- China

- /

- Professional Services

- /

- SZSE:300492

August 2025 Asian Stocks That Might Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As the Asian markets experience a period of cautious optimism driven by easing trade tensions and improved economic indicators, investors are increasingly on the lookout for opportunities that may be undervalued amidst these shifting dynamics. In this context, identifying stocks that are trading below their estimated value can offer potential advantages, especially in an environment where global economic conditions remain fluid and investor sentiment is buoyed by positive developments.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥155.71 | CN¥311.11 | 49.9% |

| Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266) | CN¥113.18 | CN¥223.99 | 49.5% |

| Kolmar Korea (KOSE:A161890) | ₩79700.00 | ₩155158.44 | 48.6% |

| KeePer Technical Laboratory (TSE:6036) | ¥3490.00 | ¥6847.61 | 49% |

| Japan Data Science ConsortiumLtd (TSE:4418) | ¥1011.00 | ¥1973.01 | 48.8% |

| Heartland Group Holdings (NZSE:HGH) | NZ$0.81 | NZ$1.60 | 49.3% |

| Guangdong Lyric Robot AutomationLtd (SHSE:688499) | CN¥59.31 | CN¥115.92 | 48.8% |

| GEM (SZSE:002340) | CN¥6.70 | CN¥13.07 | 48.7% |

| GCH Technology (SHSE:688625) | CN¥34.60 | CN¥68.17 | 49.2% |

| EROAD (NZSE:ERD) | NZ$2.31 | NZ$4.61 | 49.9% |

Let's uncover some gems from our specialized screener.

DPC Dash (SEHK:1405)

Overview: DPC Dash Ltd, along with its subsidiaries, operates a chain of fast-food restaurants in the People's Republic of China and has a market cap of HK$11.44 billion.

Operations: The company's revenue is primarily generated from its fast-food restaurant operations in the People's Republic of China, amounting to CN¥4.31 billion.

Estimated Discount To Fair Value: 23.7%

DPC Dash, trading at HK$87.4, is considered undervalued based on discounted cash flow analysis with a fair value estimate of HK$114.61. The company recently became profitable and its earnings are projected to grow significantly at 51.7% annually, outpacing the Hong Kong market's 11.2%. Revenue growth forecasts also exceed market averages, enhancing its investment appeal despite a forecasted low return on equity of 13.9% in three years.

- In light of our recent growth report, it seems possible that DPC Dash's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of DPC Dash.

Beijing Chunlizhengda Medical Instruments (SEHK:1858)

Overview: Beijing Chunlizhengda Medical Instruments Co., Ltd. is a company engaged in the development, production, and sale of orthopedic implants and medical instruments with a market cap of approximately HK$9.04 billion.

Operations: The company's revenue from the manufacture and trading of surgical implants, instruments, and related products is CN¥813.85 million.

Estimated Discount To Fair Value: 17.3%

Beijing Chunlizhengda Medical Instruments, trading at HK$16.87, is undervalued based on discounted cash flow analysis with a fair value estimate of HK$20.39. Despite lower profit margins this year, earnings are expected to grow significantly at 27.4% annually, surpassing the Hong Kong market's growth rate. Revenue is forecasted to increase by 20.7% per year, further supporting its potential as an undervalued investment opportunity in the Asian market.

- Insights from our recent growth report point to a promising forecast for Beijing Chunlizhengda Medical Instruments' business outlook.

- Take a closer look at Beijing Chunlizhengda Medical Instruments' balance sheet health here in our report.

Huatu Cendes (SZSE:300492)

Overview: Huatu Cendes Co., Ltd. is an architectural design company offering professional design, consulting, and engineering services to various clients in China, with a market cap of CN¥12.21 billion.

Operations: Huatu Cendes generates its revenue by providing architectural design, consulting, and engineering services to state-owned enterprises, multinational corporations, private companies, and government agencies across China.

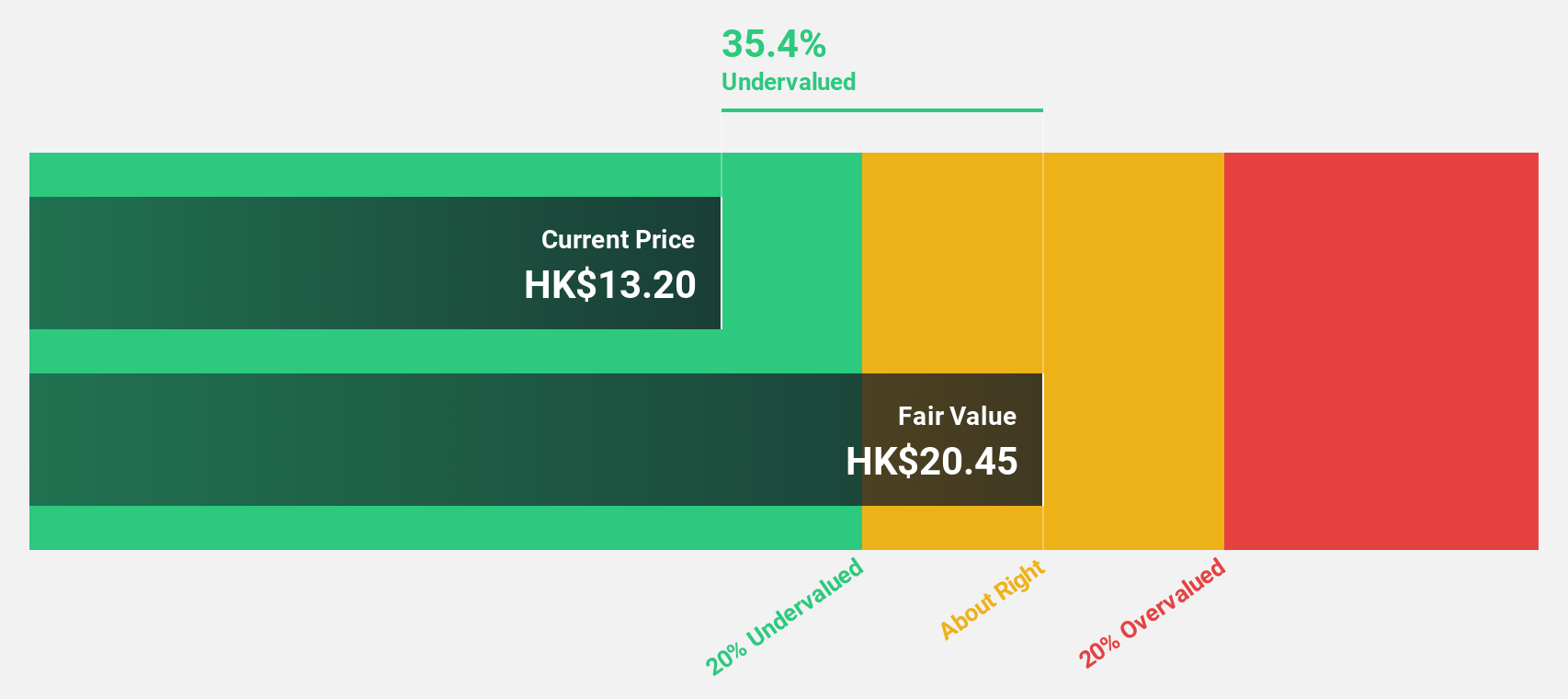

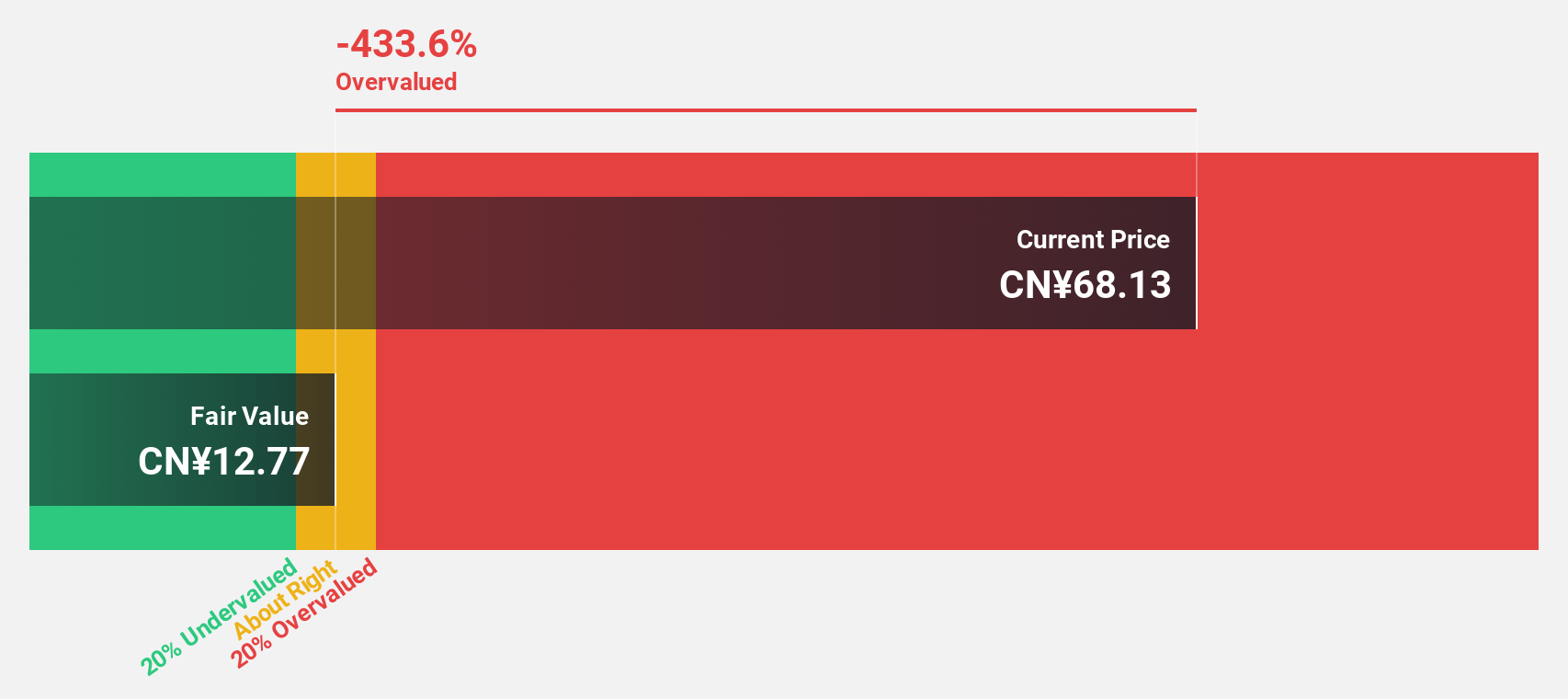

Estimated Discount To Fair Value: 15.6%

Huatu Cendes, priced at CN¥62.1, is undervalued with a fair value estimate of CN¥73.57 based on discounted cash flow analysis. The company has completed a share buyback program totaling 3,815,563 shares for CNY 260.23 million by July 24, 2025. Earnings are projected to grow significantly at an annual rate of 44.9%, outpacing the Chinese market's growth rate of 23.9%. Revenue is expected to rise by 18.3% annually over the next few years.

- The analysis detailed in our Huatu Cendes growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Huatu Cendes stock in this financial health report.

Make It Happen

- Navigate through the entire inventory of 267 Undervalued Asian Stocks Based On Cash Flows here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huatu Cendes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300492

Huatu Cendes

Huatu Cendes Co., Ltd., an architectural design company, provides professional, designing, consulting, and engineering services to state-owned enterprises, multinational corporations, private companies, and government agencies in China.

High growth potential with solid track record.

Market Insights

Community Narratives