- Hong Kong

- /

- Consumer Services

- /

- SEHK:1525

Here's Why I Think Shanghai Gench Education Group (HKG:1525) Is An Interesting Stock

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Shanghai Gench Education Group (HKG:1525), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Shanghai Gench Education Group

How Fast Is Shanghai Gench Education Group Growing Its Earnings Per Share?

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So EPS growth can certainly encourage an investor to take note of a stock. Shanghai Gench Education Group boosted its trailing twelve month EPS from CN¥0.42 to CN¥0.47, in the last year. That's a 13% gain; respectable growth in the broader scheme of things.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Shanghai Gench Education Group is growing revenues, and EBIT margins improved by 4.1 percentage points to 42%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

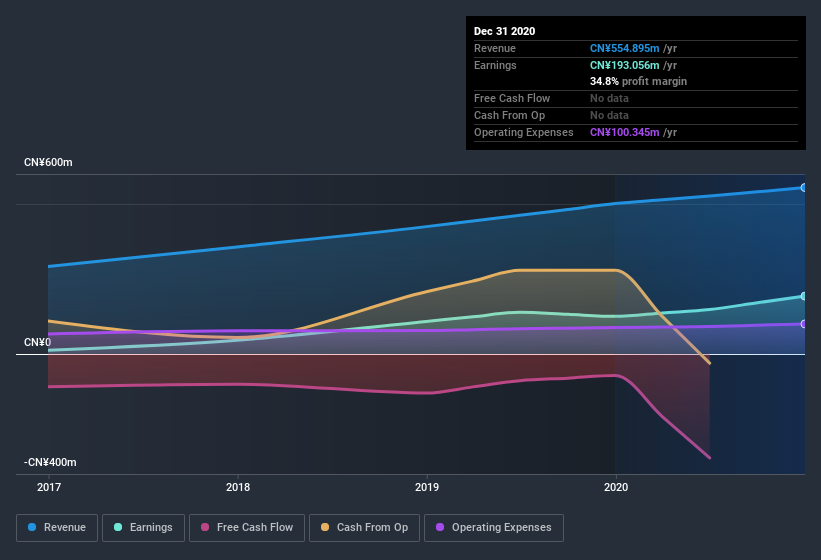

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Shanghai Gench Education Group's forecast profits?

Are Shanghai Gench Education Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

First things first; I didn't see insiders sell Shanghai Gench Education Group shares in the last year. Even better, though, is that the Executive Chairman, Xingzeng Zhou, bought a whopping CN¥1.7m worth of shares, paying about CN¥6.85 per share, on average. Big buys like that give me a sense of opportunity; actions speak louder than words.

On top of the insider buying, we can also see that Shanghai Gench Education Group insiders own a large chunk of the company. Actually, with 44% of the company to their names, insiders are profoundly invested in the business. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. With that sort of holding, insiders have about CN¥1.1b riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

Should You Add Shanghai Gench Education Group To Your Watchlist?

As I already mentioned, Shanghai Gench Education Group is a growing business, which is what I like to see. Better yet, insiders are significant shareholders, and have been buying more shares. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. We don't want to rain on the parade too much, but we did also find 1 warning sign for Shanghai Gench Education Group that you need to be mindful of.

The good news is that Shanghai Gench Education Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Shanghai Gench Education Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1525

Shanghai Gench Education Group

An investment holding company, provides higher education services in the People’s Republic of China.

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives