- China

- /

- Medical Equipment

- /

- SZSE:301363

DPC Dash And 2 More Stocks Estimated To Be Trading Below Fair Value

Reviewed by Simply Wall St

In a week where major global indices showed mixed results, with growth stocks outpacing value counterparts significantly, investors are keenly observing the economic indicators and central bank signals for guidance. Amidst this backdrop of fluctuating market dynamics and geopolitical developments, identifying undervalued stocks becomes crucial as they offer potential opportunities to capitalize on discrepancies between current prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Round One (TSE:4680) | ¥1244.00 | ¥2550.71 | 51.2% |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.26 | US$99.93 | 49.7% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.7% |

| West Bancorporation (NasdaqGS:WTBA) | US$23.32 | US$46.38 | 49.7% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP289.40 | CLP576.08 | 49.8% |

| EnomotoLtd (TSE:6928) | ¥1450.00 | ¥2884.09 | 49.7% |

| Nidaros Sparebank (OB:NISB) | NOK99.60 | NOK198.62 | 49.9% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$27.10 | HK$54.00 | 49.8% |

| Zalando (XTRA:ZAL) | €34.70 | €69.28 | 49.9% |

| Akeso (SEHK:9926) | HK$66.35 | HK$131.88 | 49.7% |

Let's explore several standout options from the results in the screener.

DPC Dash (SEHK:1405)

Overview: DPC Dash Ltd, along with its subsidiaries, operates a chain of fast-food restaurants in the People’s Republic of China and has a market cap of HK$10.38 billion.

Operations: The company's revenue primarily comes from its fast-food restaurant operations in the People’s Republic of China, generating CN¥3.72 billion.

Estimated Discount To Fair Value: 36.8%

DPC Dash is trading significantly below its estimated fair value, making it a potentially undervalued stock based on cash flows. Despite recent insider selling, the company has achieved double-digit revenue growth and reported its first positive net profit. With a robust expansion strategy, including the opening of its 1,000th store in China and plans for further growth, DPC Dash's revenue is expected to outpace market averages. However, low forecasted return on equity remains a concern.

- The growth report we've compiled suggests that DPC Dash's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of DPC Dash stock in this financial health report.

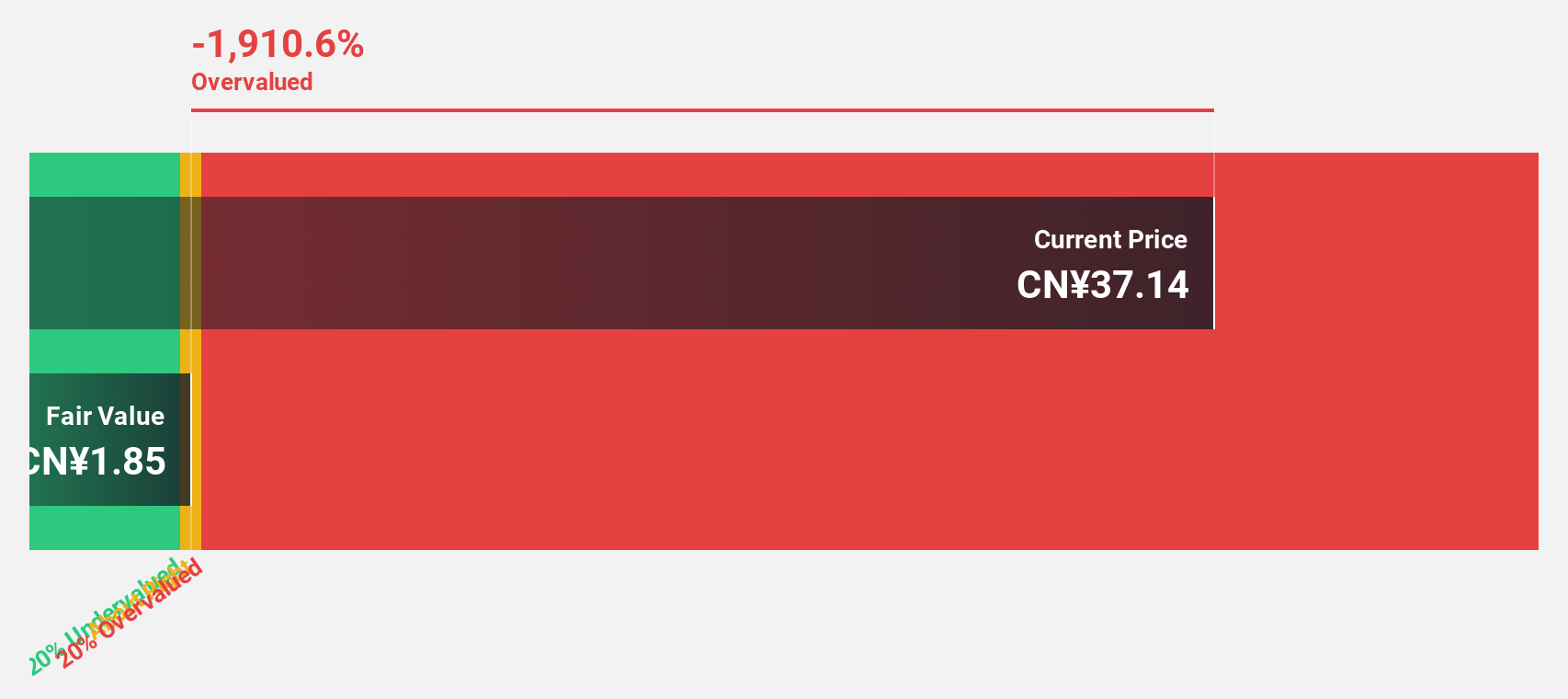

Fujian Torch Electron Technology (SHSE:603678)

Overview: Fujian Torch Electron Technology Co., Ltd. operates in the electronic components industry and has a market capitalization of approximately CN¥13.95 billion.

Operations: Fujian Torch Electron Technology Co., Ltd. generates its revenue from various segments within the electronic components industry.

Estimated Discount To Fair Value: 32.9%

Fujian Torch Electron Technology is trading at a significant discount to its estimated fair value of CN¥46.69, with current trading around CN¥31.32, highlighting potential undervaluation based on cash flows. Despite a decline in revenue and net income for the first nine months of 2024, the company’s earnings are forecasted to grow substantially at over 36% annually, outpacing the broader Chinese market growth expectations. However, its return on equity remains relatively low.

- Upon reviewing our latest growth report, Fujian Torch Electron Technology's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Fujian Torch Electron Technology's balance sheet health report.

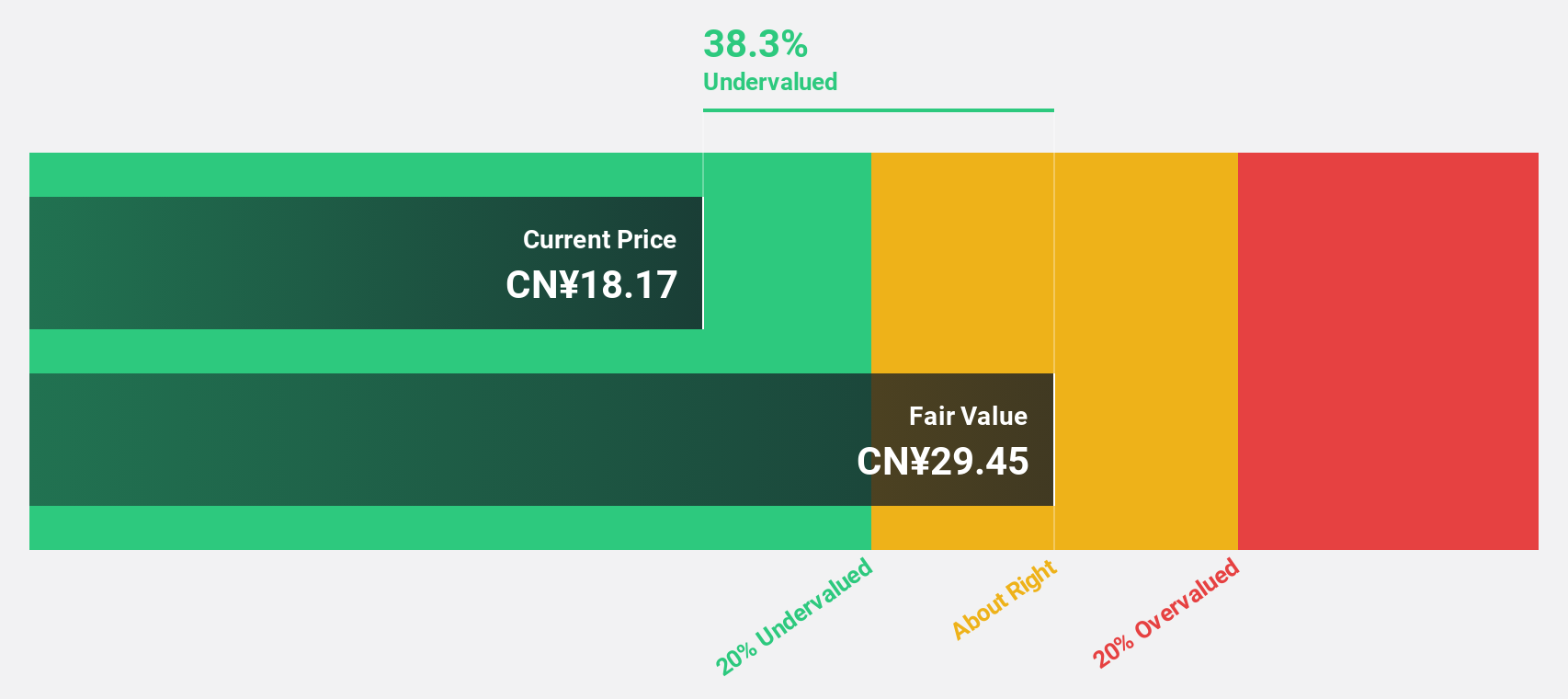

MeHow Innovative (SZSE:301363)

Overview: Mehow Innovative Ltd. specializes in designing, developing, manufacturing, and selling precision medical device components and products both in China and internationally, with a market cap of CN¥12.61 billion.

Operations: The company generates revenue through the design, development, manufacturing, and sale of precision medical device components and products in China and international markets.

Estimated Discount To Fair Value: 20.8%

MeHow Innovative is trading at a discount to its estimated fair value of CNY 40.22, with shares currently around CNY 31.87, suggesting potential undervaluation based on cash flows. Despite lower profit margins compared to last year and a decrease in net income for the first nine months of 2024, earnings are expected to grow significantly at over 31% annually, surpassing market averages. Revenue growth is also forecasted to exceed the broader Chinese market rate.

- According our earnings growth report, there's an indication that MeHow Innovative might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of MeHow Innovative.

Next Steps

- Delve into our full catalog of 890 Undervalued Stocks Based On Cash Flows here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301363

MeHow Innovative

Designs, develops, manufactures, and sells precision medical device components and products in China and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives