- Hong Kong

- /

- Hospitality

- /

- SEHK:1128

Wynn Macau, Limited's (HKG:1128) 33% Share Price Surge Not Quite Adding Up

Wynn Macau, Limited (HKG:1128) shares have had a really impressive month, gaining 33% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 10% over that time.

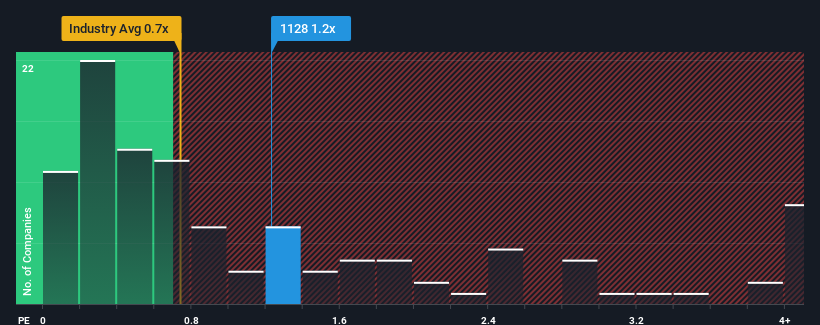

Although its price has surged higher, there still wouldn't be many who think Wynn Macau's price-to-sales (or "P/S") ratio of 1.2x is worth a mention when the median P/S in Hong Kong's Hospitality industry is similar at about 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Wynn Macau

How Wynn Macau Has Been Performing

Wynn Macau certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Wynn Macau's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Wynn Macau's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 115%. The strong recent performance means it was also able to grow revenue by 172% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 7.8% per annum as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 14% per year, which is noticeably more attractive.

With this in mind, we find it intriguing that Wynn Macau's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Final Word

Wynn Macau's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given that Wynn Macau's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

It is also worth noting that we have found 2 warning signs for Wynn Macau that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Wynn Macau might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1128

Wynn Macau

Owns, develops, and operates integrated destination casino resorts in the People’s Republic of China.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives