- Hong Kong

- /

- Consumer Services

- /

- SEHK:1739

Qeeka Home (Cayman) Inc.'s (HKG:1739) Price Is Right But Growth Is Lacking After Shares Rocket 40%

Despite an already strong run, Qeeka Home (Cayman) Inc. (HKG:1739) shares have been powering on, with a gain of 40% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 13% is also fairly reasonable.

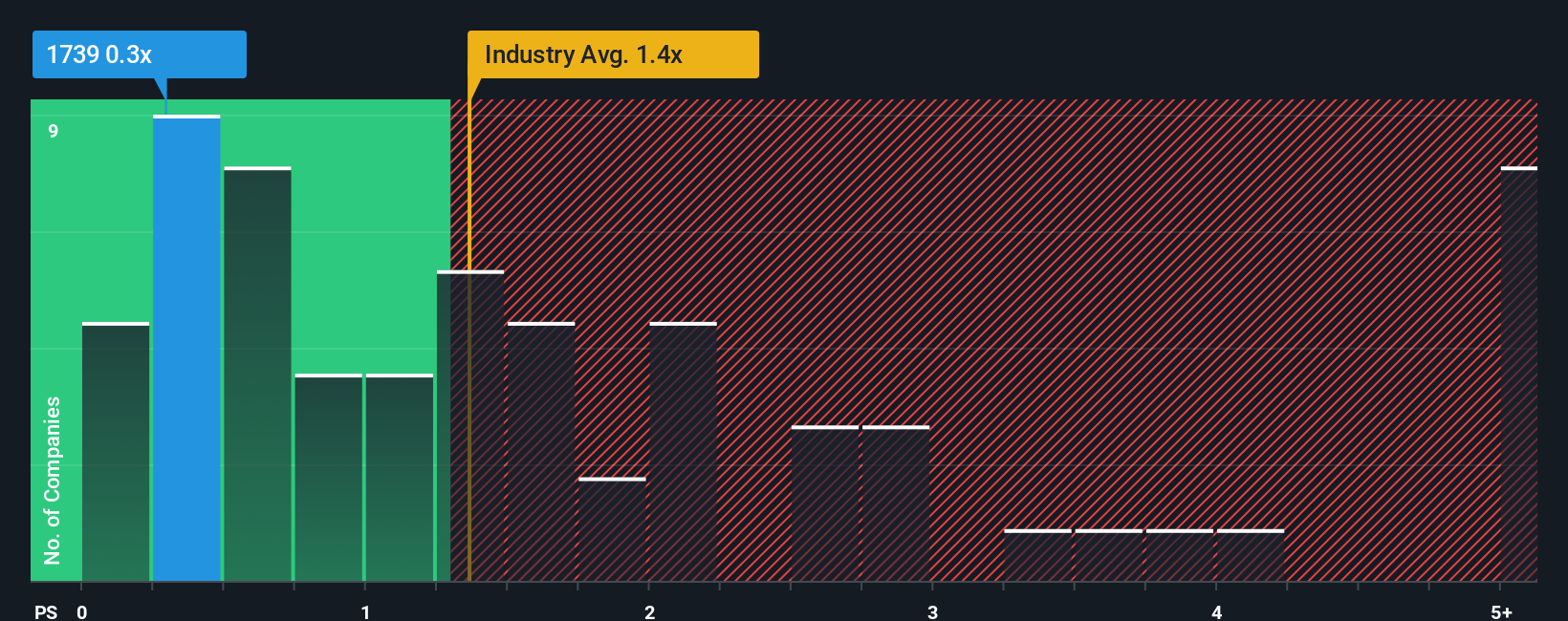

In spite of the firm bounce in price, when close to half the companies operating in Hong Kong's Consumer Services industry have price-to-sales ratios (or "P/S") above 1.4x, you may still consider Qeeka Home (Cayman) as an enticing stock to check out with its 0.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Qeeka Home (Cayman)

How Qeeka Home (Cayman) Has Been Performing

As an illustration, revenue has deteriorated at Qeeka Home (Cayman) over the last year, which is not ideal at all. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Qeeka Home (Cayman) will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Qeeka Home (Cayman)?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Qeeka Home (Cayman)'s to be considered reasonable.

Retrospectively, the last year delivered a frustrating 29% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 11% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 14% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we understand why Qeeka Home (Cayman)'s P/S is lower than most of its industry peers. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

Despite Qeeka Home (Cayman)'s share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Qeeka Home (Cayman) revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Having said that, be aware Qeeka Home (Cayman) is showing 4 warning signs in our investment analysis, and 2 of those can't be ignored.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Qeeka Home (Cayman) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1739

Qeeka Home (Cayman)

Operates online interior design and construction platform in the People’s Republic of China.

Excellent balance sheet and good value.

Market Insights

Community Narratives