In the final stretch of the year, global markets experienced a mixed performance with major U.S. stock indexes showing moderate gains, despite a dip in consumer confidence and declines in durable goods orders. Amidst this backdrop, small-cap stocks have been navigating through fluctuating economic indicators and broader market sentiment, presenting opportunities for discerning investors to identify stocks with strong fundamentals and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Natural Food International Holding | NA | 2.49% | 20.35% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Scholar Education Group (SEHK:1769)

Simply Wall St Value Rating: ★★★★★★

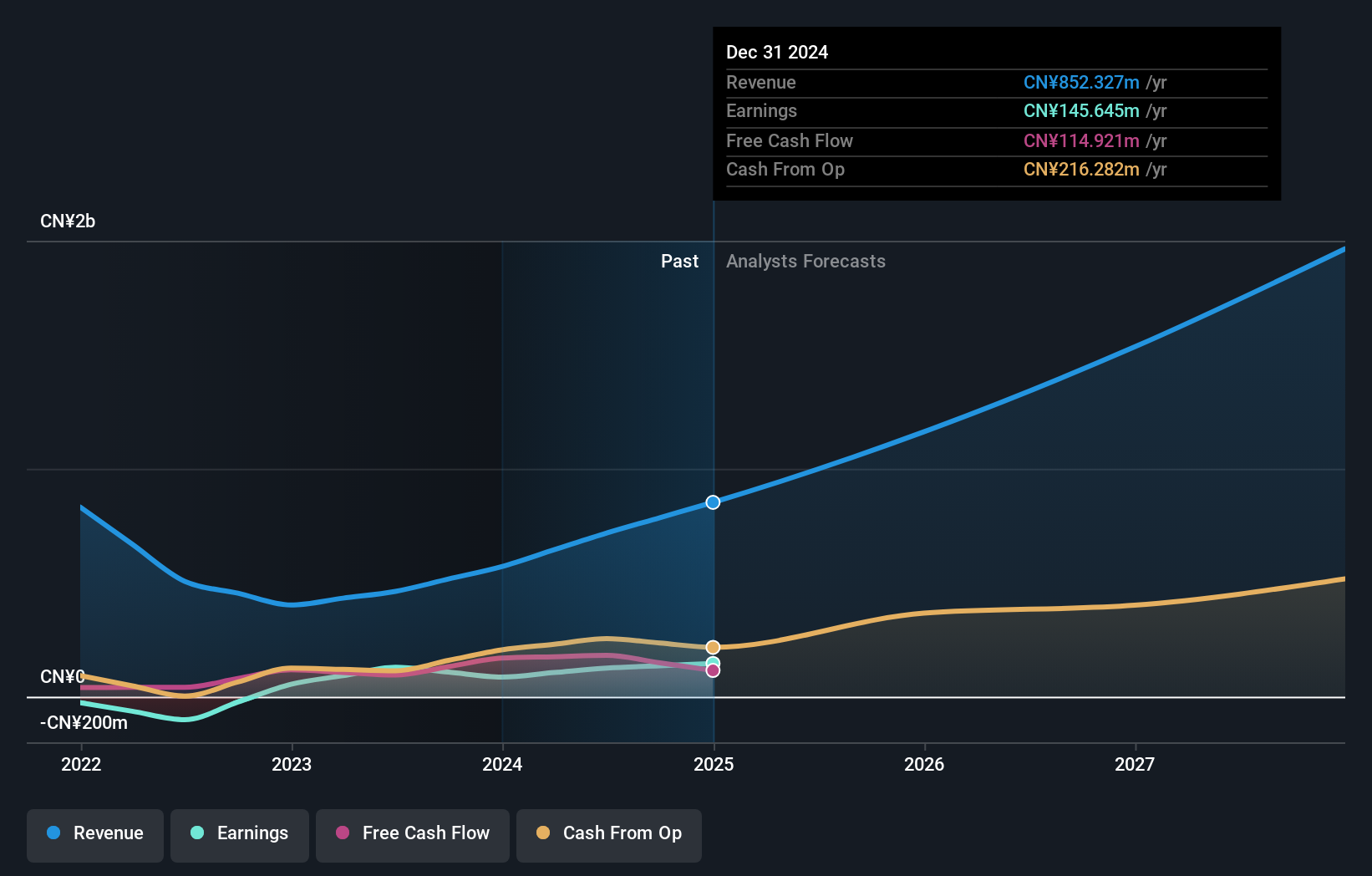

Overview: Scholar Education Group is an investment holding company that offers K-12 after-school education services in the People’s Republic of China, with a market cap of HK$2.88 billion.

Operations: Scholar Education Group generates revenue primarily from its private education services, amounting to CN¥718.40 million.

Scholar Education Group, a smaller player in the education sector, exhibits intriguing characteristics. Its debt to equity ratio has improved from 9% to 5.6% over five years, indicating prudent financial management. Despite this, the net profit margin has slipped from 28% to 17.5%, suggesting challenges in maintaining profitability levels. However, with interest payments well covered by EBIT at an impressive 2184x and high-quality earnings reported, financial stability seems robust for now. The stock trades significantly below its estimated fair value by about 85%, offering potential upside if revenue grows as forecasted at over 36% annually.

- Click here and access our complete health analysis report to understand the dynamics of Scholar Education Group.

Assess Scholar Education Group's past performance with our detailed historical performance reports.

UOB-Kay Hian Holdings (SGX:U10)

Simply Wall St Value Rating: ★★★★☆☆

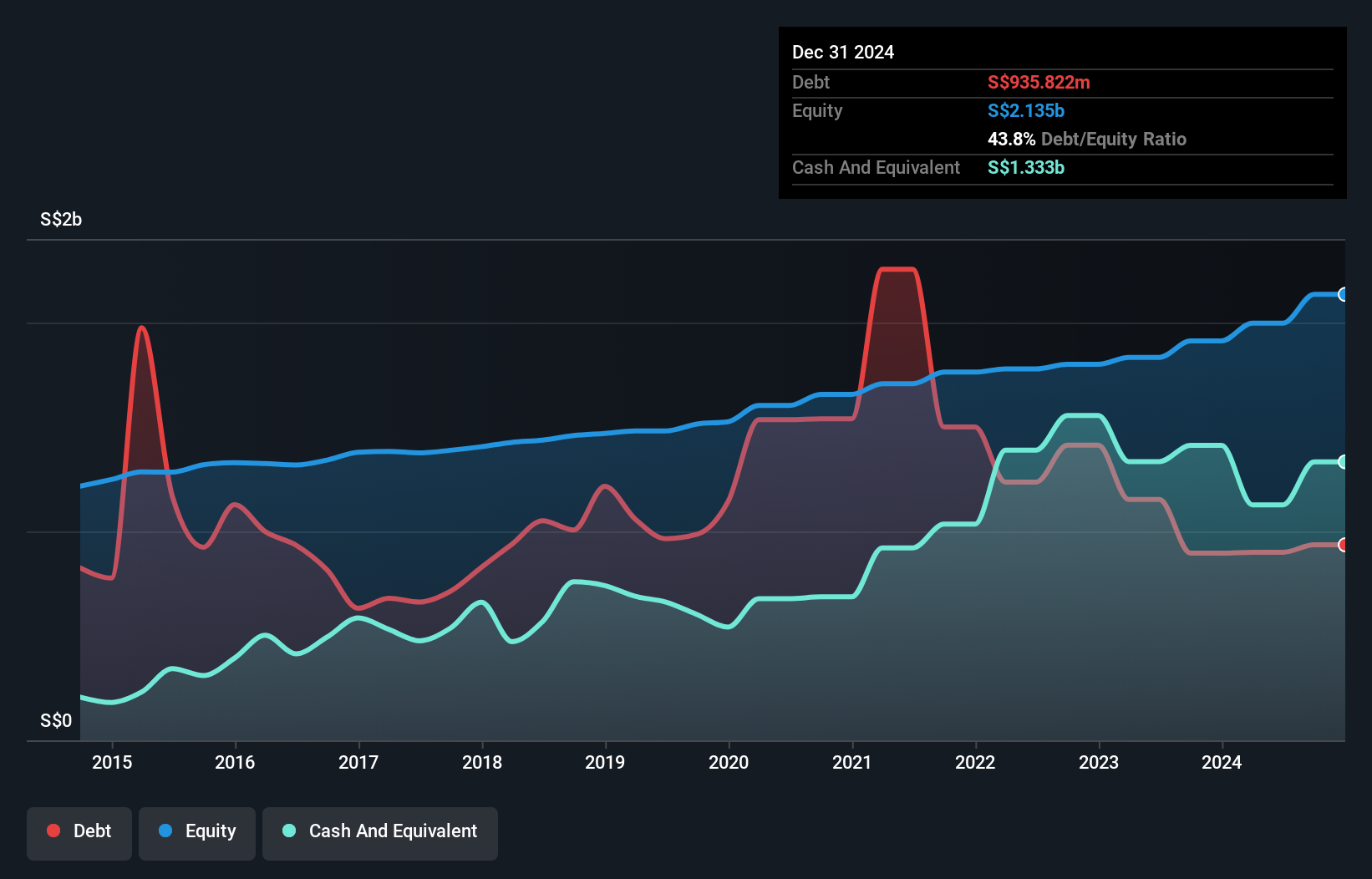

Overview: UOB-Kay Hian Holdings Limited is an investment holding company offering stockbroking, futures broking, structured lending, investment trading, margin financing, and nominee and research services across Singapore, Hong Kong, Thailand, Malaysia, and internationally with a market cap of SGD1.57 billion.

Operations: The primary revenue stream for UOB-Kay Hian Holdings comes from its Securities and Futures Broking and Other Related Services, generating approximately SGD581.07 million.

UOB-Kay Hian Holdings, a financial services player, has seen its earnings grow by 80% over the past year, outpacing the industry average of 22.4%. Despite this impressive growth, shareholders experienced dilution in the past year. The company's debt-to-equity ratio improved significantly from 65.2% to 45.1% over five years, indicating better financial leverage management. Recently, UOB-Kay Hian expanded its footprint by establishing a new investment management subsidiary in Hong Kong with HKD 500K capital. These moves suggest strategic positioning for future growth while trading at a value below estimated fair value by about 22%.

Sumitomo Seika Chemicals Company (TSE:4008)

Simply Wall St Value Rating: ★★★★★★

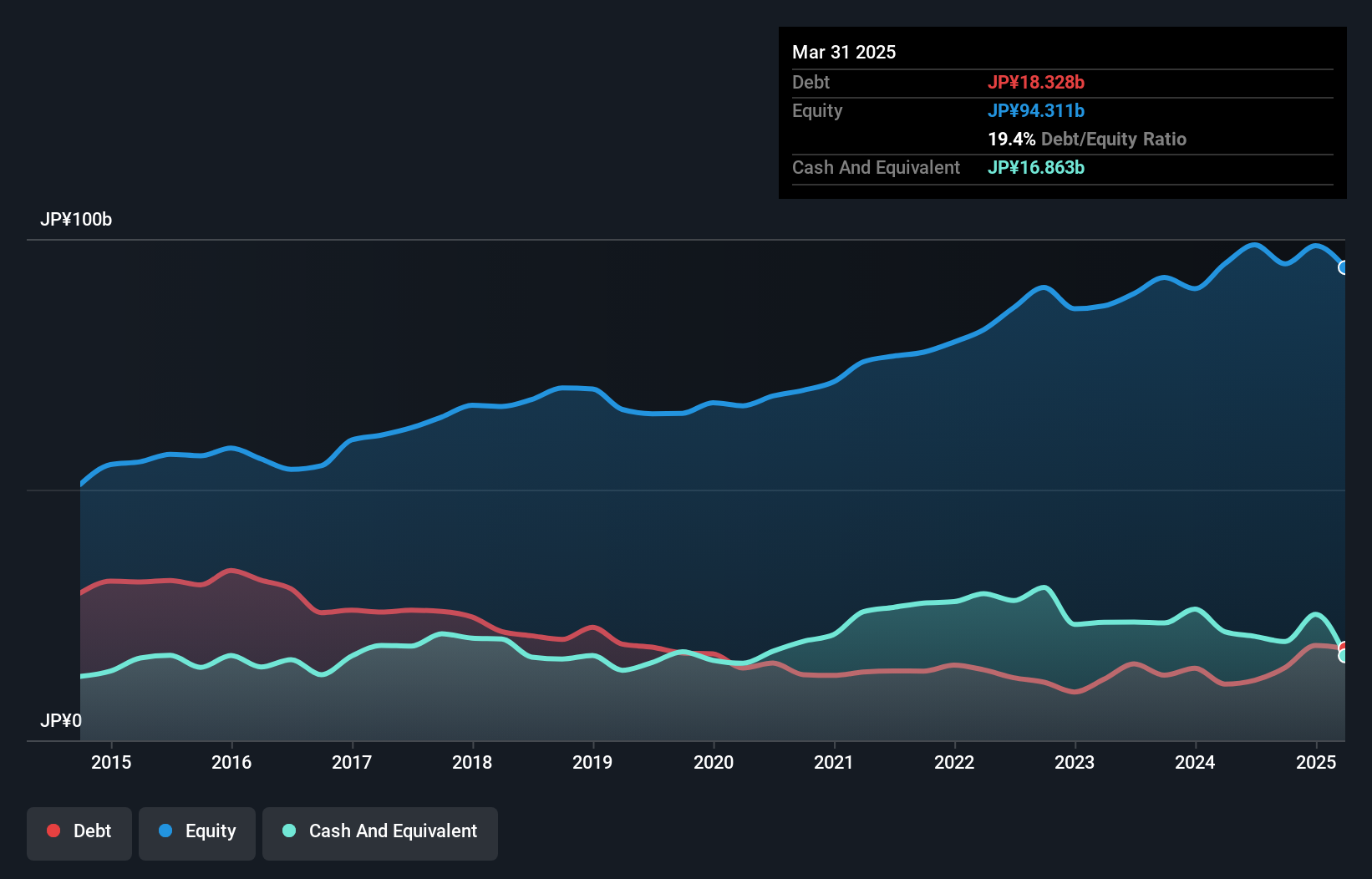

Overview: Sumitomo Seika Chemicals Company, Limited is a Japanese firm engaged in the production and sale of chemical products, with a market capitalization of approximately ¥62.69 billion.

Operations: Sumitomo Seika Chemicals generates revenue through its chemical products segment. The company's net profit margin is a key financial indicator, reflecting the efficiency of its operations in converting revenue into profit.

Sumitomo Seika, a compact player in the chemicals sector, has shown promising financial health with cash exceeding its total debt and a reduced debt-to-equity ratio from 26.7% to 15.3% over five years. Recent earnings growth of 19.8% outpaced the industry average of 14%, indicating strong performance relative to peers. The company completed a share repurchase program, buying back 200,000 shares for ¥994.87 million to enhance shareholder value and capital efficiency. Trading at about 57.6% below estimated fair value suggests potential undervaluation, while high-quality earnings further bolster its investment appeal amidst stable dividends at JPY100 per share annually.

- Navigate through the intricacies of Sumitomo Seika Chemicals Company with our comprehensive health report here.

Understand Sumitomo Seika Chemicals Company's track record by examining our Past report.

Summing It All Up

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4637 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4008

Sumitomo Seika Chemicals Company

Sumitomo Seika Chemicals Company, Limited.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives