- Hong Kong

- /

- Hospitality

- /

- SEHK:1701

Tu Yi Holding (HKG:1701) Posted Healthy Earnings But There Are Some Other Factors To Be Aware Of

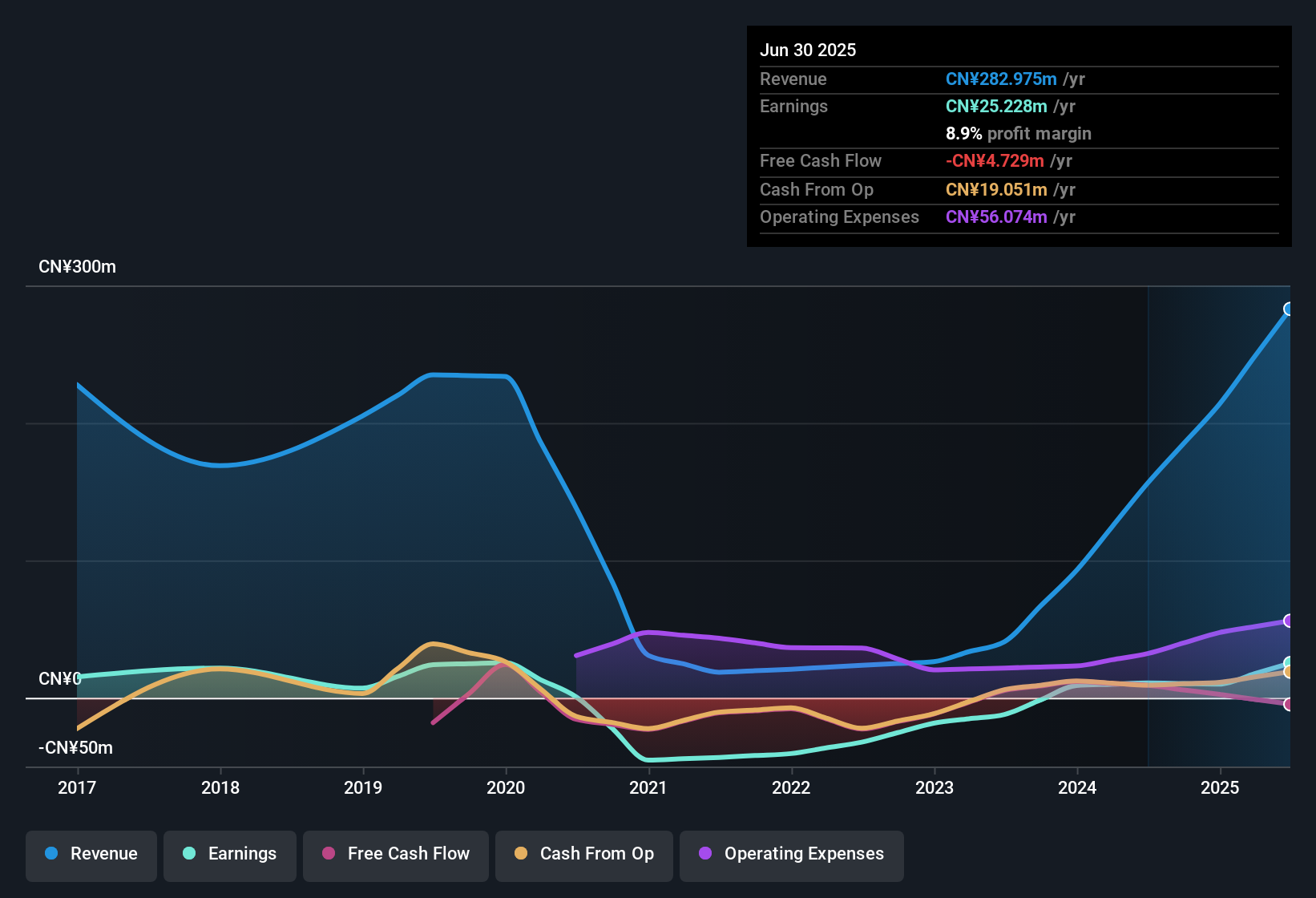

Tu Yi Holding Company Limited's (HKG:1701) stock was strong after they recently reported robust earnings. However, we think that shareholders may be missing some concerning details in the numbers.

The Impact Of Unusual Items On Profit

For anyone who wants to understand Tu Yi Holding's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit gained from CN¥4.6m worth of unusual items. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's as you'd expect, given these boosts are described as 'unusual'. Tu Yi Holding had a rather significant contribution from unusual items relative to its profit to June 2025. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Tu Yi Holding.

An Unusual Tax Situation

Just as we noted the unusual items, we must inform you that Tu Yi Holding received a tax benefit which contributed CN¥1.3m to the bottom line. This is meaningful because companies usually pay tax rather than receive tax benefits. Of course, prima facie it's great to receive a tax benefit. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Our Take On Tu Yi Holding's Profit Performance

In the last year Tu Yi Holding received a tax benefit, which boosted its profit in a way that might not be much more sustainable than turning prime farmland into gas fields. Furthermore, it also benefitted from a positive unusual item, which boosted the profit result even higher. Considering all this we'd argue Tu Yi Holding's profits probably give an overly generous impression of its sustainable level of profitability. If you'd like to know more about Tu Yi Holding as a business, it's important to be aware of any risks it's facing. You'd be interested to know, that we found 2 warning signs for Tu Yi Holding and you'll want to know about these.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Tu Yi Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1701

Tu Yi Holding

An investment holding company, provides outbound travel products and service in the People’s Republic of China and Japan.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives