shows that Koolearn Technology Holding Limited has a market capitalization of HK$39b, and reported total annual CEO compensation of CN¥10m for the year to May 2022. That's a fairly small increase of 3.5% over the previous year. While we always look at total compensation first, our analysis shows that the salary component is less, at CN¥1.0m.

On comparing similar companies from the same industry with market caps ranging from HK$31b to HK$94b, we found that the median CEO total compensation was CN¥45m. In other words, Koolearn Technology Holding pays its CEO lower than the industry median. Furthermore, Dongxu Sun directly owns HK$131m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | CN¥1.0m | CN¥796k | 10% |

| Other | CN¥9.5m | CN¥9.3m | 90% |

| Total Compensation | CN¥10m | CN¥10m | 100% |

Speaking on an industry level, nearly 81% of total compensation represents salary, while the remainder of 19% is other remuneration. Koolearn Technology Holding sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Koolearn Technology Holding Limited's Growth Numbers

Over the last three years, Koolearn Technology Holding Limited has shrunk its earnings per share by 38% per year. Its revenue is down 3.7% over the previous year.

The decline in EPS is a bit concerning. This is compounded by the fact revenue is actually down on last year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Koolearn Technology Holding Limited Been A Good Investment?

We think that the total shareholder return of 125%, over three years, would leave most Koolearn Technology Holding Limited shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Although shareholders would be quite happy with the returns they have earned on their initial investment, earnings have failed to grow and this could mean these strong returns may not continue. These are are some concerns that shareholders may want to address the board when they revisit their investment thesis.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 1 warning sign for Koolearn Technology Holding that investors should think about before committing capital to this stock.

Important note: Koolearn Technology Holding is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if East Buy Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1797

East Buy Holding

An investment holding company, engages in the livestreaming e-commerce business for sale of private label products in the People's Republic of China.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives