- Hong Kong

- /

- Hospitality

- /

- SEHK:1180

Paradise Entertainment (HKG:1180) Shareholders Have Enjoyed A 43% Share Price Gain

By buying an index fund, investors can approximate the average market return. But many of us dare to dream of bigger returns, and build a portfolio ourselves. Just take a look at Paradise Entertainment Limited (HKG:1180), which is up 43%, over three years, soundly beating the market decline of 8.3% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 3.6%.

See our latest analysis for Paradise Entertainment

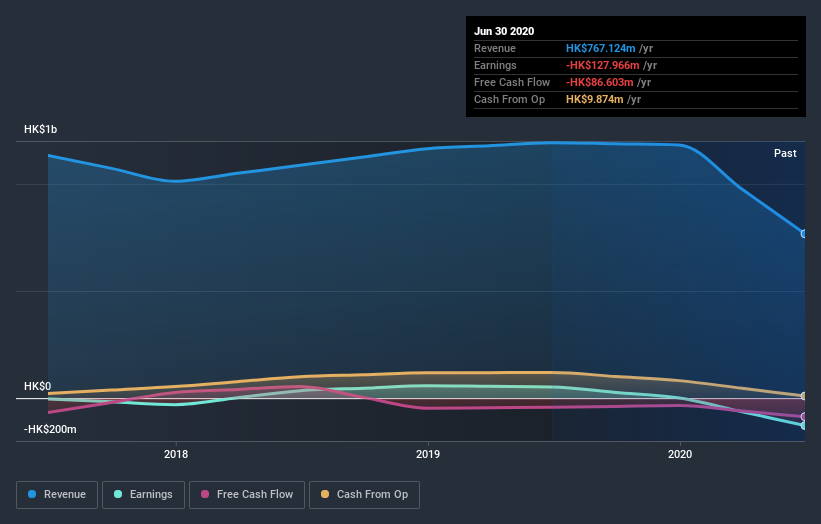

Paradise Entertainment wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Paradise Entertainment actually saw its revenue drop by 2.7% per year over three years. The revenue growth might be lacking but the share price has gained 13% each year in that time. If the company is cutting costs profitability could be on the horizon, but the revenue decline is a prima facie concern.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Paradise Entertainment's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We've already covered Paradise Entertainment's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Paradise Entertainment's TSR of 46% for the 3 years exceeded its share price return, because it has paid dividends.

A Different Perspective

Paradise Entertainment shareholders are up 3.6% for the year. But that was short of the market average. But at least that's still a gain! Over five years the TSR has been a reduction of 3% per year, over five years. It could well be that the business is stabilizing. You could get a better understanding of Paradise Entertainment's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading Paradise Entertainment or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1180

Paradise Entertainment

An investment holding company, provides casino management services in Macau, the People’s Republic of China, the Philippines, the United States, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives